1065 Schedule B 1 2019-2026

What is the 1065 Schedule B 1

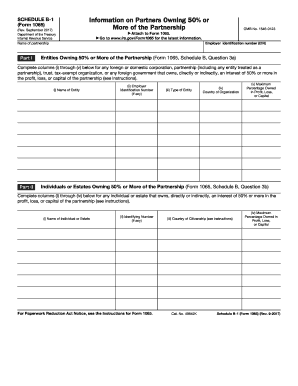

The 1065 Schedule B 1 is a supplementary form used by partnerships to report additional information regarding their operations and ownership structure. This form is part of the IRS Form 1065, which is the U.S. Return of Partnership Income. Schedule B 1 specifically focuses on the partner's share of liabilities, contributions, and distributions. It is essential for accurately reflecting the financial position of the partnership and ensuring compliance with IRS regulations.

Steps to complete the 1065 Schedule B 1

Completing the 1065 Schedule B 1 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including partnership agreements and prior year tax returns. Next, fill out the form by providing detailed information about each partner's contributions, liabilities, and distributions. It is crucial to ensure that all figures match the partnership's financial statements. After completing the form, review it for any errors before submission. Finally, attach the completed Schedule B 1 to the Form 1065 when filing with the IRS.

Legal use of the 1065 Schedule B 1

The legal use of the 1065 Schedule B 1 is vital for partnerships to maintain compliance with federal tax laws. This form not only provides the IRS with necessary information about the partnership's financial activities but also helps partners understand their individual tax obligations. Proper completion and submission of Schedule B 1 can prevent potential legal issues, such as audits or penalties for non-compliance. It is important for partnerships to adhere to the guidelines set forth by the IRS to ensure that their filings are legally valid.

IRS Guidelines

The IRS provides specific guidelines for completing the 1065 Schedule B 1, which must be followed to ensure compliance. These guidelines include detailed instructions on how to report each partner's share of liabilities and contributions. The IRS also outlines deadlines for filing the form, as well as any penalties for late submissions. It is important for partnerships to stay informed about any changes to these guidelines, as they can impact how the form is completed and submitted.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for the 1065 Schedule B 1 to avoid penalties. Generally, the Form 1065, along with Schedule B 1, is due on the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they must be requested prior to the original due date. Keeping track of these important dates is crucial for maintaining compliance with IRS regulations.

Required Documents

To complete the 1065 Schedule B 1 accurately, certain documents are required. Partnerships should gather financial statements, partner agreements, and prior tax returns. Additionally, any documentation related to partner contributions and liabilities must be collected. Having these documents on hand ensures that the information reported on Schedule B 1 is accurate and complete, which is essential for compliance with IRS requirements.

Quick guide on how to complete 1065 schedule b 1 2018

Complete 1065 Schedule B 1 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage 1065 Schedule B 1 on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to alter and eSign 1065 Schedule B 1 without hassle

- Obtain 1065 Schedule B 1 and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choice. Alter and eSign 1065 Schedule B 1 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065 schedule b 1 2018

Create this form in 5 minutes!

How to create an eSignature for the 1065 schedule b 1 2018

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow's 'b 1' feature?

The 'b 1' feature in airSlate SignNow allows users to send documents for electronic signatures seamlessly. This feature simplifies the process of obtaining signatures, making it efficient for businesses of all sizes. With 'b 1', you can manage your documents with ease and focus on your core business activities.

-

How does airSlate SignNow pricing work for the 'b 1' plan?

The pricing for the 'b 1' plan is designed to be flexible and accommodating for varying business needs. It offers competitive rates while providing full access to essential features such as document management and eSigning capabilities. You can choose from different pricing tiers based on your requirements, ensuring cost-effectiveness.

-

What benefits does the 'b 1' service of airSlate SignNow provide?

The 'b 1' service enhances productivity by reducing the time spent on document signing processes. By utilizing airSlate SignNow's user-friendly interface, businesses can speed up workflows and improve overall efficiency. Additionally, it ensures secure and legally binding eSignatures for peace of mind.

-

Are there integrations available with 'b 1' from airSlate SignNow?

Yes, the 'b 1' plan provides numerous integrations with popular platforms and applications. This allows businesses to streamline their document processes across various systems they already use. Integration with CRM tools and cloud storage solutions enhances the overall utility of airSlate SignNow.

-

Is the 'b 1' plan suitable for small businesses?

Absolutely! The 'b 1' plan is tailored to meet the needs of small businesses looking for cost-effective solutions. With its range of features, airSlate SignNow can help small enterprises streamline their document management and eSigning processes, making it an excellent choice.

-

How secure is the 'b 1' feature on airSlate SignNow?

The 'b 1' feature prioritizes security with advanced encryption technologies to protect your sensitive documents. airSlate SignNow complies with industry standards and regulations to ensure that your eSigned documents are secure and legally valid. This provides users with confidence in the integrity of their transactions.

-

Can I customize documents using the 'b 1' service?

Yes, airSlate SignNow's 'b 1' service allows for document customization to meet specific business needs. Users can create templates and modify various elements of their documents before sending them for signatures. This flexibility enhances the user experience and meets unique requirements.

Get more for 1065 Schedule B 1

- New jersey timber sale contract new jersey form

- New jersey forest products timber sale contract new jersey form

- New jersey easement form

- New jersey easement 497319414 form

- Nj easement form

- New jersey deed 497319416 form

- Assumption agreement of mortgage and release of original mortgagors new jersey form

- Foreign judgment enforcement form

Find out other 1065 Schedule B 1

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed