PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN Form

What is the PIT 1 New Mexico Personal Income Tax Return

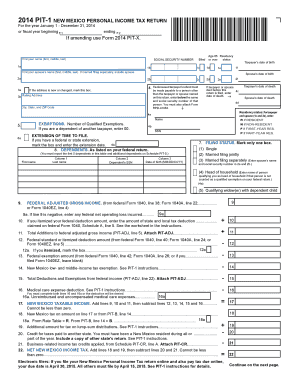

The PIT 1 New Mexico Personal Income Tax Return is a state-specific tax form used by individuals to report their income and calculate their tax liability for the state of New Mexico. This form is essential for residents and non-residents earning income in New Mexico, as it ensures compliance with state tax laws. The PIT 1 form captures various income sources, deductions, and credits, allowing taxpayers to accurately determine their tax obligations.

Steps to Complete the PIT 1 New Mexico Personal Income Tax Return

Completing the PIT 1 New Mexico Personal Income Tax Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, dividends, and any other taxable income.

- Claim applicable deductions and credits, which may include standard deductions or itemized deductions.

- Calculate your total tax liability based on the income reported and deductions claimed.

- Sign and date the form to validate your submission.

How to Obtain the PIT 1 New Mexico Personal Income Tax Return

The PIT 1 New Mexico Personal Income Tax Return can be obtained through several methods:

- Visit the New Mexico Taxation and Revenue Department's website to download a printable version of the form.

- Request a physical copy by contacting the New Mexico Taxation and Revenue Department directly.

- Access the form through tax preparation software that supports New Mexico tax filings.

Legal Use of the PIT 1 New Mexico Personal Income Tax Return

The PIT 1 New Mexico Personal Income Tax Return is legally binding when filled out accurately and submitted according to state regulations. To ensure its legal validity, taxpayers must provide truthful information and necessary signatures. The form must be filed by the designated deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods

Taxpayers have multiple options for submitting the PIT 1 New Mexico Personal Income Tax Return:

- Online submission through the New Mexico Taxation and Revenue Department's e-filing system.

- Mailing a completed paper form to the appropriate state address.

- In-person submission at designated state tax offices.

Filing Deadlines / Important Dates

Taxpayers should be aware of the following important dates regarding the PIT 1 New Mexico Personal Income Tax Return:

- The standard filing deadline is typically April 15 of each year, aligning with federal tax deadlines.

- Extensions for filing may be requested, but any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete 2014 pit 1 new mexico personal income tax return

Effortlessly Prepare PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any holdups. Manage PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Easily Modify and Electronically Sign PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN

- Obtain PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN and click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools provided specifically for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and electronically sign PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

A PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN is the form used by residents to file their personal income taxes in New Mexico. This return allows individuals to report their income, calculate tax obligations, and claim any applicable credits or deductions.

-

How can airSlate SignNow help with completing a PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

airSlate SignNow streamlines the process of completing a PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN by providing easy-to-use tools for filling out, signing, and submitting your document electronically. This ensures that your return is filed accurately and on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Our cost-effective solution enables you to manage your PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN efficiently, with a range of features that add value to your filing experience.

-

What features does airSlate SignNow offer for handling PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

With airSlate SignNow, you gain access to features such as document templates, secure eSigning, and storage organization. These functionalities simplify the process of managing your PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN and enhance your overall productivity.

-

What are the benefits of using airSlate SignNow for my PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

Using airSlate SignNow for your PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN offers several benefits, including time savings, reduced paper clutter, and enhanced security. Our platform allows you to complete tax forms efficiently while ensuring your sensitive information is protected.

-

Can airSlate SignNow integrate with tax software for filing my PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

Yes, airSlate SignNow can integrate seamlessly with various tax software solutions, making it easier to file your PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN. This integration streamlines your workflow by enabling data transfer between applications, reducing manual input.

-

How secure is the information I use with airSlate SignNow for my PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN?

Security is a top priority for airSlate SignNow. When you use airSlate SignNow for your PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN, your data is encrypted and stored securely, ensuring that your personal information remains safe throughout the eSigning process.

Get more for PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN

Find out other PIT 1 NEW MEXICO PERSONAL INCOME TAX RETURN

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple