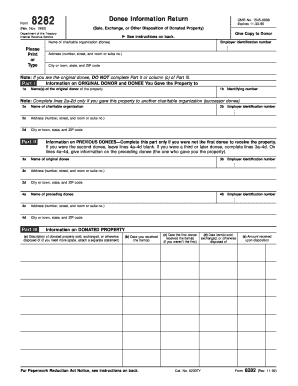

1192 Form 8282 Donee Information Return Sale, Exchange or Trade of Donated Property

What is the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

The 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property is a tax form used in the United States. It is specifically designed for donees—those who receive donated property—to report the sale, exchange, or trade of that property. This form is essential for ensuring compliance with IRS regulations, particularly when the donated property is sold for more than $500. The information provided helps the IRS track the value of donated items and ensures that proper tax deductions are claimed by donors.

Steps to Complete the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

Completing the 1192 Form 8282 involves several key steps:

- Gather Necessary Information: Collect details about the donated property, including its description, date of donation, and the fair market value at the time of donation.

- Provide Donee Information: Fill in the donee's name, address, and taxpayer identification number (TIN).

- Report Sale Details: Indicate the sale, exchange, or trade date, as well as the amount received from the transaction.

- Sign and Date the Form: Ensure that the form is signed and dated by an authorized representative of the donee organization.

Following these steps accurately ensures that the form is completed correctly and submitted on time.

How to Obtain the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

The 1192 Form 8282 can be obtained directly from the IRS website or through authorized tax professionals. It is available in a printable format, allowing users to fill it out by hand or digitally. For those who prefer electronic submission, the form can be completed using various tax software that supports IRS forms. Always ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

The legal use of the 1192 Form 8282 is crucial for both donees and donors. This form serves as a record for the IRS, detailing transactions involving donated property. It helps maintain transparency and accountability in charitable donations. Failure to file this form when required can lead to penalties for the donee and may affect the donor's ability to claim tax deductions. Therefore, understanding the legal implications of this form is essential for compliance with federal tax laws.

IRS Guidelines for the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

The IRS provides specific guidelines for completing and submitting the 1192 Form 8282. These guidelines include:

- Filing the form within the required timeframe, typically within 125 days of the sale, exchange, or trade.

- Ensuring accuracy in reporting the fair market value and sale proceeds.

- Maintaining records of the donated property and the transaction for at least three years in case of an audit.

Adhering to these guidelines helps ensure compliance and reduces the risk of penalties.

Examples of Using the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

There are various scenarios where the 1192 Form 8282 is applicable:

- A charitable organization receives a vehicle as a donation and later sells it for $8,000. The organization must complete the form to report this transaction.

- A non-profit receives artwork as a donation, valued at $1,500, and subsequently trades it for another piece of art. The form is necessary to document the exchange.

These examples illustrate the importance of the form in maintaining accurate records of donated property transactions.

Quick guide on how to complete 1192 form 8282 donee information return sale exchange or trade of donated property

Prepare 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property effortlessly on any device

Web-based document management has gained traction among both enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property with ease

- Find 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property?

The 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property is a tax form that must be filed by donees who sell, exchange, or trade donated property. This form is crucial for documenting the sale of such items for tax purposes, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist in filing the 1192 Form 8282?

airSlate SignNow simplifies the eSigning process for the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property. Our platform enables users to easily create, send, and securely sign documents, making the filing process more efficient and streamlined.

-

Are there any fees associated with submitting the 1192 Form 8282 through airSlate SignNow?

While airSlate SignNow has a subscription fee for its services, there are no additional costs for submitting the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property. Users can benefit from our affordable plans that provide a cost-effective solution for document management.

-

What features does airSlate SignNow offer for the 1192 Form 8282?

Our platform includes features like customizable templates, automated alerts, and cloud storage that enhance the process of managing the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property. These features ensure you can easily track and manage your documents from anywhere, at any time.

-

Can airSlate SignNow integrate with other software for filing the 1192 Form 8282?

Yes, airSlate SignNow offers integrations with various accounting and management software, facilitating the seamless filing of the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property. This allows users to connect their existing tools and streamline their workflow.

-

Is airSlate SignNow secure for handling sensitive information related to the 1192 Form 8282?

Absolutely! airSlate SignNow prioritizes user data security, employing robust encryption and compliance measures for the 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property. You can trust that your sensitive information is protected throughout the signing process.

-

How can I ensure my 1192 Form 8282 is completed correctly?

Using airSlate SignNow helps ensure your 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property is completed correctly through easy-to-follow templates and guidance. Our platform also provides options for collaboration, allowing users to verify details with stakeholders before submission.

Get more for 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

- Residential rental lease agreement oregon form

- Tenant welcome letter oregon form

- Warning of default on commercial lease oregon form

- Warning of default on residential lease oregon form

- Oregon certificate form

- Oregon parenting plan form

- Affidavit of service regarding marriage oregon form

- Affidavit for use in trial by affidavit oregon form

Find out other 1192 Form 8282 Donee Information Return Sale, Exchange Or Trade Of Donated Property

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now