Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

What is the Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

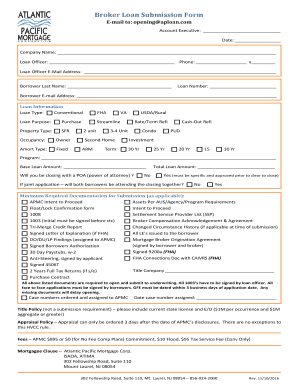

The Broker Loan Submission Form 1008 is a crucial document used in the mortgage application process, specifically for loans facilitated by Atlantic Pacific Mortgage. This form collects essential information about the borrower, property, and loan details. It serves as a standardized method for brokers to submit loan requests to lenders, ensuring that all necessary data is provided for evaluation. The form is designed to streamline the mortgage application process, making it easier for both brokers and lenders to assess loan eligibility and terms.

How to use the Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

Using the Broker Loan Submission Form 1008 involves several steps. First, gather all required information, including borrower details, property information, and loan specifics. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Once the form is filled, it can be submitted electronically or printed for physical submission. Utilizing a digital platform like airSlate SignNow can enhance the process by allowing for secure e-signatures and easy document management.

Steps to complete the Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

Completing the Broker Loan Submission Form 1008 requires careful attention to detail. Follow these steps:

- Collect necessary documents, such as income statements, credit reports, and property details.

- Fill in borrower information, including names, addresses, and Social Security numbers.

- Provide property details, including the address, type of property, and estimated value.

- Specify loan details, including the loan amount requested and the purpose of the loan.

- Review the form for accuracy and completeness before submission.

Key elements of the Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

The Broker Loan Submission Form 1008 includes several key elements that are critical for processing the loan application. These elements typically encompass:

- Borrower information: Personal details of the borrower, including financial history.

- Property details: Information regarding the property being financed.

- Loan information: Amount requested, type of loan, and intended use of funds.

- Broker details: Information about the broker submitting the application.

Legal use of the Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

The legal use of the Broker Loan Submission Form 1008 is governed by various regulations that ensure compliance with lending laws. This includes adherence to the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, which protect borrowers from discrimination. Proper completion and submission of the form are essential for the loan to be processed legally and ethically, safeguarding both the lender's and borrower's interests.

Required Documents

When completing the Broker Loan Submission Form 1008, certain documents are required to support the application. These typically include:

- Proof of income: Recent pay stubs or tax returns.

- Credit report: A comprehensive overview of the borrower's credit history.

- Property appraisal: An assessment of the property's value.

- Identification: A government-issued ID for all borrowers.

Quick guide on how to complete broker loan submission form 1008 atlantic pacific mortgage

Manage Broker Loan Submission Form 1008 Atlantic Pacific Mortgage easily on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any hold-ups. Handle Broker Loan Submission Form 1008 Atlantic Pacific Mortgage across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Broker Loan Submission Form 1008 Atlantic Pacific Mortgage effortlessly

- Locate Broker Loan Submission Form 1008 Atlantic Pacific Mortgage and click on Access Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Finish button to store your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Broker Loan Submission Form 1008 Atlantic Pacific Mortgage and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Atlantic Pacific Mortgage and how does it work?

Atlantic Pacific Mortgage is a reliable financial service that helps customers secure various mortgage options. By using an efficient online platform, it streamlines the mortgage application process, enabling you to submit documents and receive approvals more quickly. With Atlantic Pacific Mortgage, you can take advantage of competitive rates and personalized guidance.

-

What features does Atlantic Pacific Mortgage offer?

Atlantic Pacific Mortgage offers a range of features including easy online applications, real-time document tracking, and comprehensive loan calculators. Additionally, their platform provides users with resources to understand mortgage terms and rates better, ensuring informed decisions. The seamless integration with various document management systems enhances usability.

-

How much does Atlantic Pacific Mortgage cost?

The pricing for using Atlantic Pacific Mortgage can vary based on the type of mortgage you are applying for and the associated fees. Typically, their service includes a straightforward fee structure without hidden costs, making it transparent for users. For the most accurate details, it’s recommended to consult directly with Atlantic Pacific Mortgage representatives.

-

What are the benefits of choosing Atlantic Pacific Mortgage?

Choosing Atlantic Pacific Mortgage provides several benefits, including a user-friendly platform, enhanced security for sensitive documents, and expert support throughout the mortgage process. Their commitment to customer satisfaction ensures that clients receive timely responses and assistance. Ultimately, this can lead to a more efficient and stress-free home financing experience.

-

Can I integrate Atlantic Pacific Mortgage with other tools?

Yes, Atlantic Pacific Mortgage offers integration capabilities that allow you to connect with various third-party tools and services. This includes document management systems, CRM solutions, and eSignature platforms such as airSlate SignNow. This flexibility can help streamline your workflow and improve productivity.

-

Is Atlantic Pacific Mortgage suitable for first-time homebuyers?

Absolutely! Atlantic Pacific Mortgage is particularly geared towards helping first-time homebuyers navigate the complexities of securing a mortgage. They provide resources and personalized guidance to assist newcomers in understanding the process, making it less daunting. Their options are tailored to meet different financial situations and needs.

-

How does Atlantic Pacific Mortgage ensure the security of my information?

Atlantic Pacific Mortgage prioritizes the security of your personal and financial information by employing top-notch encryption and security protocols. Their platform is designed to protect sensitive data through secure access and storage methods. This commitment to security helps build trust and confidence in their services.

Get more for Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

- Insulation contractor package texas form

- Paving contractor package texas form

- Site work contractor package texas form

- Siding contractor package texas form

- Refrigeration contractor package texas form

- Drainage contractor package texas form

- Tax free exchange package texas form

- Texas sublease agreement form

Find out other Broker Loan Submission Form 1008 Atlantic Pacific Mortgage

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template