Individual Credit Application Pennsylvania Form

What is the Individual Credit Application Pennsylvania

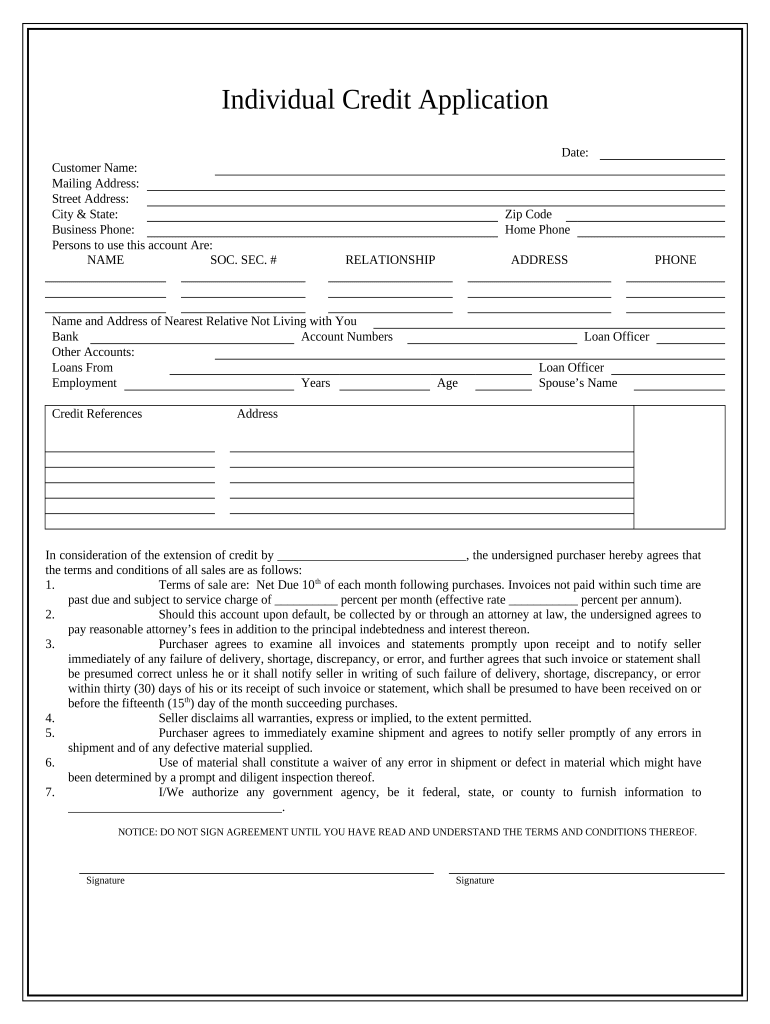

The Individual Credit Application Pennsylvania is a formal document used by individuals seeking credit from financial institutions or lenders within the state. This application collects essential information about the applicant's financial history, employment status, and personal identification details. The purpose of this form is to assess the creditworthiness of the applicant, allowing lenders to make informed decisions regarding credit approvals. Understanding this form is crucial for anyone looking to secure loans, credit cards, or other financial products in Pennsylvania.

Steps to complete the Individual Credit Application Pennsylvania

Completing the Individual Credit Application Pennsylvania involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect personal identification details, employment information, and financial history.

- Fill out the application: Provide accurate information in each section of the form, ensuring clarity and completeness.

- Review the application: Double-check all entries for accuracy, as errors can delay the approval process.

- Sign the application: Include your signature to validate the information provided, either electronically or physically.

- Submit the application: Choose your preferred submission method, ensuring it reaches the lender promptly.

Legal use of the Individual Credit Application Pennsylvania

The Individual Credit Application Pennsylvania is legally binding when completed and signed according to specific guidelines. It must comply with federal and state regulations governing credit applications. This includes adherence to the Fair Credit Reporting Act (FCRA), which ensures that the information collected is used fairly and responsibly. Additionally, the application must be executed in a manner that meets the legal standards for electronic signatures, ensuring that it holds up in court if necessary.

