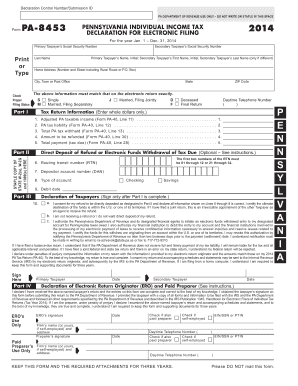

PA Individual Income Tax Declaration for Electronic Filing PA Form

What is the PA Individual Income Tax Declaration For Electronic Filing PA

The PA Individual Income Tax Declaration for Electronic Filing PA is a specific form used by residents of Pennsylvania to report their individual income tax electronically. This form is essential for taxpayers who wish to submit their income tax returns through digital means, ensuring compliance with state tax regulations. It simplifies the filing process and allows for quicker processing times compared to traditional paper submissions.

Steps to complete the PA Individual Income Tax Declaration For Electronic Filing PA

Completing the PA Individual Income Tax Declaration for Electronic Filing PA involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and any other income statements.

- Access the form through a reliable electronic filing platform.

- Fill in the required personal information, such as your name, address, and Social Security number.

- Report your income and deductions accurately, following the guidelines provided on the form.

- Review your entries for accuracy to avoid potential errors that could delay processing.

- Submit the form electronically, ensuring you receive confirmation of your submission.

Legal use of the PA Individual Income Tax Declaration For Electronic Filing PA

The PA Individual Income Tax Declaration for Electronic Filing PA is legally valid when completed and submitted according to Pennsylvania tax laws. Electronic signatures are recognized as binding, provided that they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Utilizing a secure platform for e-signatures ensures that the form meets all legal requirements for validity.

Required Documents

To successfully complete the PA Individual Income Tax Declaration for Electronic Filing PA, you will need the following documents:

- W-2 forms from all employers for the tax year.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for deductions, including receipts for business expenses, medical expenses, and charitable contributions.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the PA Individual Income Tax Declaration for Electronic Filing PA. Typically, individual income tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may file, which can provide additional time to submit their forms.

Who Issues the Form

The PA Individual Income Tax Declaration for Electronic Filing PA is issued by the Pennsylvania Department of Revenue. This state agency oversees the collection of taxes and ensures compliance with tax laws. Taxpayers can obtain the form through the department's official website or through authorized electronic filing platforms that facilitate tax submissions.

Quick guide on how to complete 2014 pa individual income tax declaration for electronic filing pa

Effortlessly Prepare PA Individual Income Tax Declaration For Electronic Filing PA on Any Device

The management of online documents has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle PA Individual Income Tax Declaration For Electronic Filing PA on any platform with airSlate SignNow's Android or iOS applications, and enhance any document-centric process today.

How to Edit and Electronically Sign PA Individual Income Tax Declaration For Electronic Filing PA with Ease

- Find PA Individual Income Tax Declaration For Electronic Filing PA and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive details using specialized tools that airSlate SignNow provides.

- Create your signature using the Sign tool; this takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, time-consuming form searches, or mistakes necessitating new document prints. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign PA Individual Income Tax Declaration For Electronic Filing PA to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the PA Individual Income Tax Declaration For Electronic Filing PA?

The PA Individual Income Tax Declaration For Electronic Filing PA is a digital form that allows individuals to electronically file their state income tax returns in Pennsylvania. It streamlines the filing process, ensuring accuracy and efficiency while helping taxpayers meet their obligations quickly.

-

How can airSlate SignNow help with the PA Individual Income Tax Declaration For Electronic Filing PA?

airSlate SignNow provides a user-friendly platform for sending and signing the PA Individual Income Tax Declaration For Electronic Filing PA. Our eSigning features ensure that your documents are securely signed, enhancing the filing process and reducing turnaround times for submissions.

-

Is there a cost associated with using airSlate SignNow for the PA Individual Income Tax Declaration For Electronic Filing PA?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including those who require assistance with the PA Individual Income Tax Declaration For Electronic Filing PA. Our plans are designed to be cost-effective, allowing businesses to choose the option that best fits their budget.

-

What are the key features of airSlate SignNow for electronic tax filing?

Key features of airSlate SignNow for electronic tax filing include easy document routing, secure eSignature capabilities, and custom templates for the PA Individual Income Tax Declaration For Electronic Filing PA. These features provide users with a streamlined, efficient method for managing their tax documents.

-

Are there any integrations available with airSlate SignNow for the PA Individual Income Tax Declaration For Electronic Filing PA?

Yes, airSlate SignNow integrates with a variety of popular applications and tools, enhancing your ability to work with the PA Individual Income Tax Declaration For Electronic Filing PA. These integrations allow for seamless data transfer and improved workflow management, making tax filing easier and more efficient.

-

What benefits does using airSlate SignNow offer for filing PA Individual Income Tax Declaration?

Using airSlate SignNow for filing the PA Individual Income Tax Declaration For Electronic Filing PA offers numerous benefits, including reduced paperwork, faster processing times, and enhanced document security. Our platform also helps ensure compliance with state regulations, providing peace of mind for taxpayers.

-

Can multiple users collaborate on the PA Individual Income Tax Declaration For Electronic Filing PA using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate seamlessly on the PA Individual Income Tax Declaration For Electronic Filing PA. This capability makes it easier for teams to work together, ensuring that all necessary signatures and approvals are obtained without delays.

Get more for PA Individual Income Tax Declaration For Electronic Filing PA

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure new form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497318642 form

- Tenant landlord security form

- New hampshire landlord form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497318645 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497318646 form

- New hampshire landlord 497318647 form

- New hampshire lease form

Find out other PA Individual Income Tax Declaration For Electronic Filing PA

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe