FORM 709 REV 12 1989 UNITED STATES GIFT and GENERATION SKIPPING TRANSFER TAX RETURN Irs

What is the Form 709 Rev 12 1989 United States Gift and Generation Skipping Transfer Tax Return?

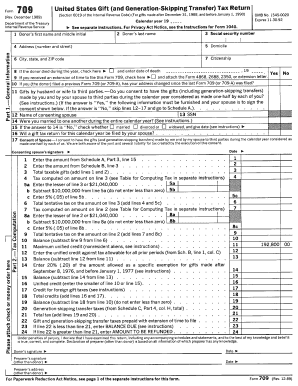

The Form 709 Rev 12 1989 is an official document used by individuals in the United States to report gifts made during the tax year and to calculate the generation-skipping transfer tax. This form is essential for taxpayers who exceed the annual gift exclusion amount, which is set by the IRS. It is important to accurately complete this form to ensure compliance with federal tax regulations and to avoid potential penalties.

Steps to Complete the Form 709 Rev 12 1989

Completing the Form 709 Rev 12 1989 involves several key steps:

- Gather necessary information, including details about the gifts made and the recipients.

- Fill out the identification section with your personal information, including your Social Security number.

- Report each gift on the appropriate section of the form, ensuring that you include the fair market value at the time of the gift.

- Calculate any applicable exclusions and deductions, such as the annual exclusion amount.

- Sign and date the form before submission.

Legal Use of the Form 709 Rev 12 1989

The legal use of the Form 709 Rev 12 1989 is governed by IRS regulations. To be considered valid, the form must be filed by the due date, typically April fifteenth of the year following the gift. Additionally, the form must be signed by the donor, and any required supporting documentation should be attached. Proper completion and timely filing help avoid issues with the IRS.

Filing Deadlines / Important Dates

The filing deadline for the Form 709 Rev 12 1989 is generally April fifteenth of the year following the year in which the gifts were made. If you miss this deadline, you may be subject to penalties and interest on any taxes owed. It is advisable to keep track of important dates related to tax filings to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 709 Rev 12 1989 can be submitted in various ways. Taxpayers have the option to file the form electronically through approved tax software or to mail a paper copy to the IRS. It is essential to ensure that the form is sent to the correct address based on your location. In-person submissions are not typically accepted for this form.

Penalties for Non-Compliance

Failure to file the Form 709 Rev 12 1989 on time or inaccurately reporting gifts can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and interest may accrue on unpaid taxes. Understanding the importance of timely and accurate filing can help mitigate these risks.

Quick guide on how to complete form 709 rev 12 1989 united states gift and generation skipping transfer tax return irs

Complete FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without any delays. Manage FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs with ease

- Obtain FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 709 1989?

airSlate SignNow is an innovative eSignature solution that allows businesses to send and sign documents efficiently. The relevance of '709 1989' comes from its association with document automation trends that began in that era. This platform enhances workflows through advanced features and security that have evolved since those early days.

-

How much does airSlate SignNow cost compared to the market trends of 709 1989?

airSlate SignNow offers competitive pricing that reflects modern demands while being cost-effective. Unlike many solutions available around the '709 1989' period, which often required extensive investments, SignNow provides plans that cater to all business sizes, ensuring you get great value without overspending.

-

What features does airSlate SignNow offer that were not available in 709 1989?

airSlate SignNow includes a variety of features not available in 709 1989, such as real-time document tracking, automated workflows, and multi-party signing capabilities. These features streamline the signing process signNowly compared to the limitations of previous generations, enhancing productivity and user experience.

-

Can I integrate airSlate SignNow with other applications, similar to how businesses evolved after 709 1989?

Yes, airSlate SignNow can be seamlessly integrated with numerous applications, reminiscent of how businesses adapted post-709 1989. This flexibility allows users to connect with CRM systems, cloud storage, and other essential tools, creating a cohesive workflow that suits modern business needs.

-

What are the benefits of using airSlate SignNow over traditional signing methods from 709 1989?

The primary benefits of airSlate SignNow include speed, security, and convenience, which far surpass traditional signing methods from 709 1989. By digitizing the signing process, businesses can reduce turnaround times, improve document security, and enhance collaboration among teams.

-

How does airSlate SignNow enhance security compared to the standards of 709 1989?

airSlate SignNow enhances document security with advanced encryption methods and compliance with global security standards, which were far less developed in 709 1989. These robust security measures ensure that businesses can trust the platform to protect sensitive information during the signing process.

-

Is there a free trial available for airSlate SignNow like many services emerged after 709 1989?

Yes, airSlate SignNow offers a free trial which allows potential users to experience its powerful features before committing financially. This approach is reminiscent of innovations that emerged after 709 1989, where businesses sought trial options to ensure they were making prudent investments.

Get more for FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497319280 form

- Nj violating form

- New jersey violating form

- Notice breach tenant form

- Business credit application new jersey form

- Individual credit application new jersey form

- Interrogatories to plaintiff for motor vehicle occurrence new jersey form

- Interrogatories to defendant for motor vehicle accident new jersey form

Find out other FORM 709 REV 12 1989 UNITED STATES GIFT AND GENERATION SKIPPING TRANSFER TAX RETURN Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors