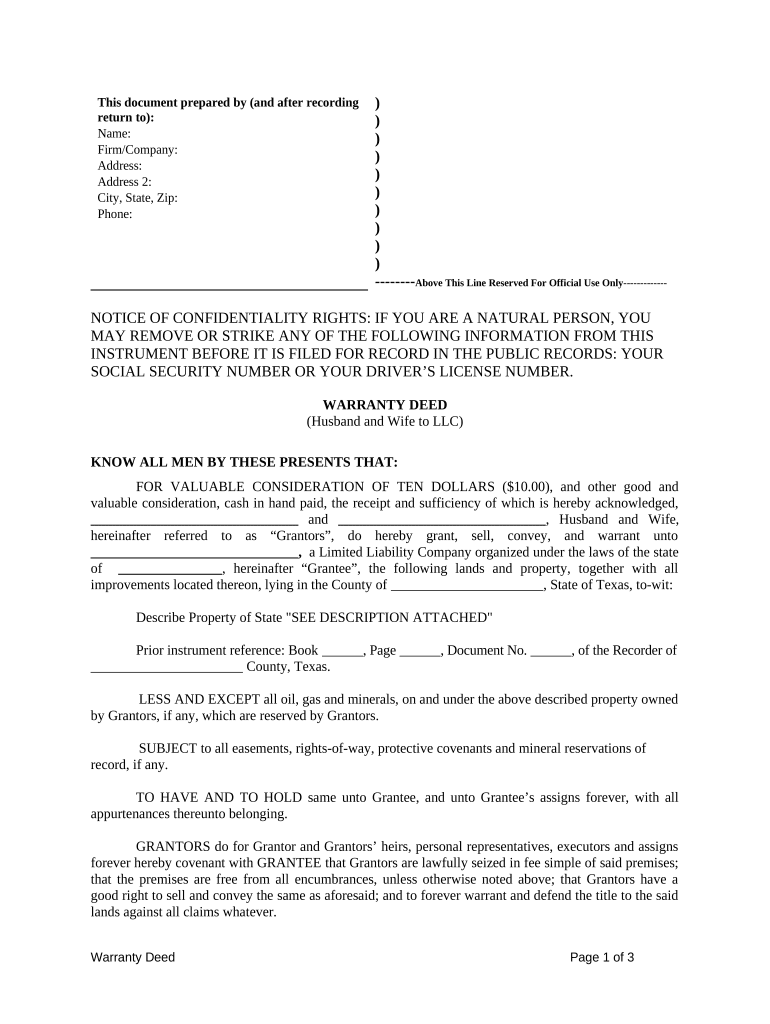

Husband Wife Llc Form

What is the Husband Wife LLC?

A Husband Wife LLC is a unique business structure designed specifically for married couples who wish to operate a business together. This type of limited liability company allows both spouses to manage the business while providing personal liability protection. The primary advantage of forming a Husband Wife LLC is that it simplifies the ownership structure, making it easier for couples to manage their business affairs without the complexities that come with traditional partnerships or corporations.

How to Use the Husband Wife LLC

Using a Husband Wife LLC involves several steps that ensure compliance with state laws and regulations. Couples must first choose a suitable name for their LLC, ensuring it complies with state naming requirements. Next, they should file the necessary formation documents with the state, which typically include Articles of Organization. Once established, the couple can operate their business, keeping personal and business finances separate to maintain liability protection. Regular compliance with state requirements, such as annual reports, is also essential for maintaining the LLC's good standing.

Steps to Complete the Husband Wife LLC

Completing the formation of a Husband Wife LLC involves a series of steps:

- Choose a Business Name: Ensure the name is unique and complies with state regulations.

- File Articles of Organization: Submit this document to your state’s business filing agency.

- Create an Operating Agreement: Although not always required, this document outlines the management structure and operational procedures.

- Obtain an EIN: Apply for an Employer Identification Number from the IRS for tax purposes.

- Open a Business Bank Account: Keep personal and business finances separate to protect personal assets.

Legal Use of the Husband Wife LLC

The legal use of a Husband Wife LLC encompasses various aspects of business operations. This structure allows couples to enjoy the benefits of limited liability, protecting personal assets from business debts and liabilities. Additionally, the IRS treats a Husband Wife LLC as a disregarded entity for tax purposes unless they elect to be taxed as a corporation. This means profits and losses can be reported on the couple's personal tax returns, simplifying the tax process.

State-Specific Rules for the Husband Wife LLC

Each state has its own regulations regarding the formation and operation of LLCs, including Husband Wife LLCs. It is crucial for couples to research their specific state laws, as some states may have unique requirements for formation documents or annual reporting. Additionally, certain states may offer specific tax advantages or incentives for LLCs owned by married couples. Understanding these nuances can help couples maximize the benefits of their business structure.

Required Documents

To successfully form a Husband Wife LLC, couples need to gather several key documents:

- Articles of Organization: This document officially establishes the LLC with the state.

- Operating Agreement: Although not mandatory in all states, it outlines the management structure and operational guidelines.

- Employer Identification Number (EIN): Required for tax purposes and to open a business bank account.

- Business Licenses and Permits: Depending on the nature of the business, additional licenses may be required.

Quick guide on how to complete husband wife llc 497327465

Effortlessly Prepare Husband Wife Llc on Any Device

Online document administration has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents swiftly and without hurdles. Manage Husband Wife Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Husband Wife Llc seamlessly

- Obtain Husband Wife Llc and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Husband Wife Llc to ensure excellent communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a husband wife LLC?

A husband wife LLC is a limited liability company that is owned and operated by a married couple. This structure provides both legal protection for personal assets and possible tax benefits. Forming a husband wife LLC can simplify business operations and increase flexibility in management.

-

How do I form a husband wife LLC?

To form a husband wife LLC, you need to choose a unique business name, file Articles of Organization with your state, and obtain necessary licenses. Additionally, it is advisable to create an Operating Agreement to outline the management and operation of the LLC. Working with a professional can streamline this process.

-

What are the benefits of a husband wife LLC?

A husband wife LLC allows couples to enjoy limited liability protection while simplifying the management of their business. It can also provide tax advantages, as income can be reported on a personal tax return. Moreover, this structure fosters joint decision-making, ensuring both partners are involved in the business.

-

What features does airSlate SignNow offer for husband wife LLCs?

airSlate SignNow offers features that empower husband wife LLCs to eSign documents securely, manage workflows, and collaborate easily. Its intuitive interface allows couples to send and receive signed documents efficiently. Furthermore, the platform enables document templates, enhancing consistency in business processes.

-

Is there a pricing model for husband wife LLCs using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing models tailored for businesses, including those structured as husband wife LLCs. Plans are designed to accommodate varying needs and budgets, allowing couples to choose a subscription that aligns with their business goals. Free trials may also be available for evaluation.

-

Can a husband wife LLC use airSlate SignNow with other software integrations?

Absolutely! airSlate SignNow supports various integrations with popular business applications, making it convenient for husband wife LLCs to streamline their workflows. This allows seamless collaboration with tools like Google Drive, Salesforce, and more, enhancing efficiency in document management.

-

Are there any legal protections for a husband wife LLC?

Yes, a husband wife LLC provides legal protection by separating personal and business assets, shielding personal finances from business liabilities. This structure is particularly beneficial for couples looking to operate a business together while mitigating risks associated with entrepreneurship. Legal advice is recommended to ensure compliance.

Get more for Husband Wife Llc

- Requirement specfications for submission of form ir56e in ird

- Sponsorship form for religious workers inz 1190 immigration

- The fastest and easiest way to apply for a student visa is online form

- Form 81c efm

- Habitual residence condition form

- Form33b1

- Consent form and terms of use for amazon aws

- Imm 5645 fill online printable fillable blank pdffiller form

Find out other Husband Wife Llc

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free