Schedule OSC Form

What is the Schedule OSC

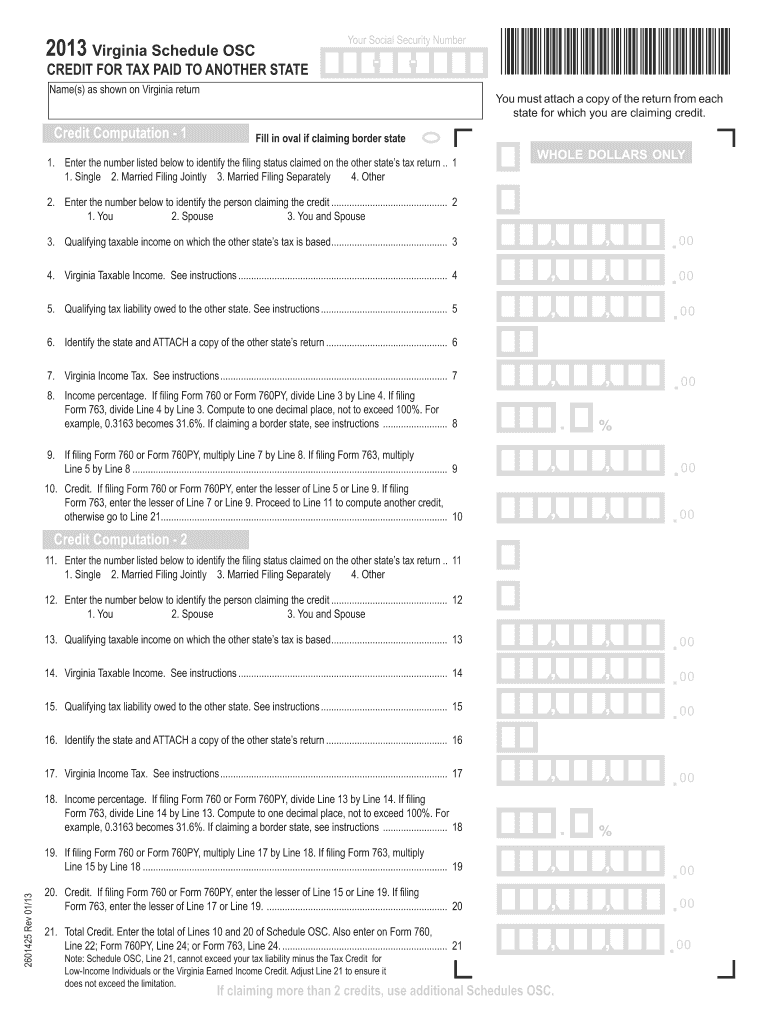

The Schedule OSC is a tax form used by businesses to report specific income and expenses related to their operations. This form is particularly relevant for entities that need to disclose certain financial information to the IRS. By completing the Schedule OSC, businesses can ensure compliance with tax regulations while accurately reflecting their financial activities.

How to use the Schedule OSC

Using the Schedule OSC involves several key steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form by entering the required information in the designated fields. It is important to ensure that all data is accurate and complete to avoid potential issues with the IRS. After completing the form, review it carefully before submission.

Steps to complete the Schedule OSC

Completing the Schedule OSC can be broken down into a few straightforward steps:

- Collect all relevant financial documents.

- Fill out the form with accurate income and expense information.

- Double-check all entries for accuracy.

- Sign and date the form as required.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Schedule OSC

The Schedule OSC is legally recognized as a valid document for reporting financial information to the IRS. To ensure its legal standing, it must be completed accurately and submitted within the required time frame. Compliance with IRS guidelines is essential to avoid penalties and ensure that the submitted information is accepted.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule OSC are crucial for compliance. Typically, the form must be submitted by the tax return due date, which is usually April 15 for most businesses. However, if an extension is filed, the deadline may be extended. It is important to stay informed about any changes to filing dates to avoid late submission penalties.

Who Issues the Form

The Schedule OSC is issued by the Internal Revenue Service (IRS). This governmental body is responsible for collecting taxes and enforcing tax laws in the United States. The IRS provides guidelines and instructions for completing the Schedule OSC, ensuring that businesses understand their obligations when reporting financial information.

Quick guide on how to complete schedule osc

Effortlessly Complete [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to swiftly create, edit, and eSign your documents without any delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using specialized tools provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, a process that takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you prefer to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule OSC

Create this form in 5 minutes!

People also ask

-

What does it mean to Schedule OSC with airSlate SignNow?

To Schedule OSC with airSlate SignNow means to plan and organize your document signing sessions efficiently. This feature allows users to set specific times for sending and signing documents, ensuring that all parties can participate at their convenience.

-

How can I benefit from the Schedule OSC feature?

The Schedule OSC feature streamlines the document signing process, enhancing productivity. It allows you to align document signing times with all parties' schedules, reducing delays and increasing collaboration.

-

Is there a cost associated with using the Schedule OSC feature?

Schedule OSC is included in airSlate SignNow's affordable pricing plans, which offer various tiers based on your business size and needs. This feature provides great value, making it a cost-effective solution for managing document workflows.

-

What integrations are available for Schedule OSC with airSlate SignNow?

airSlate SignNow offers a variety of integrations that work seamlessly with the Schedule OSC feature. These include popular applications like Google Workspace, Salesforce, and Microsoft Office, allowing you to manage your documents efficiently across platforms.

-

Can I customize reminders when I Schedule OSC?

Yes, when you Schedule OSC with airSlate SignNow, you can customize reminders for all signers. This ensures that everyone is notified in advance, helping to keep the document signing process on schedule.

-

How secure is the Schedule OSC feature?

The Schedule OSC feature within airSlate SignNow adheres to industry standards for security. All documents are encrypted and securely stored, ensuring that your sensitive information is protected throughout the signing process.

-

Can I track the status of documents I Schedule OSC for?

Absolutely! airSlate SignNow enables you to track the status of any document you've scheduled for signing. This feature provides real-time updates, allowing you to monitor progress and ensure timely completion.

Get more for Schedule OSC

Find out other Schedule OSC

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple