Withholding Tax FAQs Division of Revenue Delaware Form

What is the Withholding Tax FAQs Division Of Revenue Delaware?

The Withholding Tax FAQs Division Of Revenue Delaware is a resource designed to provide clarity on withholding tax obligations for businesses and individuals operating in Delaware. This document outlines the essential information regarding the withholding tax process, including definitions, responsibilities, and frequently asked questions. It serves as a guide to help taxpayers understand their obligations under Delaware law, ensuring compliance and minimizing potential issues with tax authorities.

Steps to Complete the Withholding Tax FAQs Division Of Revenue Delaware

Completing the Withholding Tax FAQs Division Of Revenue Delaware involves several key steps:

- Gather necessary information, including your business or personal identification details.

- Review the FAQs to understand your withholding tax responsibilities.

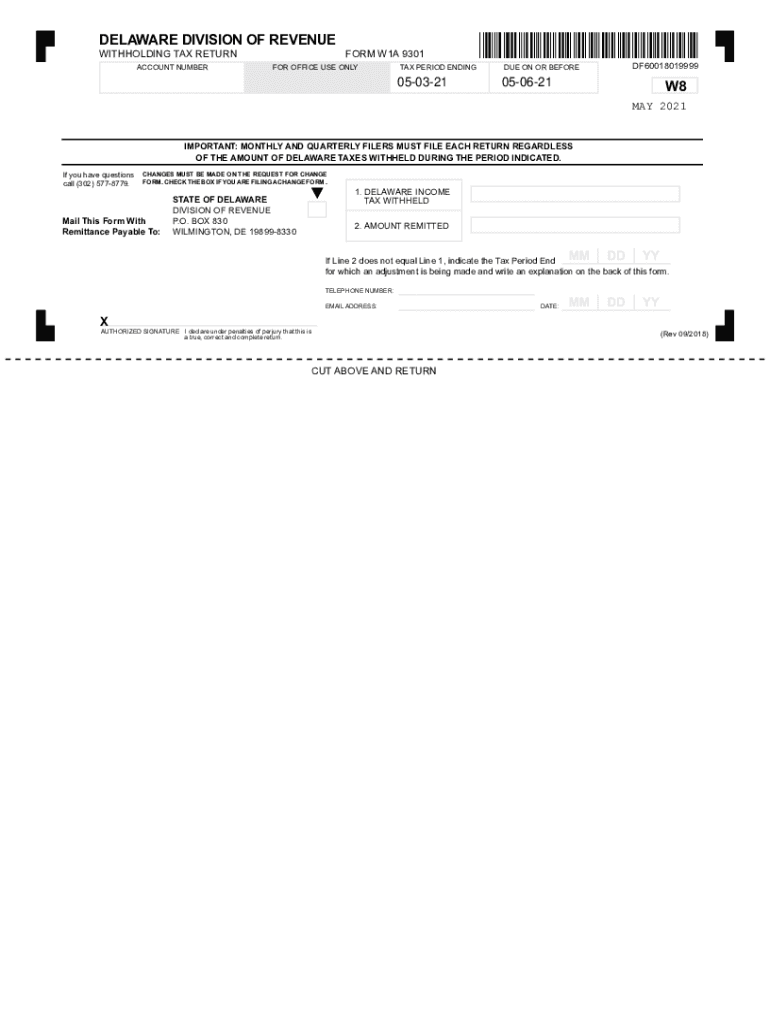

- Complete the required forms as outlined in the document.

- Ensure all information is accurate and complete to avoid delays.

- Submit the completed forms through the designated method, whether online or by mail.

Following these steps carefully will help ensure that your withholding tax obligations are met efficiently.

Legal Use of the Withholding Tax FAQs Division Of Revenue Delaware

The Withholding Tax FAQs Division Of Revenue Delaware is legally recognized as a valid document for tax purposes. It provides essential guidelines that help individuals and businesses comply with state tax laws. By following the information provided in this document, taxpayers can ensure that they are adhering to the legal requirements set forth by the Delaware Division of Revenue. This compliance is crucial for avoiding penalties and ensuring that all tax obligations are met in a timely manner.

Filing Deadlines / Important Dates

Understanding the filing deadlines and important dates associated with the Withholding Tax FAQs Division Of Revenue Delaware is vital for compliance. Key dates typically include:

- Quarterly withholding tax payment deadlines.

- Annual reconciliation deadlines for withholding tax forms.

- Specific dates for submitting forms electronically or by mail.

Staying informed about these dates helps ensure that all tax submissions are timely, reducing the risk of penalties.

Required Documents

To complete the Withholding Tax FAQs Division Of Revenue Delaware, certain documents may be required. These typically include:

- Employer identification number (EIN) or Social Security number.

- Completed withholding tax forms.

- Any supporting documentation that verifies income or deductions.

Having these documents ready will streamline the process and help ensure compliance with Delaware tax regulations.

Who Issues the Form

The Withholding Tax FAQs Division Of Revenue Delaware is issued by the Delaware Division of Revenue. This state agency is responsible for administering tax laws and ensuring that taxpayers comply with their withholding tax obligations. The Division provides resources and support to help individuals and businesses navigate the complexities of tax compliance in Delaware.

Quick guide on how to complete withholding tax faqs division of revenue delaware

Complete Withholding Tax FAQs Division Of Revenue Delaware effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and safely keep it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents promptly without interruptions. Manage Withholding Tax FAQs Division Of Revenue Delaware on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and electronically sign Withholding Tax FAQs Division Of Revenue Delaware with ease

- Locate Withholding Tax FAQs Division Of Revenue Delaware and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your selecting. Edit and electronically sign Withholding Tax FAQs Division Of Revenue Delaware and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding tax faqs division of revenue delaware

The best way to create an e-signature for a PDF in the online mode

The best way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the purpose of the Withholding Tax FAQs Division Of Revenue Delaware?

The Withholding Tax FAQs Division Of Revenue Delaware provides essential information about the state's withholding tax regulations and obligations for businesses. This section is designed to help you navigate common questions and issues regarding withholding taxes.

-

How can airSlate SignNow assist with the Withholding Tax FAQs Division Of Revenue Delaware?

airSlate SignNow streamlines the process of signing and sending documents related to your withholding tax obligations. With our eSignature solutions, you can easily manage compliance with the Withholding Tax FAQs Division Of Revenue Delaware without the hassle of traditional paperwork.

-

What features of airSlate SignNow support compliance with Delaware's withholding tax regulations?

Features like customizable templates, real-time tracking, and audit trails help ensure that your documents meet the requirements outlined in the Withholding Tax FAQs Division Of Revenue Delaware. This enhances your compliance and record-keeping efficiency.

-

Is there a cost associated with using airSlate SignNow for withholding tax documents?

While utilizing airSlate SignNow for eSigning and managing withholding tax documents incurs a nominal fee, it is often more cost-effective than traditional methods. We offer various pricing plans that can cater to businesses of all sizes while addressing your needs related to the Withholding Tax FAQs Division Of Revenue Delaware.

-

Can airSlate SignNow integrate with accounting software to manage withholding taxes?

Yes, airSlate SignNow seamlessly integrates with various accounting software to help you manage your withholding tax responsibilities effectively. This integration allows you to keep track of your documents and ensures compliance with the Withholding Tax FAQs Division Of Revenue Delaware.

-

What benefits does airSlate SignNow provide for managing withholding tax documents?

By using airSlate SignNow, you gain benefits such as increased efficiency, reduced paper clutter, and faster document processing. These advantages are crucial for staying compliant with the Withholding Tax FAQs Division Of Revenue Delaware.

-

How does airSlate SignNow ensure the security of tax-related documents?

airSlate SignNow employs advanced security measures, including encryption and secure access, to protect all tax-related documents. This ensures that your sensitive information remains safe while you address your needs outlined in the Withholding Tax FAQs Division Of Revenue Delaware.

Get more for Withholding Tax FAQs Division Of Revenue Delaware

Find out other Withholding Tax FAQs Division Of Revenue Delaware

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free