Kentucky K 3 Tax Form 2019-2026

What is the Kentucky K-3 Tax Form

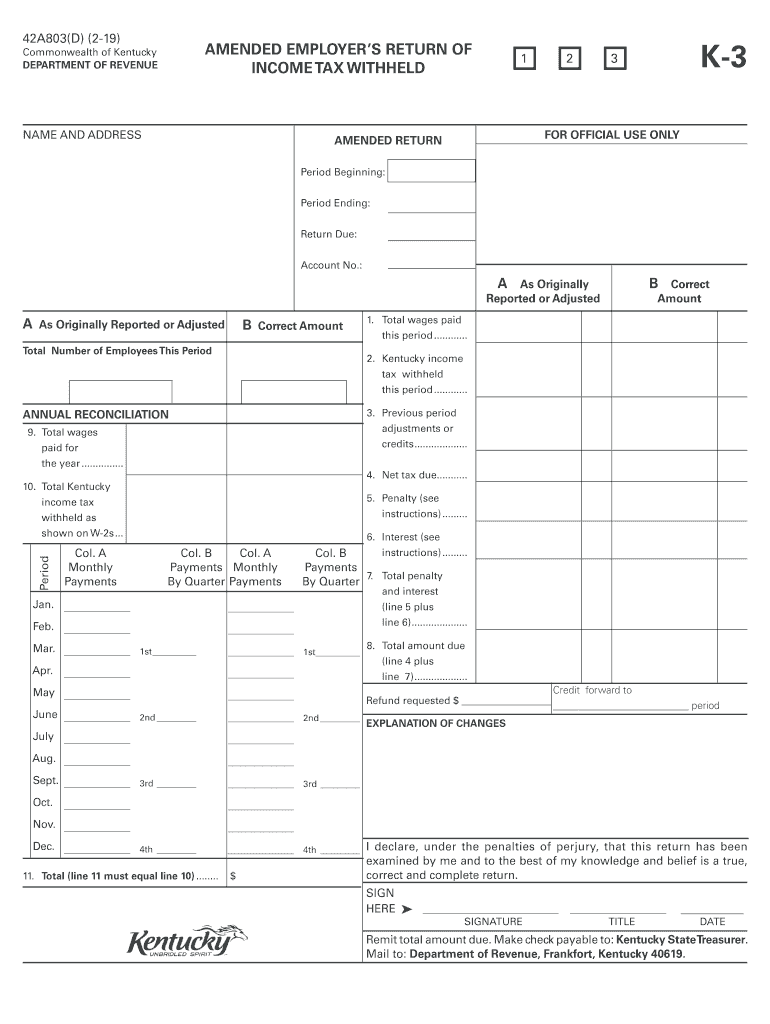

The Kentucky K-3 Tax Form is a document used primarily for reporting income that has been withheld for state tax purposes. It is essential for individuals and businesses to accurately report their income to ensure compliance with Kentucky tax laws. The form is typically issued by employers to employees, detailing the amount of state income tax withheld from their paychecks. Understanding the K-3 form is crucial for both employees and employers to maintain proper tax records and fulfill their tax obligations.

How to use the Kentucky K-3 Tax Form

Using the Kentucky K-3 Tax Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant income documents, such as W-2 forms or 1099s, to determine the total income for the tax year. Next, fill out the K-3 form by entering personal details, including your name, address, and Social Security number. Then, input the total amount of state income tax withheld as indicated by your employer. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Kentucky K-3 Tax Form

Completing the Kentucky K-3 Tax Form requires careful attention to detail. Follow these steps:

- Obtain the Kentucky K-3 Tax Form from the Kentucky Department of Revenue or your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income as indicated on your W-2 or 1099 forms.

- Enter the total amount of state income tax that has been withheld.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Kentucky K-3 Tax Form

The Kentucky K-3 Tax Form serves a legal purpose in documenting state income tax withholding. To be considered legally binding, the form must be filled out accurately and submitted to the appropriate state tax authority. Electronic signatures are permissible, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Maintaining a copy of the submitted form is advisable for personal records and potential audits.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the Kentucky K-3 Tax Form to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Staying informed about any changes in tax law or filing deadlines is essential for compliance.

Form Submission Methods

The Kentucky K-3 Tax Form can be submitted through various methods. Taxpayers have the option to file online through the Kentucky Department of Revenue's e-filing system, which offers a secure and efficient way to submit forms. Alternatively, the form can be mailed to the designated address provided by the state. In-person submissions may also be possible at local tax offices, depending on the specific requirements of the Kentucky Department of Revenue.

Quick guide on how to complete withholding kentucky income tax kentucky dor

Facilitate Kentucky K 3 Tax Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Kentucky K 3 Tax Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and electronically sign Kentucky K 3 Tax Form with ease

- Obtain Kentucky K 3 Tax Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Design your signature with the Sign tool, which takes mere seconds and bears the same legal validity as a conventional ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Kentucky K 3 Tax Form and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding kentucky income tax kentucky dor

Create this form in 5 minutes!

How to create an eSignature for the withholding kentucky income tax kentucky dor

How to create an eSignature for your Withholding Kentucky Income Tax Kentucky Dor in the online mode

How to make an electronic signature for the Withholding Kentucky Income Tax Kentucky Dor in Google Chrome

How to create an eSignature for signing the Withholding Kentucky Income Tax Kentucky Dor in Gmail

How to create an eSignature for the Withholding Kentucky Income Tax Kentucky Dor straight from your smartphone

How to create an electronic signature for the Withholding Kentucky Income Tax Kentucky Dor on iOS

How to make an eSignature for the Withholding Kentucky Income Tax Kentucky Dor on Android

People also ask

-

What is the Kentucky Form K3, and why do I need it?

The Kentucky Form K3 is a crucial document for businesses operating in Kentucky that outlines the state's specific tax obligations. It's important for ensuring compliance with state tax laws and can impact your overall tax liabilities. Using airSlate SignNow to manage this form can streamline the process and maintain accurate records.

-

How can airSlate SignNow simplify the completion of the Kentucky Form K3?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign the Kentucky Form K3. With customizable templates and guided workflows, users can complete the form accurately and efficiently. This minimizes the risk of errors and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for the Kentucky Form K3?

Yes, airSlate SignNow offers various pricing plans depending on the features and level of service you need for managing the Kentucky Form K3. The cost is generally positioned as a cost-effective solution for businesses seeking to streamline their document signing process. Free trials are often available to explore the platform's capabilities.

-

What features does airSlate SignNow offer for handling the Kentucky Form K3?

airSlate SignNow offers features like document templates, automatic reminders, and secure eSigning, specifically designed to handle forms like the Kentucky Form K3. Additionally, the platform includes audit trails to track document history and ensures compliance throughout the process. These features make managing the form much more straightforward.

-

Can I integrate airSlate SignNow with other software for filing the Kentucky Form K3?

Yes, airSlate SignNow offers numerous integrations with popular software systems, making it easy to connect your existing tools for filing the Kentucky Form K3. Services like CRM systems, accounting software, and cloud storage solutions can be integrated to streamline your workflow. This enhances productivity and ensures all your documents remain organized.

-

What are the benefits of eSigning the Kentucky Form K3 through airSlate SignNow?

Using airSlate SignNow for eSigning the Kentucky Form K3 offers numerous benefits, including faster turnaround times and improved document security. It eliminates the need for physical signatures, reducing delays and potential loss of paperwork. Additionally, documents are easily stored and accessible for future reference.

-

Is airSlate SignNow compliant with Kentucky laws regarding the Kentucky Form K3?

Absolutely, airSlate SignNow complies with both federal and state laws, including those specific to the Kentucky Form K3. The platform is designed to ensure that all signed documents meet legal requirements, providing peace of mind for businesses. Moreover, regular updates help maintain compliance with any changes in legislation.

Get more for Kentucky K 3 Tax Form

Find out other Kentucky K 3 Tax Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online