Schedule B 1 Instructions 2017

What is the Schedule B 1 Instructions

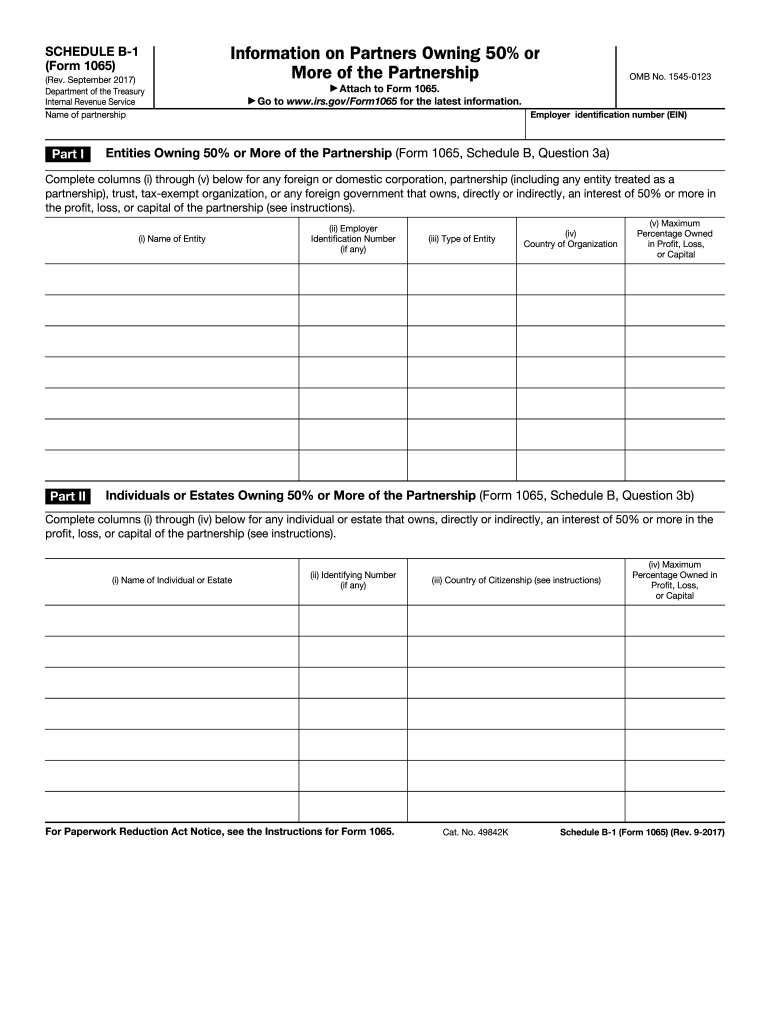

The Schedule B-1 is a critical component of the IRS Form 1065, which is used by partnerships to report income, deductions, gains, losses, and other financial information. The Schedule B-1 specifically provides detailed instructions on how to report each partner’s share of income, deductions, and credits. It is essential for ensuring that partners accurately report their respective shares on their individual tax returns. Understanding these instructions helps in maintaining compliance with IRS regulations and avoiding potential penalties.

Steps to complete the Schedule B 1 Instructions

Completing the Schedule B-1 requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents, including partnership income statements and expense reports.

- Identify each partner’s share of income, losses, and deductions for the tax year.

- Fill out the Schedule B-1 by entering the appropriate amounts for each partner in the designated sections.

- Ensure all figures are accurate and correspond to the partnership's overall financial statements.

- Review the completed form for any errors or omissions before submission.

Legal use of the Schedule B 1 Instructions

The Schedule B-1 instructions are legally binding as they are issued by the IRS. Accurate completion of this form is necessary for compliance with federal tax laws. Failure to adhere to these instructions can lead to misreporting income, which may result in penalties or audits by the IRS. It is important for partnerships to use the most current version of the Schedule B-1 and follow the instructions closely to ensure legal compliance.

Filing Deadlines / Important Dates

Partnerships must file Form 1065, along with the Schedule B-1, by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically falls on March 15. If the deadline is missed, partnerships may face penalties. Extensions can be requested, but it is crucial to file the extension form before the original due date to avoid late fees.

Required Documents

To complete the Schedule B-1, partnerships need several key documents:

- Partnership financial statements, including income and expense reports.

- Prior year tax returns for reference, if applicable.

- Records of each partner’s contributions and distributions throughout the year.

- Any additional documentation that supports deductions or credits claimed on the form.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule B-1. These guidelines include instructions on how to calculate each partner's share of income and deductions, as well as how to report special allocations. It is important to refer to the latest IRS publications and instructions to ensure compliance and accuracy. Following these guidelines helps to minimize the risk of errors and potential audits.

Quick guide on how to complete 2017 federal tax forms

Discover the easiest method to complete and endorse your Schedule B 1 Instructions

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior way to complete and endorse your Schedule B 1 Instructions and associated forms for public services. Our intelligent eSignature solution equips you with everything necessary to process documents swiftly while adhering to official standards - robust PDF editing, management, protection, signing, and distribution tools all accessible through a user-friendly interface.

Only a few steps are required to finalize and endorse your Schedule B 1 Instructions:

- Upload the fillable document to the editor using the Get Form button.

- Review the information you need to enter in your Schedule B 1 Instructions.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any preferred method.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finished Schedule B 1 Instructions in the Documents folder in your profile, download it, or export it to your preferred cloud storage. Our service also provides versatile file sharing options. There’s no need to print your forms when you need to send them to the appropriate public office - simply use email, fax, or request a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 federal tax forms

FAQs

-

How much does it cost to start a 501(c)3 in NYC?

According to the Department of State, Division of Corporations, State Records, and UCC for New York, you must pay the statutory filing fee of $75 (as of July 2017) along with a small fee to check name availability.Filling out your non-profit forms accurately is very, very important. Ultimately, what you put in your documents may affect whether you are (or will remain) tax-exempt. Now, with that being said, your state documents aren’t the only documents you must complete. You must also fill out an Application for Recognition of Exemption with the IRS. Some non-profits are eligible to fill out a streamlined version, but you should talk with an attorney or tax professional to determine which one you should complete.You may also be required to obtain certain permits or licenses in New York (at either the city or the state level). This depends on what your non-profit will do or sell in order to raise money. Without the right permits or licenses, your non-profit could be shut down.You also need to write bylaws and appoint directors to the non-profit. Directors are important and should be chosen with care. They make important business and financial decisions for your non-profit. They will also officially adopt the bylaws at the first board meeting. The bylaws explain how the non-profit will be ran.Because non-profits must remain in compliance with state and federal law, it’s a good idea to first speak with an attorney and maybe even consider allowing the attorney to fill out the documents. It’s really worth the price since the tax-exempt status of the non-profit can be affected by a mistake. If you’d like to speak with an experienced attorney, check out LawTrades. Our legal marketplace has helped connect many entrepreneurs with experienced, non-profit attorneys to get them up and running. Hope you give us a try!

-

How is it possible for Amazon to pay $0 in Federal Taxes for its 11.2 billion profits?

To start, for the sake of accuracy, let’s make some clarifications.Amazon recorded a provision for income taxes in 2018 of $1.2 billion. Of this amount, $436 million was provisioned for U.S. Federal Taxes, $327 million for U.S. State Taxes and $434 million for International Taxes.Out of the U.S. Federal Tax amount, $565 million was deferred and negative $129 million (i.e. “less than zero”) was provisioned for current-year obligations:Source: Amazon 10-K (2018) (Note 9, p. 62)In accounting-speak, “provision” is a fancy way of saying “estimate”. For example, in 2018, the tax provision includes a “one-time provisional tax benefit of the U.S. Tax Act recognized in 2017”. The Tax Cuts and Jobs Act of 2017[1] reduced the corporate tax rate from 35% to 21%, and this shows up as a benefit for profit-generating corporations like Amazon. Translation: what happened here is that the previously estimated figure was re-estimated based on recent changes in tax laws.Actual taxes paid are another matter, although it just so happens that for 2018 they were pretty much the same (also $1.2 billion). Normally, these numbers are different. Amazon’s 10-K does not provide a breakdown of this amount between U.S. Federal, U.S. State and International.With this out of the way, let’s look at how Amazon managed to reduce its current-year U.S. Federal taxable income to the point where it could record a negative provision in 2018. Our tax code is complicated, and this means there are a lot of tricks that you can do to legally reduce taxes or push them out as far into the future as possible.Aggressive re-investment. Amazon plays in a number of sectors that (i) feature signNow long-term growth opportunities and (ii) require signNow capital or technology investment to capture. Historically, the company has re-invested nearly all of its growth back into the business, including the creation of entirely new market segments from scratch — e.g. how it parlayed internal technology services into a third-party business (Amazon Web Services) that is now the largest contributor to consolidated group operating profit. Heavy re-investment, whether through capital assets (more on this below) or hiring of high-salaried technology workers, will serve to reduce taxable income.It took a long time before Amazon started generating GAAP[2] profits. Even after it started generating GAAP profits, the company still had to burn through all of the tax losses accumulated in the earlier, ramp-up years. It wasn’t until 2009 that Amazon’s retained earnings account on the balance sheet turned positive. And it has only been the last couple years where the company has really started to see its profits increase to substantial levels relative to its market cap.On top of this, remember that U.S. companies keep two sets of books, one for GAAP accounting and the other for taxes. This is perfectly legal, as the rules for tax treatment are often very different than GAAP treatment. This means that even as its accumulated GAAP earnings finally caught up in 2009, accumulated losses for tax purposes would take much longer to burn up.One of the key GAAP vs. tax accounting differences that Amazon takes advantage of is accelerated depreciation.Accelerated depreciation. Amazon is a capital-intensive business that requires signNow capital to grow, both for its core e-commerce operation (logistics and fulfillment) as well as its technology services (Amazon Web Services). For e-commerce, it invests in warehouses and the equipment and machinery within the warehouses. For cloud/technology services, it invests in servers, networking equipment and some capitalized software development to expand capacity to meet both internal needs and that of third-party customers.These investments are typically made via something called a “capital lease”. Capital leases allow companies to finance the purchase of long-lived assets, but for tax purposes treat them like normal capital assets. As a capital asset, the company can take a depreciation charge for tax accounting purposes. Companies typically try to “accelerate” as much of the depreciation as possible, which has the net effect reducing current-year taxable income by pushing profits farther out into the future.This accelerated depreciation shows up in something called “deferred taxes”. When a company pushes taxable income into the future, this shows up as a future liability on the balance sheet through the deferred tax liability account. To the extent tax laws stay the same, at some point the company will need to pay those taxes. Of course, most companies, Amazon included, try their best to push the actual bill as far out into the future as possible.Other cool tricks. Interestingly, the largest adjustment to Amazon’s 2018 income tax provision was an adjustment made for stock-based compensation.Stock-based compensation arises when companies like Amazon issue stock options to employees. When equity is awarded to employees, a complicated calculation is performed — typically by the HR department — to calculate the value of the equity, using models with fancy-sounding names (e.g. the “Black-Scholes”[3] formula).However, in the time from when the equity award was issued to when it was exercised, the share price invariably changes. In the case of Amazon, the direction has historically been upwards, often at a very steep slope!When this happens, tax accounting rules[4] allow the company to calculate how much higher the realized equity award was compared to the original estimate. The difference between these two numbers gives rise to something called “excess tax benefits from stock-based compensation” and has the effective of lowering current-year income tax provisions.This is one reason why companies love to issue options!Profit-shifting. Another common practice is maximizing the allocation profits to overseas entities in jurisdictions where tax rates are lower. The most profitable segment within Amazon is its cloud/technology services division, and a not-insignNow proportion of these revenues are generated overseas. As I discuss here[5], because of the intangible nature of technology and software services, it is quite easy to structure things so that a big chunk of these profits are recognized offshore to lower the overall tax bill.In my view, Amazon is actually not as aggressive compared to some other technology companies at shifting profits overseas. A big part of this is, as described earlier, Amazon does not generate signNow profits to begin with (again, relative to its market cap). The other reason is that a signNow amount of its profit is actually generated onshore vs. offshore. For example, its International operations are barely profitable (as you can see in the first table above).However, as the company’s profits start to signNowly ramp up, expect more of an effort to use international tax havens like Ireland and the British Virgin Islands to minimize its overall tax bill.As it states in its 10-K (p. 63) , “we intend to invest substantially all of our foreign subsidiary earnings, as well as our capital in our foreign subsidiaries, indefinitely outside of the U.S. in those jurisdictions in which we would incur signNow, additional costs upon repatriation of such amounts.”I just want to add that even though Amazon’s corporate tax bill is relatively low (or even non-existent) at the federal level, the company is still responsible for generating signNow tax revenue when you analyze things holistically. Amazon pays tens of billions of dollars in wage and compensation income to its employees, the majority of whom are based in the United States. A signNow portion of the wages will fill government coffers in the form of federal and state-level income taxes.Its spending (on capital leases and other non-compensation related expenses) also indirectly generates taxable income for other companies in its eco-system.Finally, unlike many other multinational corporations, Amazon is actually heavily investing back into the United States, both in terms of hiring workers and investing in next-generation warehouse and datacenter operations.Footnotes[1] https://www.govinfo.gov/content/...[2] Generally Accepted Accounting Principles (United States) - Wikipedia[3] Black Scholes Model[4] Proposed ASUâCompensationâStock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting[5] Glenn Luk's answer to Where does the money I pay for an iPhone go?

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How can we fight against the NRA regarding gun control?

Are you sure that the NRA is the problem?Oh, I know that the media and the talking heads are all making them out to be some 500 lb gorilla and the reason psychos shoot up school yards, but have you ever bothered to look into the matter beyond the headlines?I’ll give you an example. In 2017, the push was for a “Universal Background Check”. The idea was to be sure that people buying guns were not criminals. Believe it or not, the NRA wholly supports this and in fact was involved with creating the current NICS (National Instant Check System) that is used.But the bill that was proposed was not what you heard in the media. First, it would not plug any “Gunshow Loophole” because there is no such thing. The only sales at a gun show that the bill covered was private sales. Of course, private sales can occur anywhere, not just gun shows.But the bill didn’t make the NICS easier for private sales. They just required all private sales to be conducted through a licensed dealer. Had this actually passed, a gun show would be an ideal location for such sales as there would be access to many dealer. In effect, you would greatly increase the number of private sales at a gun show by this law.So, what is involved with a sale through a dealer? Well, the dealer would have to do the following:1) Record the transfer in their bound book. This is a book where all the transactions of a firearm is recorded via that dealer. The book is auditable by the BATF and many dealers have faced fines for poorly kept records, so many dealers go to great pains to keep their book neat and accurate.2) Fill out the federal form 4473. This is required by all dealer sales of both new and used guns. It asks for the buyer’s name, address, the make and model of the gun, serial number, and then asks a bunch of questions. The dealer can get fined if the person fills out the form wrong. For example, answering a question with “Y” or “N” instead of “Yes” or “No” is a BATF violation. So the dealer has to carefully examine the form for errors and have the person fill out another if errors are found.3) The dealer then calls into the NICS. NICS can come back with a “Proceed”, “Denied” or “Delay”. A delay can take up to 3 days. Typically this is a name that appears similar to a Prohibited Person and requires some research. If this happens, the transfer is on hold. The dealer has no idea when the result of the research is likely to finish. If you are at a gun show, the show could be over before the approval is made.4) All this paperwork, verification, etc takes time. Time is money. So dealers charge for this service. It is typical for a dealer to charge $25-$40 per gun, but sometimes multiple guns get a discount because the dealer can process up to 4 on a single form, but when more than one gun is transferred, the dealer has to fill out Form 3310 which is supposed to help with gun trafficking.All of this is well and good if you are buying a gun from someone you don’t know and many people will require sales be conducted at a dealer for the piece of mind such protections provide. But friends and family typically do not bother with the hassle and expense.One thing you need to realize is that to get a gun dealer license is not an easy process. Since the federal government cracked down on so called “kitchen table” dealers back in the 1980’s, you now must show a commercially zoned storefront with posted business hours to qualify. Many communities don’t want gun shops, and use zoning laws to make them difficult or unattractive. For example the city of Boston does not have any dealers. In fact, the nearest dealer is 3 towns away. Many rural areas don’t have the traffic to keep a dealer in business and you’ll find they are typically only open in the evening or on a Saturday as they work another full time job. Keep this in mind as we get into the next issue.But the bill didn’t stop at sales. It stated that ALL transfers had to be done in this manner. No exceptions. So, two friends out on a hunt would need to go through the whole process listed above just to swap guns for the afternoon. Oh, and they would have to do it all again to give the gun back. It is very common on a range to try out other people’s guns - such a thing would also require the full transfer and back process. Demo guns at a national event by manufacturers? Same thing.Basically any time a gun were to swap hands, the law would apply. There are private shooting clubs where guns are treated like library books and members take whatever they want. Families regularly swap guns. Heck, some shooting courses provide guns for students to use. All of these events would have been impacted by these new transfer requirements.The NRA balked at this. Essentially the rule would curtail many of the traditions and practices that are very common and virtually never result in any kind of criminal activity. In essence it would criminalize things that simply are not crimes.Not only would it create criminals where no criminal intent existed, but the cost to manage the volume of temporary transfers, the staffing needed to take the calls and do the checks would have cost millions each year. All money that would not go toward actually dealing with criminals.When the issue was brought up, many members of Congress agreed the requirements were too restrictive and the whole bill failed to pass. The supporters of the bill did not even attempt to listen to the complaints and work out a manageable fix.Did you hear any of that in the media?But what about catching criminals?Well, the bill didn’t change anything in regards to enforcing the rules to make sure the people who should not own guns were properly entered into NICS. In fact, other than maybe getting fired, there is NO PENALTY for failing to report a person. We have laws that will jail a teacher or coach that fail to report bullies. We have laws that put priests in prison who fail to report potential inappropriate behaviors in other clergy. But we do not have any laws that punish law enforcement agents that fail to do their job and make sure that dangerous people are reported to the background system. And this bill made no effort to change that.NICS is not open to anyone but federally licensed gun dealers. The left are so worried that the system might be used to check people for things other than guns that they refuse to create a means to allow people to verify someone they are selling a gun to. It would be easy to create an app that takes a photo of the buyer and seller’s ID (or just their faces and type in some data) and then return a simple “Proceed” or “Deny” with no other details. You’d have plenty of information to audit for illegal use. And if someone didn’t have an ID, they could then use a dealer. Heck, you can’t file taxes on-line without submitting some kind of ID, so this isn’t anything unique.And yet, the bill did nothing to address the issue of accessing the NICS for easier private sales.Here is the thing. We have 20,000 gun laws in this country. On the federal side, a prohibited person touching a gun could see them in prison for a minimum of 5 years. And yet, we still see cities with high violent crime rates that have virtually no federal cases. Why isn’t law enforcement using those stiff federal laws to get the violent people off the streets? Such a program called “Project Exile” worked wonders in Richmond, VA to reduce violent crime dramatically.OK, back to the “Universal Background Check” bill.I spent a lot of words above explaining what the bill would have required of people and why the situation would have been a nightmare. You never saw any of this in the news and the media pretty much ignored the issue.When the bill was defeated, it was never reported that a “terrible bill that would have cost millions and made criminals out of the innocent was defeated”, instead, all you ever heard was“The NRA used its influence to defeat the Universal Background Check bill that would have closed the gunshow loophole”Almost everything about that statement is false.So, be careful what you want to “Fight Against”. I suspect that most of what you think about the NRA is highly biased due to the way the organization is treated in the media. When you look at the actual facts, many times their concerns are quite valid. And, they have a lot of rank and file law enforcement on their side which helps them represent real world situations. I’ve found their positions in many cases very well presented. Most of the arguments you get on TV news are highly edited and taken out of context to promote an agenda, not facilitate a debate.Make sure you know what you are fighting for. You might be surprised.

-

My spouse had an internship during February 2017 until April 2017. I forgot to update my W4. How does one correct W4 allowances now? Can a tax advisor help?

It is completely OK for you to not update your W4 form with your employer due to your spouse’s change in employment status. When you filled out your W4, it asked you how many withholdings you are claiming based upon how many dependents you have and unless you got divorced, had or adopted a child, had a child leave the nest, or had a relative move in or out of your home, then your answer to that question has not changed.I’m going to presume that on your W4 you entered “2” - for yourself and your spouse. Based on that number, your employer recalculates how much of your paycheck they withhold to pay your federal taxes. The higher the W4 number entered (meaning the more people that paycheck supports), the less your employer will withhold and the more you’ll be able to bring home every payday.The logic behind this is so that large families will have enough money on-hand to cover life expenses and because tax deductions for dependents at the end of the year usually mean less taxes are paid overall by larger families. The idea is to have the right amount of money taken out of your paychecks so that you don’t owe the feds any money at the end of the year but that they don’t owe you any money (a return) either.Some people really like overpaying their taxes though because they enjoy getting them returned at the end of the year. A common tax strategy is to claim (or enter) “0” on one’s W4 so that their employer will withhold the highest amount of taxes allowed by law, leaving them with the smallest possible paychecks, regardless of their family size (and obviously, because claiming oneself would be “1”).If your spouse’s internship was a paid one, s/he had to fill out their own W4 and provide the same information. If it was an unpaid internship then the IRS doesn’t even care about it at all. They only care about the money (and benefits) actually made by individuals.In conclusion, the advice of a tax professional is always wise to obtain if you have any questions about your liability and the process of filing accurately. Licensed tax preparers are qualified to answer simple tax questions and are much much much cheaper than CPAs are but, I’d recommend a CPA if your taxes are complicated or you make over 100k annually.Good luck. And don’t forget, you only NEED to change your W4 when you add or subtract someone from your household, but you CAN change it at any time to any number you want (0–10+). Peace and happy tax season!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the 2017 federal tax forms

How to create an eSignature for the 2017 Federal Tax Forms in the online mode

How to make an eSignature for your 2017 Federal Tax Forms in Google Chrome

How to generate an eSignature for putting it on the 2017 Federal Tax Forms in Gmail

How to make an eSignature for the 2017 Federal Tax Forms from your smartphone

How to generate an electronic signature for the 2017 Federal Tax Forms on iOS devices

How to generate an electronic signature for the 2017 Federal Tax Forms on Android OS

People also ask

-

What is the 1065 form K-1 for 2017 and who needs it?

The 1065 form K-1 for 2017 is an essential document for partnerships to report each partner's share of income, deductions, and credits. Partners must receive this form to accurately report their share on their personal tax returns. It is crucial for tax compliance and must be issued to every partner involved in the partnership.

-

How can airSlate SignNow help with the 1065 form K-1 for 2017?

airSlate SignNow offers a streamlined solution for signing and managing your 1065 form K-1 for 2017. With our easy-to-use platform, you can quickly eSign, send, and store documents securely. This results in enhanced efficiency and accuracy in your tax reporting.

-

Is there a cost associated with using airSlate SignNow for the 1065 form K-1 for 2017?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Our competitive pricing ensures that you have access to a cost-effective solution for managing important documents like the 1065 form K-1 for 2017. Choose a plan that fits your needs for maximizing workflow efficiency.

-

What features does airSlate SignNow provide for handling the 1065 form K-1 for 2017?

airSlate SignNow provides features like customizable templates, in-app signing, and document management. These functionalities ensure that you can create, send, and track your 1065 form K-1 for 2017 effortlessly. Simplifying the signing process can save your team valuable time.

-

Can I integrate airSlate SignNow with other software to manage the 1065 form K-1 for 2017?

Absolutely! airSlate SignNow offers integrations with various popular software solutions, making it easy to manage your 1065 form K-1 for 2017. By integrating with accounting and document management tools, you enhance collaboration and streamline workflow.

-

What are the benefits of using airSlate SignNow for the 1065 form K-1 for 2017?

Using airSlate SignNow for your 1065 form K-1 for 2017 offers benefits like reduced paperwork, faster processing times, and enhanced security. Our platform ensures that your sensitive information is protected while providing a seamless user experience. This can lead to increased productivity and accurate tax filings.

-

How does airSlate SignNow ensure the security of my documents like the 1065 form K-1 for 2017?

airSlate SignNow prioritizes document security with features like encryption, secure data storage, and user authentication. When managing important documents such as the 1065 form K-1 for 2017, you can trust that your information remains confidential and protected from unauthorized access.

Get more for Schedule B 1 Instructions

- W 119d form

- Louisiana divorce form

- Csp rlb form

- To obtain an employment application robson communities form

- Form 1023 ez eligibility worksheet national pta pta

- Engg assingment cover page blank form

- California form demand 2012

- Driver license liability insurance certification allstar underwriters form

Find out other Schedule B 1 Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors