Eitc Forms from the Print Out

What is the EITC Form from the Print Out

The EITC (Earned Income Tax Credit) form from the print out is a crucial document for taxpayers who qualify for this tax benefit. This form allows eligible individuals and families to claim a credit that reduces their tax liability, potentially resulting in a refund. The EITC is designed to assist low to moderate-income workers, making it an essential component of the tax filing process for many. Understanding the specifics of this form is vital for ensuring that taxpayers receive the financial support they are entitled to.

Steps to Complete the EITC Form from the Print Out

Completing the EITC form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, Social Security numbers, and information about qualifying children. Next, carefully fill out the form, ensuring that all information is correct and complete. It is important to follow the instructions provided on the form closely. After filling it out, review the form for any errors before submission. Finally, keep a copy of the completed form for your records.

Eligibility Criteria for the EITC Form from the Print Out

To qualify for the EITC, taxpayers must meet specific eligibility criteria. These include having earned income from employment or self-employment, meeting certain income limits, and having a valid Social Security number. Additionally, taxpayers must be U.S. citizens or resident aliens for the entire tax year. If claiming children, they must meet age and residency requirements. Understanding these criteria is essential for determining eligibility and ensuring the correct amount of credit is claimed.

IRS Guidelines for the EITC Form from the Print Out

The IRS provides comprehensive guidelines for completing the EITC form, which are crucial for taxpayers to follow. These guidelines outline the eligibility requirements, how to calculate the credit amount, and the documentation needed to support the claim. Taxpayers should refer to the IRS website or the instructions included with the form for the most current information. Adhering to these guidelines helps avoid errors that could delay processing or result in penalties.

Filing Deadlines for the EITC Form from the Print Out

Filing deadlines for the EITC form align with the standard tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to be aware of these deadlines to ensure timely submission and avoid any potential penalties or interest on unpaid taxes.

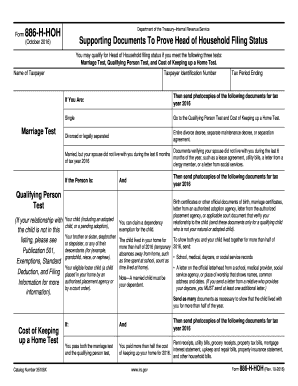

Required Documents for the EITC Form from the Print Out

When completing the EITC form, several documents are required to support the claim. Taxpayers should have their W-2 forms from employers, any 1099 forms for freelance or contract work, and records of other income. Additionally, documentation proving the identity and residency of qualifying children is necessary, such as birth certificates or school records. Having these documents ready can streamline the filing process and help ensure accuracy.

Form Submission Methods for the EITC Form from the Print Out

The EITC form can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated IRS offices. Online filing is often the quickest and most efficient method, allowing for faster processing and potential refunds. Taxpayers opting to mail their forms should ensure they send them to the correct address and consider using certified mail for tracking purposes. Understanding these submission methods can help taxpayers choose the best option for their situation.

Quick guide on how to complete eitc forms from the print out

Manage Eitc Forms From The Print Out effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Handle Eitc Forms From The Print Out on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Eitc Forms From The Print Out effortlessly

- Locate Eitc Forms From The Print Out and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Eitc Forms From The Print Out and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 886 h hoh in the context of airSlate SignNow?

The term '886 h hoh' refers to a unique feature provided by airSlate SignNow that simplifies the eSigning process for users. This feature enhances document security and compliance, ensuring that your sensitive information remains protected during transactions. Utilizing 886 h hoh can streamline your workflow and increase productivity.

-

How does airSlate SignNow with 886 h hoh enhance document management?

airSlate SignNow, integrated with features like 886 h hoh, allows businesses to efficiently manage and track all documents in one platform. This streamlining means you can easily access, sign, and send documents without the hassle of juggling multiple tools. The inclusion of 886 h hoh also automates reminders and notifications to keep all parties informed.

-

What are the pricing options for airSlate SignNow with 886 h hoh?

airSlate SignNow offers competitive pricing plans that include access to features like 886 h hoh. Depending on your business size and needs, you can choose between monthly or annual subscription options, ensuring that you only pay for what you need. Each plan is designed to provide comprehensive eSigning solutions at a budget-friendly price.

-

Can I integrate other applications with airSlate SignNow and 886 h hoh?

Yes, airSlate SignNow supports seamless integrations with various applications, enhancing the functionality offered by features like 886 h hoh. You can connect with popular CRM systems, cloud storage platforms, and other productivity tools. This integration capability allows you to create a more unified workflow, improving efficiency across all business operations.

-

What benefits does the 886 h hoh feature provide for businesses?

Utilizing the 886 h hoh feature within airSlate SignNow provides businesses with enhanced security, improved compliance, and faster turnaround times for document handling. It helps reduce the risks associated with manual processes and paper-based documents. Additionally, businesses see cost savings and improved bandwidth for core activities.

-

Is there a mobile app available for airSlate SignNow with 886 h hoh?

Yes, airSlate SignNow offers a mobile app that incorporates the 886 h hoh feature, enabling users to manage eSignatures and documents on-the-go. This is particularly useful for professionals who need to access important documents from remote locations. The mobile functionality enhances flexibility and ensures that you can keep your business moving forward.

-

How does eSigning with 886 h hoh improve document security?

The 886 h hoh feature in airSlate SignNow provides robust encryption and authentication processes that greatly enhance document security. Each signed document carries an audit trail that tracks all actions taken, ensuring full accountability. This integrity in document management helps minimize risks and build trust with clients.

Get more for Eitc Forms From The Print Out

- Special durable power of attorney for bank account matters ohio form

- Oh business form

- Ohio property management package ohio form

- Annual minutes for an ohio professional corporation aka professional association ohio form

- Ohio sample bylaws form

- Ohio professional corporation form

- Professional association ohio form

- Sample transmittal letter for articles of incorporation ohio form

Find out other Eitc Forms From The Print Out

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later