Form 1065 Schedule B 1 2019

What is the Form 1065 Schedule B 1

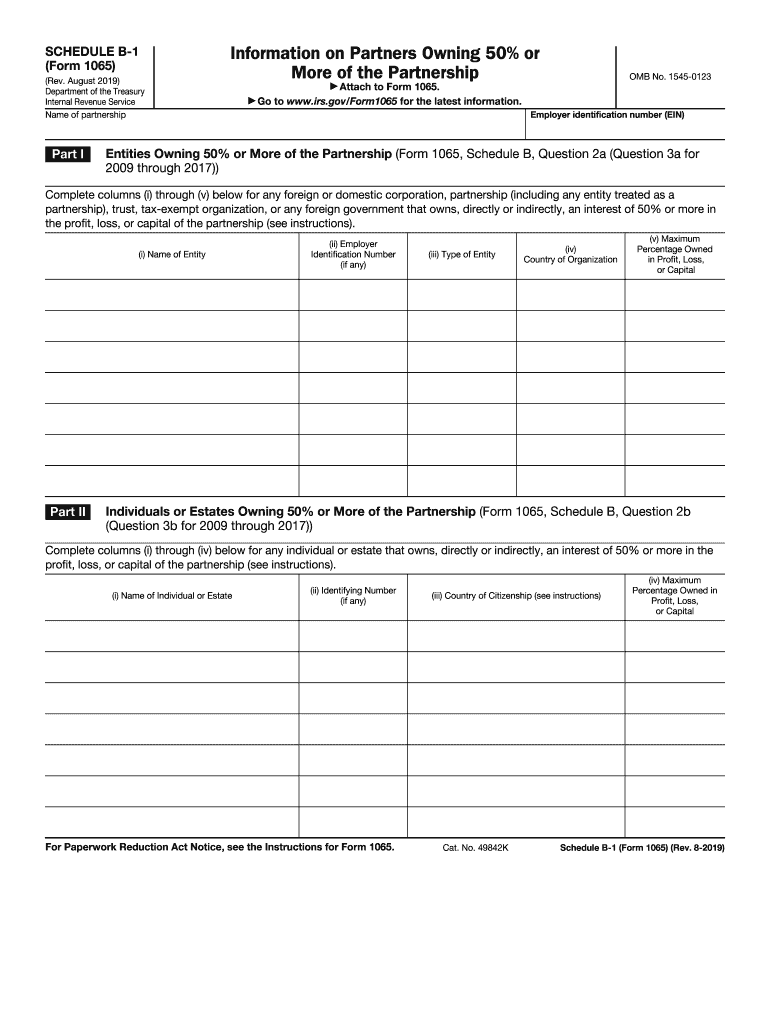

The Form 1065 Schedule B 1 is a supplementary document that partnerships use to provide additional information about their operations and partners. This form is part of the IRS Form 1065, which is the U.S. Return of Partnership Income. Schedule B 1 specifically focuses on questions that help the IRS understand the partnership's financial activities and compliance with tax regulations. It includes inquiries about the partnership's ownership structure, types of income, and any deductions claimed. Accurate completion of this form is essential for ensuring compliance with federal tax laws.

How to use the Form 1065 Schedule B 1

Using the Form 1065 Schedule B 1 involves answering a series of questions that pertain to the partnership's financial situation. Each question is designed to gather specific information that the IRS requires for tax assessment. To effectively use this form, partnerships should gather all necessary financial records and documentation before beginning the completion process. It is important to provide clear and accurate answers to each question, as this information contributes to the overall integrity of the partnership's tax return.

Steps to complete the Form 1065 Schedule B 1

Completing the Form 1065 Schedule B 1 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and partnership agreements.

- Review each question on the form and determine the appropriate responses based on your partnership's financial activities.

- Fill out the form accurately, ensuring that all information is complete and truthful.

- Double-check your entries for accuracy and compliance with IRS guidelines.

- Attach the completed Schedule B 1 to your Form 1065 before submission.

Legal use of the Form 1065 Schedule B 1

The legal use of the Form 1065 Schedule B 1 is governed by IRS regulations. This form must be completed and submitted accurately to avoid penalties and ensure compliance with federal tax laws. The information provided on this form is used by the IRS to assess the partnership's tax obligations. Failure to complete this form correctly can lead to audits, fines, or other legal consequences. Therefore, partnerships should ensure they understand the legal implications of the information they report on Schedule B 1.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 1065 and its accompanying Schedule B 1. Generally, the deadline for filing Form 1065 is the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due on March 15. It is important for partnerships to mark these dates on their calendars to avoid late filing penalties. Extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the Form 1065 Schedule B 1, partnerships should have several key documents on hand. These include:

- Partnership agreement outlining the ownership structure.

- Financial statements, including profit and loss statements and balance sheets.

- Records of income received and expenses incurred during the tax year.

- Any additional documentation that supports the answers provided on the form.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1065 Schedule B 1. These guidelines outline the requirements for each question on the form and detail the necessary documentation needed for compliance. Partnerships are encouraged to refer to the IRS instructions for Form 1065 and Schedule B 1 to ensure they are following the latest regulations and requirements. Staying informed about IRS guidelines helps partnerships avoid common mistakes and ensures accurate reporting.

Quick guide on how to complete information on partners owning 50 or form 1065 more of

Effortlessly Prepare Form 1065 Schedule B 1 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and store it securely online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and efficiently. Manage Form 1065 Schedule B 1 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Edit and Electronically Sign Form 1065 Schedule B 1 with Ease

- Locate Form 1065 Schedule B 1 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1065 Schedule B 1 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information on partners owning 50 or form 1065 more of

Create this form in 5 minutes!

How to create an eSignature for the information on partners owning 50 or form 1065 more of

How to generate an electronic signature for the Information On Partners Owning 50 Or Form 1065 More Of in the online mode

How to create an electronic signature for the Information On Partners Owning 50 Or Form 1065 More Of in Chrome

How to generate an eSignature for signing the Information On Partners Owning 50 Or Form 1065 More Of in Gmail

How to generate an electronic signature for the Information On Partners Owning 50 Or Form 1065 More Of from your smartphone

How to make an eSignature for the Information On Partners Owning 50 Or Form 1065 More Of on iOS devices

How to create an electronic signature for the Information On Partners Owning 50 Or Form 1065 More Of on Android devices

People also ask

-

What is the purpose of the 1065 schedule b 1?

The 1065 schedule b 1 is a supplemental form used by partnerships to provide additional information about their income, deductions, and other pertinent financial details. It is essential for accurate tax reporting and helps the IRS understand the partnership's financial status. Completing the 1065 schedule b 1 correctly ensures compliance and avoids potential penalties.

-

How does airSlate SignNow help in filling out the 1065 schedule b 1?

AirSlate SignNow offers a user-friendly platform that simplifies the process of filling out the 1065 schedule b 1. With templates and eSignature capabilities, users can easily collaborate with partners and gather necessary signatures on required documents. This digital solution reduces errors and speeds up the completion of tax forms.

-

Is airSlate SignNow cost-effective for small businesses needing to file the 1065 schedule b 1?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses that need to file the 1065 schedule b 1. It offers flexible pricing plans which accommodate various budgets while providing robust features for document management. By investing in airSlate SignNow, businesses save time and money in preparing essential tax forms.

-

Can I integrate airSlate SignNow with accounting software to assist with the 1065 schedule b 1?

Absolutely! AirSlate SignNow seamlessly integrates with popular accounting software, allowing users to pull data directly when preparing the 1065 schedule b 1. This integration enhances efficiency by reducing manual entry and ensuring that all financial information is accurate and up-to-date.

-

What features of airSlate SignNow assist in managing the 1065 schedule b 1 filing process?

AirSlate SignNow provides several features to streamline the filing process for the 1065 schedule b 1, including template creation, secure cloud storage, and automated reminders for deadlines. Users can track the status of documents and quickly access previous filings, making it easier to manage ongoing tax responsibilities with confidence.

-

What are the benefits of eSigning documents related to the 1065 schedule b 1 with airSlate SignNow?

Using airSlate SignNow to eSign documents related to the 1065 schedule b 1 offers signNow benefits, such as increased efficiency and enhanced security. eSigning eliminates the need for physical paperwork and allows for instant document turnaround. Additionally, every transaction is securely stored and easily retrievable, providing peace of mind.

-

How does airSlate SignNow ensure the security of my 1065 schedule b 1 documents?

AirSlate SignNow employs advanced security measures to protect your 1065 schedule b 1 documents and sensitive information. With features like encryption, secure cloud storage, and access controls, your data remains protected against unauthorized access. This commitment to security ensures that your important tax documents are safe and confidential.

Get more for Form 1065 Schedule B 1

Find out other Form 1065 Schedule B 1

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online