Key elements of the Individual Credit Application Pennsylvania

Key elements of the Individual Credit Application Pennsylvania include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and income information.

- Financial History: Information about existing debts, credit accounts, and payment history.

- Consent for Credit Check: A section where the applicant authorizes the lender to perform a credit check.

How to use the Individual Credit Application Pennsylvania

Using the Individual Credit Application Pennsylvania effectively requires understanding its purpose and the information it seeks. Applicants should fill out the form accurately, ensuring that all required fields are completed. It is essential to provide truthful information, as discrepancies can lead to rejection or legal issues. Once completed, the application can be submitted to the lender via the preferred method, which may include online submission, mailing, or in-person delivery.

Eligibility Criteria

Eligibility to apply using the Individual Credit Application Pennsylvania typically includes being at least eighteen years old, having a valid Social Security number, and demonstrating a stable income source. Lenders may also consider the applicant's credit history and existing debt levels to determine creditworthiness. Meeting these criteria is essential for a successful application process.

Quick guide on how to complete individual credit application pennsylvania

Effortlessly Prepare Individual Credit Application Pennsylvania on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage Individual Credit Application Pennsylvania on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to Modify and Electronically Sign Individual Credit Application Pennsylvania with Ease

- Obtain Individual Credit Application Pennsylvania and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Identify pertinent parts of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Individual Credit Application Pennsylvania while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Individual Credit Application in Pennsylvania?

An Individual Credit Application in Pennsylvania is a form used by consumers to apply for credit, including loans and credit cards. This process allows lenders to assess an applicant's creditworthiness based on their financial history and current situation. Utilizing airSlate SignNow, businesses can streamline this process with secure eSigning options for all applicants.

-

How does airSlate SignNow improve the Individual Credit Application process in Pennsylvania?

airSlate SignNow enhances the Individual Credit Application process in Pennsylvania by providing an easy-to-use platform for sending and signing documents electronically. This eliminates the need for physical paperwork, speeds up approvals, and ensures secure storage of application data. Our solution also allows for easy tracking and reminders to speed up the interaction between lenders and applicants.

-

What are the pricing options for airSlate SignNow when using it for Individual Credit Applications in Pennsylvania?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. For institutions processing Individual Credit Applications in Pennsylvania, we provide options that include pay-as-you-go plans and subscription-based offerings. This allows businesses to choose the most cost-effective solution based on their volume of applications.

-

Can I integrate airSlate SignNow with other software for managing Individual Credit Applications in Pennsylvania?

Yes, airSlate SignNow easily integrates with various third-party applications to enhance the management of Individual Credit Applications in Pennsylvania. Popular integrations include CRM systems, project management tools, and document storage solutions. This connectivity allows for a seamless workflow and better data management throughout the application process.

-

What security features does airSlate SignNow provide for Individual Credit Applications in Pennsylvania?

airSlate SignNow prioritizes security, especially for sensitive documents like the Individual Credit Application in Pennsylvania. We implement robust encryption protocols, two-factor authentication, and secure storage solutions to protect your data. Our compliance with industry standards like GDPR and eIDAS ensures that all transactions are secure and reliable.

-

Are there any benefits of using airSlate SignNow for Individual Credit Applications compared to traditional methods?

Using airSlate SignNow for Individual Credit Applications in Pennsylvania offers numerous advantages over traditional methods, including faster turnaround times and improved accessibility. Applicants can complete and sign documents from anywhere, at any time, which leads to a better user experience. Additionally, the automated processes reduce the chance of errors, making the application process smoother for both parties.

-

What types of businesses can benefit from the Individual Credit Application feature of airSlate SignNow?

AirSlate SignNow’s Individual Credit Application feature is beneficial for a wide range of businesses, including banks, credit unions, and retail finance companies. Any organization that requires a formal credit assessment can streamline their operations and improve customer satisfaction by utilizing our platform. This solution can enhance efficiency and provide a competitive advantage in the Pennsylvania market.

Get more for Individual Credit Application Pennsylvania

Find out other Individual Credit Application Pennsylvania

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe