Bill of Sale Form D 4 Employee Withholding Allowance

What is the 2018 Allowance Form?

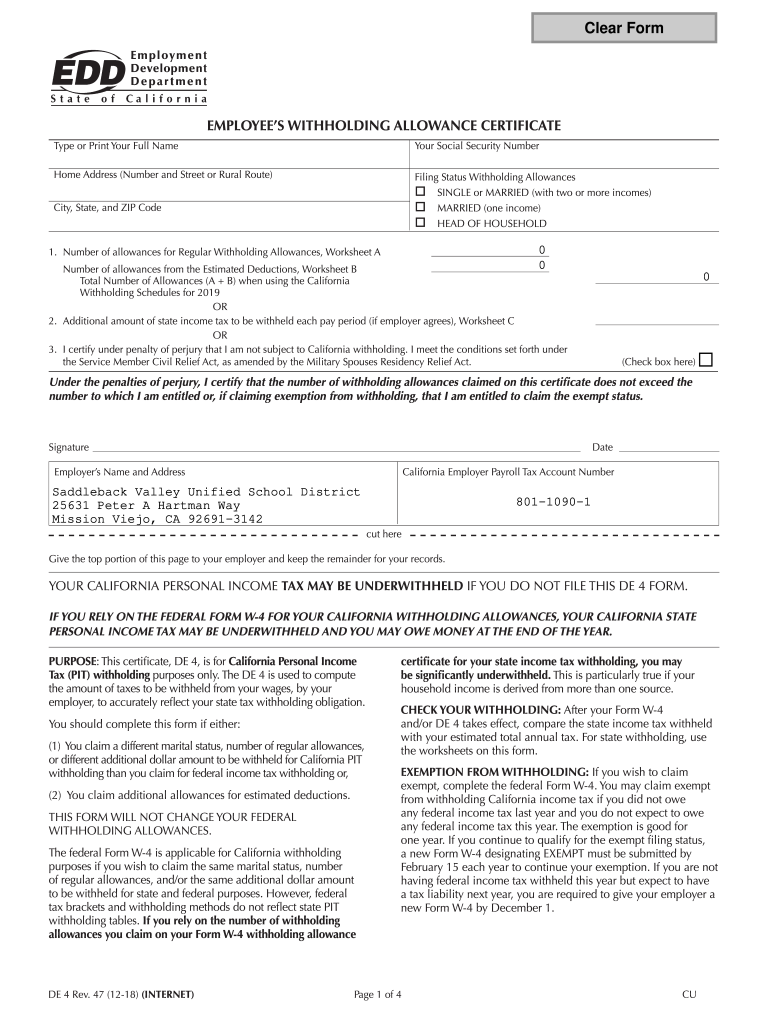

The 2018 allowance form, commonly referred to as the 2018 withholding certificate, is a crucial document for employees in the United States. It is used to determine the amount of federal income tax withholding from an employee's paycheck. By completing this form, employees can adjust their withholding allowances based on their personal financial situation, including dependents and other deductions. This ensures that the correct amount of tax is withheld, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the 2018 Allowance Form

Completing the 2018 allowance form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Determine the number of allowances you wish to claim based on your personal circumstances. This may include considerations for dependents and other deductions.

- Sign and date the form to validate your information.

Once completed, the form should be submitted to your employer to adjust your withholding accordingly.

Legal Use of the 2018 Allowance Form

The 2018 allowance form is legally binding when completed accurately and submitted to an employer. It is essential to provide truthful information, as inaccuracies can lead to penalties from the IRS. Employers are required to keep the form on file and use it to calculate the appropriate withholding amounts. Compliance with IRS regulations ensures that both employees and employers fulfill their tax obligations effectively.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines related to the 2018 allowance form. Typically, employees should submit their completed forms at the beginning of the tax year or whenever there is a significant change in their financial situation, such as marriage or the birth of a child. Additionally, employers must ensure that withholding adjustments are applied in a timely manner to reflect the changes made on the form.

Required Documents

When filling out the 2018 allowance form, you may need several supporting documents to accurately determine your withholding allowances. These documents can include:

- Previous year's tax return to reference your filing status and dependents.

- Pay stubs to assess your current withholding amounts.

- Any documents related to additional income or deductions that may affect your tax situation.

Form Submission Methods

The 2018 allowance form can be submitted to your employer in several ways. Most commonly, it is provided in person during the onboarding process or whenever changes are needed. Some employers may also allow submission via email or through an employee portal. It is essential to check with your employer for their preferred submission method to ensure timely processing.

Quick guide on how to complete bill of sale form d 4 employee withholding allowance

Prepare Bill Of Sale Form D 4 Employee Withholding Allowance effortlessly on any gadget

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Bill Of Sale Form D 4 Employee Withholding Allowance on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Bill Of Sale Form D 4 Employee Withholding Allowance without hassle

- Obtain Bill Of Sale Form D 4 Employee Withholding Allowance and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Select important sections of the documents or hide sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Bill Of Sale Form D 4 Employee Withholding Allowance to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 2018 allowance form and why do I need it?

The 2018 allowance form is a document used to report personal allowances for tax purposes. It helps ensure that the correct amount of income tax is withheld from your paycheck. Utilizing this form correctly can minimize your tax burden and align your withholding with your actual tax liability.

-

How can airSlate SignNow help me with my 2018 allowance form?

airSlate SignNow provides a straightforward platform for electronically signing and sending your 2018 allowance form securely. With user-friendly features, you can complete your form quickly, ensuring that all necessary signatures are collected efficiently. Our solution will help you streamline the process and maintain a digital record of your submissions.

-

Is there a cost associated with using airSlate SignNow for the 2018 allowance form?

Yes, while airSlate SignNow offers various pricing plans, the cost will depend on the features you choose to access. The solution remains budget-friendly and provides excellent value for businesses looking to manage forms like the 2018 allowance form efficiently. Explore our plans to find one that suits your needs.

-

What features does airSlate SignNow offer for managing the 2018 allowance form?

airSlate SignNow offers features such as electronic signatures, template creation, and document sharing to enhance your experience with the 2018 allowance form. You can create reusable templates for the allowance form, ensuring a swift process for future submissions. The platform also allows for real-time tracking, so you can see when your form has been signed.

-

Can I integrate airSlate SignNow with other applications when working on my 2018 allowance form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as cloud storage services and project management tools. This integration enables you to access and manage your 2018 allowance form alongside your other documents, streamlining your workflow and improving productivity.

-

What are the benefits of using airSlate SignNow for my 2018 allowance form?

Using airSlate SignNow for your 2018 allowance form provides numerous benefits, including enhanced security, reduced processing times, and ease of use. By digitizing your form, you minimize the chances of errors and delays associated with traditional paper forms. Moreover, with airSlate SignNow, you can sign from anywhere, making it convenient for you.

-

How can I ensure my 2018 allowance form is secure with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect your 2018 allowance form data. Our platform complies with industry standards to ensure that your documents are transmitted and stored securely. You can confidently use our service, knowing that your sensitive information is safeguarded.

Get more for Bill Of Sale Form D 4 Employee Withholding Allowance

- Request reasonable accommodation form

- Oklahoma discrimination complaint form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497323091 form

- Notice written lease form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497323093 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497323094 form

- Business credit application oklahoma form

- Individual credit application oklahoma form

Find out other Bill Of Sale Form D 4 Employee Withholding Allowance

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe