Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

What is the Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

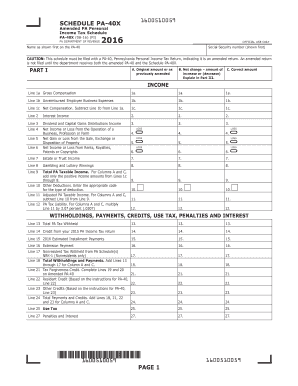

The Schedule PA 40X is a specific form used for amending Pennsylvania personal income tax returns. This form allows taxpayers to correct errors or omissions on previously filed PA personal income tax returns. The Schedule PA 40X is essential for ensuring that the tax records accurately reflect a taxpayer's financial situation and comply with state tax laws. It is particularly useful for individuals who need to adjust their reported income, deductions, or credits after the original filing.

How to use the Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

Using the Schedule PA 40X involves several steps to ensure that the form is completed accurately. Taxpayers should first gather all relevant documentation, including the original tax return and any supporting documents that justify the amendments. After filling out the form, it is crucial to double-check all entries for accuracy. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and the specific instructions provided by the Pennsylvania Department of Revenue.

Steps to complete the Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

Completing the Schedule PA 40X involves a systematic approach:

- Review the original tax return for errors or omissions.

- Obtain the Schedule PA 40X form from the Pennsylvania Department of Revenue.

- Fill in the required information, including personal details and the specific changes being made.

- Provide explanations for each change in the designated section of the form.

- Sign and date the form to validate the submission.

After completing these steps, ensure that all necessary documentation is included before submission.

Legal use of the Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

The Schedule PA 40X is legally recognized as a formal document for amending tax returns in Pennsylvania. It must be completed and submitted in accordance with state tax laws to ensure compliance. Proper use of this form can help avoid penalties and ensure that any adjustments to tax liabilities are accurately reflected in the taxpayer's records. It is important to follow all legal guidelines when filling out and submitting the form to maintain its validity.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines for filing the Schedule PA 40X. Generally, the amended return should be filed within three years from the original due date of the tax return. Missing this deadline may result in the inability to claim refunds or make necessary adjustments. Keeping track of these important dates is crucial for maintaining compliance with Pennsylvania tax regulations.

Required Documents

When preparing to file the Schedule PA 40X, taxpayers should gather the following documents:

- The original PA personal income tax return.

- Any supporting documentation that justifies the amendments, such as W-2 forms, 1099s, or receipts.

- Previous correspondence with the Pennsylvania Department of Revenue, if applicable.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is included in the amended return.

Quick guide on how to complete 2016 schedule pa 40x amended pa personal income tax schedule pa 40x formspublications

Prepare Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications with minimal effort

- Locate Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Schedule PA 40X and when should I use the Amended PA Personal Income Tax Schedule PA 40X FormsPublications?

Schedule PA 40X is an essential form used for amending Pennsylvania personal income tax returns. You should use the Amended PA Personal Income Tax Schedule PA 40X FormsPublications if you need to correct previously submitted tax information, such as adjusting income or deductions. It's important to file timely amendments to ensure compliance and avoid penalties.

-

How can airSlate SignNow simplify the process of submitting Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications?

airSlate SignNow provides a user-friendly platform that streamlines the completion and submission of Schedule PA 40X forms. With its eSignature capabilities, you can sign documents electronically, ensuring quick and efficient processing. This simplifies your tax amendment process and allows for easy tracking of your submissions.

-

What pricing plans are available for using airSlate SignNow for Schedule PA 40X submissions?

airSlate SignNow offers a variety of pricing plans tailored to fit the needs of individuals and businesses requiring assistance with Schedule PA 40X submissions. Each plan provides essential features like document storage and eSigning functionalities at a cost-effective rate. Check our website for the latest pricing details and choose a plan that suits your tax filing needs.

-

What features does airSlate SignNow offer for handling Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications?

airSlate SignNow offers features that enhance the user experience when managing Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications. Such features include mobile access, custom templates, and secure storage solutions, ensuring that you can efficiently complete your tax amendments anywhere, anytime.

-

Are there any benefits to using airSlate SignNow for my Schedule PA 40X amendments?

By using airSlate SignNow for Schedule PA 40X amendments, you gain several benefits such as reduced turnaround times and improved document security. The platform also allows for easy collaboration with tax professionals, ensuring that your amendments are accurate and compliant. This peace of mind can make managing your taxes much less stressful.

-

Can I integrate airSlate SignNow with other software for my tax filing needs?

Yes, airSlate SignNow offers integrations with various business tools and tax software, making it easier to streamline your tax filing process, including Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications. These integrations can enhance productivity and provide a seamless workflow, helping you manage your documents more effectively.

-

How does airSlate SignNow ensure the security of my Schedule PA 40X submissions?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like Schedule PA 40X submissions. The platform employs advanced encryption methods and complies with necessary privacy regulations to protect your data throughout the eSigning process. You can rest assured that your personal information remains secure and confidential.

Get more for Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

- 3 day notice to pay rent or lease terminated 15 or 30 day seasonal eviction period pennsylvania form

- Pennsylvania affidavit consent form

- Business credit application pennsylvania form

- Individual credit application pennsylvania form

- Interrogatories to plaintiff for motor vehicle occurrence pennsylvania form

- Interrogatories to defendant for motor vehicle accident pennsylvania form

- Llc notices resolutions and other operations forms package pennsylvania

- Pennsylvania disclosure form

Find out other Schedule PA 40X Amended PA Personal Income Tax Schedule PA 40X FormsPublications

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy