Business Credit Application New Jersey Form

What is the Business Credit Application New Jersey

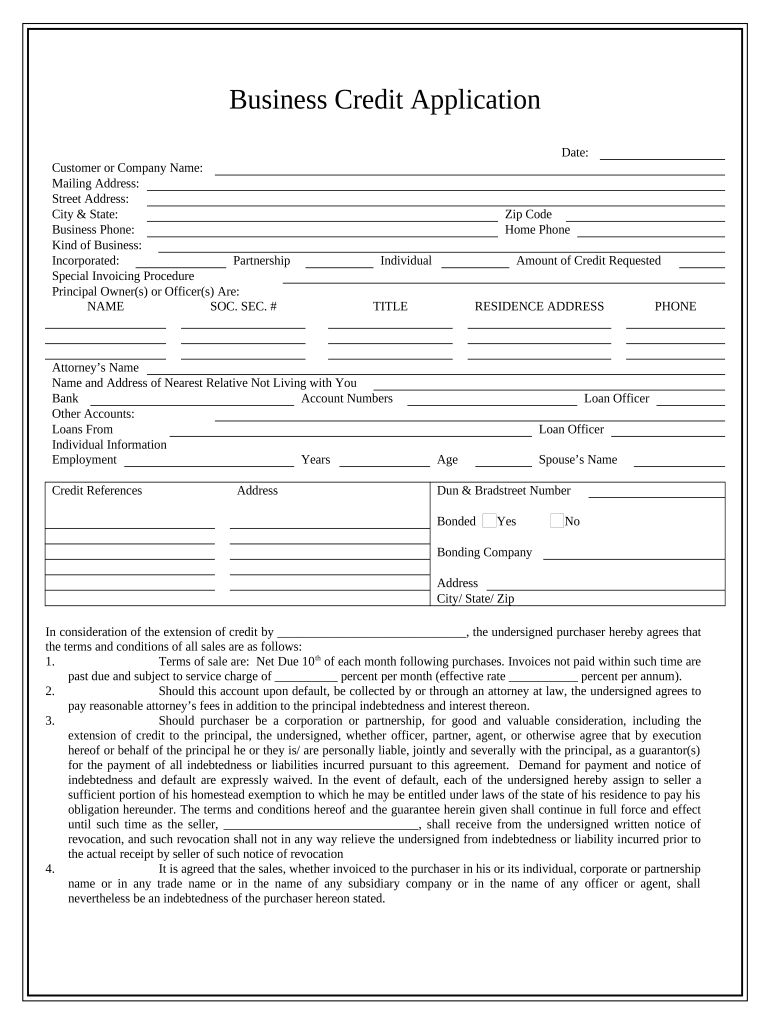

The Business Credit Application New Jersey is a formal document that businesses in New Jersey use to apply for credit from lenders or suppliers. This application typically collects essential information about the business, including its legal name, address, ownership structure, and financial details. The purpose of the application is to assess the creditworthiness of the business, enabling lenders to make informed decisions regarding credit limits and terms.

Key elements of the Business Credit Application New Jersey

When completing the Business Credit Application New Jersey, several key elements are crucial for a comprehensive submission. These include:

- Business Information: Legal name, address, and contact details.

- Ownership Structure: Details about the owners, including their names and ownership percentages.

- Financial Information: Recent financial statements, credit history, and bank references.

- Business Type: Identification of the business entity, such as LLC, corporation, or partnership.

- Purpose of Credit: A brief explanation of how the credit will be utilized.

Steps to complete the Business Credit Application New Jersey

Completing the Business Credit Application New Jersey involves several straightforward steps:

- Gather Information: Collect all necessary business and financial information before starting the application.

- Fill Out the Application: Accurately enter all required details in the application form.

- Review for Accuracy: Double-check all information to ensure accuracy and completeness.

- Submit the Application: Choose your preferred submission method, whether online or via mail.

Legal use of the Business Credit Application New Jersey

The Business Credit Application New Jersey is legally binding once submitted. It is essential for businesses to understand that providing false information can lead to legal repercussions. The application must comply with relevant laws and regulations governing credit applications in New Jersey. This includes ensuring that all disclosures are accurate and that the application adheres to the Fair Credit Reporting Act, which protects consumers against unfair credit practices.

Eligibility Criteria

To successfully complete the Business Credit Application New Jersey, businesses must meet specific eligibility criteria. These typically include:

- Operating legally within New Jersey.

- Having a valid Employer Identification Number (EIN).

- Demonstrating a stable financial history.

- Providing accurate and complete information in the application.

Application Process & Approval Time

The application process for the Business Credit Application New Jersey generally involves submitting the completed form along with any required documentation. Approval times can vary based on the lender or supplier but typically range from a few days to several weeks. Factors influencing approval time include the completeness of the application, the lender's workload, and the complexity of the credit request.

Quick guide on how to complete business credit application new jersey

Effortlessly Prepare Business Credit Application New Jersey on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools necessary to quickly create, edit, and electronically sign your documents without any hold-ups. Manage Business Credit Application New Jersey on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

How to Alter and Electronically Sign Business Credit Application New Jersey with Ease

- Obtain Business Credit Application New Jersey and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using the specific tools offered by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form—via email, SMS, or invite link—or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Alter and electronically sign Business Credit Application New Jersey and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application New Jersey?

A Business Credit Application New Jersey is a formal document that businesses in New Jersey use to request credit from lenders or suppliers. It typically includes financial information and business details, allowing the lender to assess creditworthiness and make informed lending decisions.

-

How can airSlate SignNow help with my Business Credit Application New Jersey?

airSlate SignNow streamlines the process of sending and eSigning your Business Credit Application New Jersey. With our easy-to-use platform, you can create, send, and manage your applications digitally, ensuring faster approvals and secure transactions.

-

What are the pricing options for using airSlate SignNow for Business Credit Applications New Jersey?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs for managing Business Credit Applications New Jersey. Our flexible subscription model ensures you only pay for the features you use, making it both cost-effective and scalable.

-

What features does airSlate SignNow provide for Business Credit Application New Jersey?

The platform provides features like customizable templates, real-time tracking, secure eSigning, and robust integration options for Business Credit Application New Jersey. These features simplify the application process, enhance efficiency, and promote seamless communication.

-

Are there any benefits to using airSlate SignNow for Business Credit Applications New Jersey?

Yes, using airSlate SignNow for Business Credit Applications New Jersey offers numerous benefits including reduced processing time, improved accuracy, and enhanced security. Our platform helps you focus more on growing your business while handling application workflows efficiently.

-

Can I integrate airSlate SignNow with other software for my Business Credit Application New Jersey?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software, making it easier to manage your Business Credit Application New Jersey. This includes accounting software, CRM systems, and other business applications that fit your existing workflows.

-

Is airSlate SignNow user-friendly for submitting a Business Credit Application New Jersey?

Yes, airSlate SignNow is designed to be user-friendly, allowing anyone to navigate the platform with ease. Whether you're submitting a Business Credit Application New Jersey or managing document workflows, our intuitive interface ensures a smooth experience.

Get more for Business Credit Application New Jersey

Find out other Business Credit Application New Jersey

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document