Nj 1040nr Form

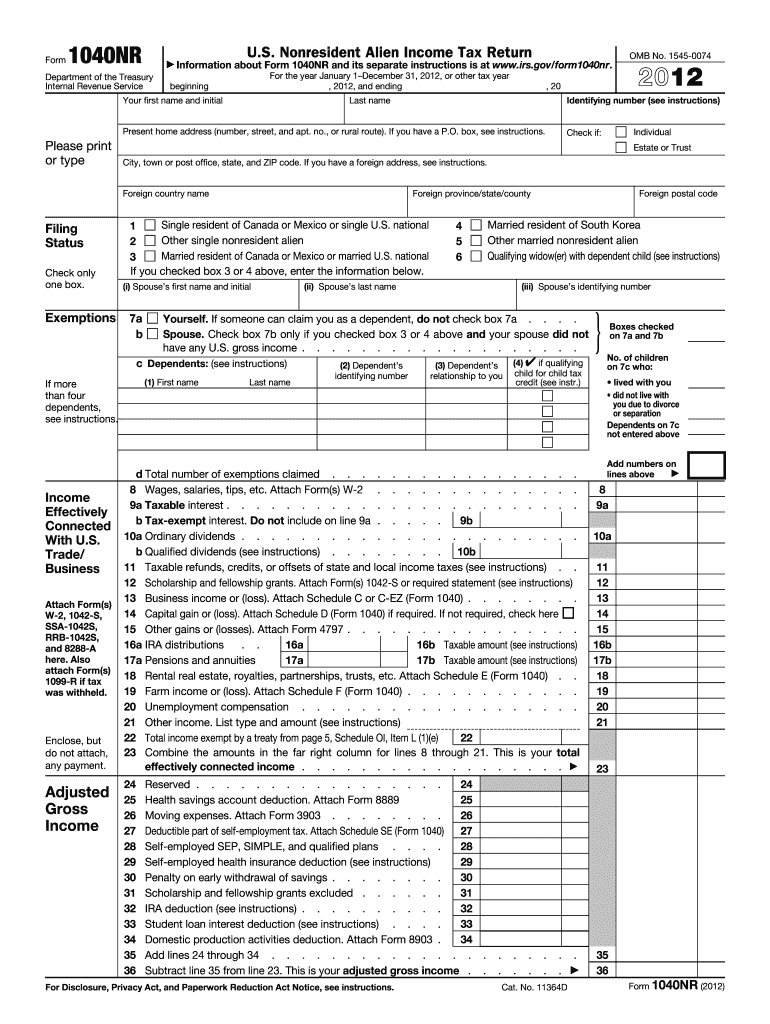

What is the NJ 1040NR?

The NJ 1040NR is the New Jersey Nonresident Income Tax Return form. This form is specifically designed for individuals who earn income in New Jersey but are not residents of the state. Nonresidents must file this form to report their New Jersey-sourced income and calculate their tax liability. It is essential for nonresidents to understand the requirements and implications of filing this form to ensure compliance with state tax laws.

Steps to complete the NJ 1040NR

Completing the NJ 1040NR involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your New Jersey-sourced income, ensuring to include only the income earned while working in the state.

- Calculate your total tax liability using the provided tax tables and instructions.

- Complete the signature section, ensuring all required signatures are included.

How to obtain the NJ 1040NR

The NJ 1040NR form can be obtained through several methods. You can download the form directly from the New Jersey Division of Taxation website, where it is available in PDF format. Alternatively, you may request a physical copy by contacting the New Jersey Division of Taxation. It is advisable to ensure you have the most current version of the form to avoid any issues during filing.

Legal use of the NJ 1040NR

The NJ 1040NR is legally recognized for reporting income earned in New Jersey by nonresidents. To ensure that the form is legally valid, it must be completed accurately and submitted by the specified deadlines. Noncompliance with filing requirements can result in penalties, making it crucial for nonresidents to understand their obligations under New Jersey tax law.

Filing Deadlines / Important Dates

Filing deadlines for the NJ 1040NR typically align with federal tax deadlines. Generally, the form must be filed by April fifteenth of the year following the tax year in question. If April fifteenth falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to stay informed about these dates to avoid late filing penalties.

Required Documents

When completing the NJ 1040NR, certain documents are required to support your income claims and deductions. These documents may include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits you intend to claim.

- Identification documents, such as your Social Security number.

Form Submission Methods (Online / Mail / In-Person)

The NJ 1040NR can be submitted through various methods. Nonresidents have the option to file online using approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the New Jersey Division of Taxation or submitted in person at designated tax offices. Each method has its benefits, and choosing the right one can depend on individual preferences and circumstances.

Quick guide on how to complete nj 1040nr

Complete Nj 1040nr effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Nj 1040nr on any device using airSlate SignNow Android or iOS applications and simplify any document-centered tasks today.

How to modify and electronically sign Nj 1040nr seamlessly

- Obtain Nj 1040nr and click on Get Form to commence.

- Utilize the tools we provide to finish your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Adjust and electronically sign Nj 1040nr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are nj1040nr instructions?

The nj1040nr instructions provide detailed guidelines for non-residents filing their New Jersey income tax returns. These instructions include information on eligibility, required forms, and necessary supporting documents.

-

How can airSlate SignNow help with nj1040nr instructions?

airSlate SignNow simplifies the process of signing and submitting your nj1040nr instructions by allowing users to eSign documents efficiently. This eliminates the need for printing and scanning, making the submission process faster and more convenient.

-

Are there any fees associated with using airSlate SignNow for nj1040nr instructions?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for managing your nj1040nr instructions. Users can select a plan that fits their needs, ensuring they only pay for the features they use.

-

Can I integrate airSlate SignNow with other tools for nj1040nr instructions?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your experience with nj1040nr instructions. This integration allows for better document management and tracking, ensuring all your forms are easily accessible.

-

What are the benefits of using airSlate SignNow for nj1040nr instructions?

Using airSlate SignNow for nj1040nr instructions provides several benefits, including increased efficiency and improved accuracy in document handling. Users can quickly send, receive, and sign documents, reducing the time spent on tax preparation.

-

Is airSlate SignNow secure for handling nj1040nr instructions?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your nj1040nr instructions and personal information. This commitment to security ensures that your sensitive data remains confidential.

-

How do I start using airSlate SignNow for nj1040nr instructions?

Getting started with airSlate SignNow for your nj1040nr instructions is easy. Simply sign up for an account, upload your documents, and begin the eSigning process immediately—no complicated setups required.

Get more for Nj 1040nr

- Excavator contractor package new hampshire form

- Renovation contractor package new hampshire form

- Concrete mason contractor package new hampshire form

- Demolition contractor package new hampshire form

- Security contractor package new hampshire form

- Insulation contractor package new hampshire form

- Paving contractor package new hampshire form

- Site work contractor package new hampshire form

Find out other Nj 1040nr

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe