Irs Form 8814

What is the IRS Form 8814

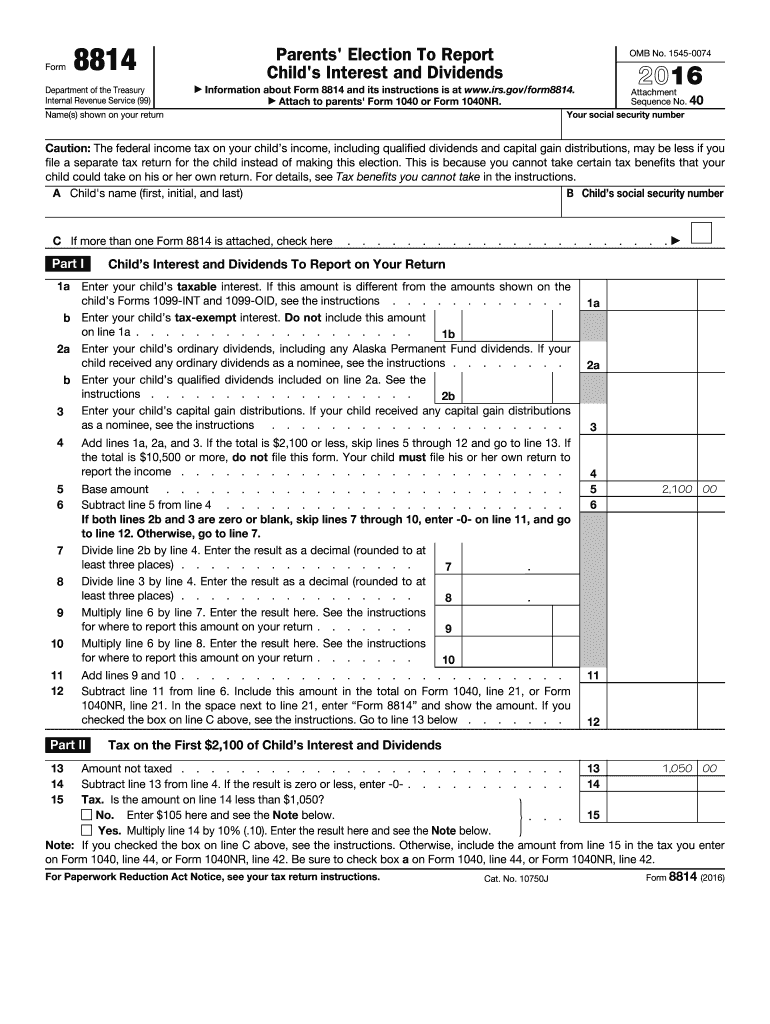

The IRS Form 8814, also known as the "Parents' Election to Report Child's Interest and Dividends," is a tax form used by parents to report their child's unearned income on their own tax return. This form allows parents to include their child's income, typically from interest and dividends, on their tax return instead of requiring the child to file a separate return. This can simplify the tax process for families with minor children who have investment income.

How to use the IRS Form 8814

To use the IRS Form 8814, parents must first determine if their child meets the eligibility criteria, which includes being under age 19 or a full-time student under age 24. If eligible, parents can report the child's income directly on their tax return using this form. The income reported on Form 8814 is then taxed at the parent's tax rate, which may be more favorable than the child's rate. It is essential to follow the instructions carefully to ensure accurate reporting and compliance with IRS regulations.

Steps to complete the IRS Form 8814

Completing the IRS Form 8814 involves several key steps:

- Gather the necessary information about your child's income, including interest and dividends received.

- Fill out the form by providing your child's name, Social Security number, and the total amount of unearned income.

- Calculate any applicable tax based on the income reported.

- Transfer the information from Form 8814 to your tax return, ensuring all figures are accurate.

- Review the completed form and your tax return for any errors before submission.

Legal use of the IRS Form 8814

The IRS Form 8814 is legally binding when completed and submitted according to IRS guidelines. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be filed along with the parent's tax return by the appropriate deadline to maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

For the IRS Form 8814, the filing deadline typically aligns with the standard tax return due date, which is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file on time to avoid penalties. Extensions may be available, but they must be requested properly and timely.

Eligibility Criteria

To use the IRS Form 8814, certain eligibility criteria must be met. The child must be under the age of 19 at the end of the tax year or a full-time student under the age of 24. Additionally, the child's unearned income must not exceed a specified threshold, which is adjusted annually. Parents should review the IRS guidelines to confirm their eligibility and ensure compliance with the requirements.

Quick guide on how to complete irs form 8814

Complete Irs Form 8814 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Handle Irs Form 8814 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign Irs Form 8814 effortlessly

- Find Irs Form 8814 and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize key parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign Irs Form 8814 while ensuring outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 8814 and how can airSlate SignNow help?

Form 8814 is used by parents to report their child's unearned income. With airSlate SignNow, you can easily fill out, sign, and send Form 8814 electronically, ensuring a streamlined and efficient process.

-

Is there a cost associated with using airSlate SignNow for Form 8814?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Regardless of the plan you choose, you can efficiently manage your Form 8814 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for processing Form 8814?

AirSlate SignNow provides features such as customizable templates, eSignatures, and document tracking. These tools make it easy to manage your Form 8814 and ensure that all necessary steps are completed promptly.

-

How does airSlate SignNow ensure the security of my Form 8814?

airSlate SignNow employs advanced security measures, including encryption and secure storage. This ensures that your Form 8814 and sensitive information remain safe throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for managing Form 8814?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive and Salesforce. This allows you to easily manage and access your Form 8814 alongside other important documents.

-

What are the benefits of using airSlate SignNow for Form 8814 compared to traditional methods?

Using airSlate SignNow simplifies the process of submitting Form 8814 by eliminating the need for printing and mailing. It saves you time and effort, allowing for quicker turnaround and greater efficiency in handling your tax obligations.

-

Is it easy to collaborate with others on Form 8814 using airSlate SignNow?

Yes, airSlate SignNow makes collaboration simple and efficient. You can invite multiple signers to review and sign Form 8814, all within a single, user-friendly platform.

Get more for Irs Form 8814

- Oregon transfer by quitcclaim or bargain and sale deed form

- Discovery interrogatories from plaintiff to defendant with production requests oregon form

- Discovery interrogatories from defendant to plaintiff with production requests oregon form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant oregon form

- Oregon quitclaim deed form

- Warranty deed one individual to three individuals oregon form

- Quitclaim deed individual to three individuals oregon form

- Warranty deed wife 497323584 form

Find out other Irs Form 8814

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free