PA Individual Income Tax Declaration for Electronic Filing PA 8453 FormsPublications

What is the PA Individual Income Tax Declaration for Electronic Filing PA 8453?

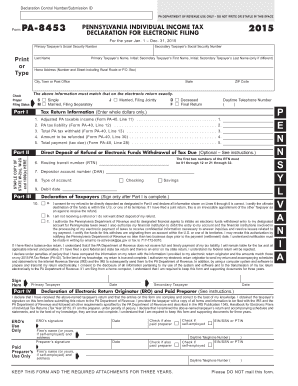

The PA 8453 form is a declaration used by individuals filing their Pennsylvania state income tax returns electronically. This form serves as a signature document that confirms the taxpayer's intent to file their return electronically. It is essential for ensuring that the filing process adheres to state regulations and provides a legal basis for the submission of tax information. The PA 8453 form is particularly relevant for those who choose to e-file their individual income tax returns, as it helps to streamline the process while maintaining compliance with state laws.

Steps to Complete the PA Individual Income Tax Declaration for Electronic Filing PA 8453

Completing the PA 8453 form involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary information: Collect all relevant tax documents, including W-2s, 1099s, and any other income statements.

- Fill out the form: Input your personal information, including your name, address, and Social Security number, as well as details about your income and deductions.

- Review the form: Check all entries for accuracy to avoid mistakes that could delay processing.

- Sign the form: Provide your electronic signature, which can be done through a secure eSignature platform that complies with legal standards.

- Submit the form: Follow the instructions for electronic submission, ensuring that you retain a copy for your records.

Legal Use of the PA Individual Income Tax Declaration for Electronic Filing PA 8453

The PA 8453 form is legally binding when completed and submitted correctly. To ensure its validity, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures hold the same legal weight as traditional handwritten signatures, provided that certain conditions are met. This includes using a secure platform for signing and maintaining a record of the transaction. By using a reliable electronic signature solution, taxpayers can ensure that their PA 8453 form is recognized by the Pennsylvania Department of Revenue.

Key Elements of the PA Individual Income Tax Declaration for Electronic Filing PA 8453

Several key elements must be included in the PA 8453 form to ensure it is complete and compliant:

- Taxpayer information: Full name, address, and Social Security number.

- Filing status: Indicate whether you are filing as single, married filing jointly, or another status.

- Signature: An electronic signature that confirms the taxpayer's agreement with the information provided.

- Tax year: Clearly specify the tax year for which the declaration is being filed.

- Declaration statement: A statement affirming that the taxpayer is authorized to file the return electronically.

Filing Deadlines / Important Dates for the PA Individual Income Tax Declaration for Electronic Filing PA 8453

Timely submission of the PA 8453 form is crucial to avoid penalties and ensure compliance with state tax laws. The typical deadline for filing Pennsylvania individual income tax returns is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file but must be requested before the original deadline.

Form Submission Methods for the PA Individual Income Tax Declaration for Electronic Filing PA 8453

The PA 8453 form can be submitted electronically or via mail, depending on the taxpayer's preferences and the e-filing software used. When e-filing, the form is typically submitted automatically through the tax software. For those who prefer to file by mail, a printed version of the form can be sent to the Pennsylvania Department of Revenue. It is important to follow the specific submission guidelines provided by the state to ensure proper processing of the tax return.

Quick guide on how to complete pa individual income tax

Effortlessly Prepare pa individual income tax on Any Device

Online document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage pa 8453 form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to Modify and Electronically Sign pa individual income tax with Ease

- Obtain form pa 8453 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or downloading it to your PC.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign pa 8453 form and ensure clear communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form pa 8453

Create this form in 5 minutes!

People also ask form pa 8453

-

What is the PA 8453 form and why is it important?

The PA 8453 form is a crucial document used for electronic filing of Pennsylvania personal income tax returns. It serves as a declaration that the taxpayer has reviewed their return and supports the accuracy of their submission. Utilizing the PA 8453 form ensures compliance with state regulations and can expedite the filing process.

-

How can airSlate SignNow help with the PA 8453 form?

airSlate SignNow is designed to simplify the signing and management of the PA 8453 form. With our platform, users can easily send, sign, and secure their PA 8453 form electronically. This not only saves time but also enhances the accuracy of form submissions.

-

Is there a cost associated with using airSlate SignNow for the PA 8453 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our pricing is competitive and provides users with a cost-effective solution to manage their PA 8453 form and other documentation. You can choose a plan that best fits your volume of document handling.

-

What features does airSlate SignNow offer for handling the PA 8453 form?

With airSlate SignNow, users have access to features like customizable templates, real-time tracking, and cloud storage, specifically for the PA 8453 form. Additionally, our platform offers advanced security measures to protect sensitive information and ensure document integrity.

-

Can I integrate airSlate SignNow with other software for managing the PA 8453 form?

Absolutely! airSlate SignNow offers integrations with popular software solutions, making it easy to manage the PA 8453 form alongside your other tools. This helps streamline your workflow and ensures that all your documents are in one place.

-

How secure is the signing process for the PA 8453 form with airSlate SignNow?

Security is a top priority at airSlate SignNow. The signing process for the PA 8453 form is protected by robust encryption and authentication measures, ensuring that your documents are safe and confidential. Users can also audit their documents for complete peace of mind.

-

What are the benefits of using airSlate SignNow for the PA 8453 form?

Using airSlate SignNow for the PA 8453 form offers numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. Our user-friendly platform ensures that you can manage and sign your documents without the hassle of traditional methods.

Get more for pa 8453 form

- Fastpitch roster sanction form usfatncom

- Esic form 25 download

- Haushaltsbescheinigung form

- Soccer referee evaluation form

- In each of the following pairs circle the form of radiation with the longer wavelength

- Guest parking pass guest parking pass reflections at hidden lake form

- Apply for an ardf grantthe anglican relief and form

- Pizza scorecard form

Find out other pa individual income tax

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF