CHANGE of BENEFICIARY FORM Combined Insurance

What is the combined insurance beneficiary form?

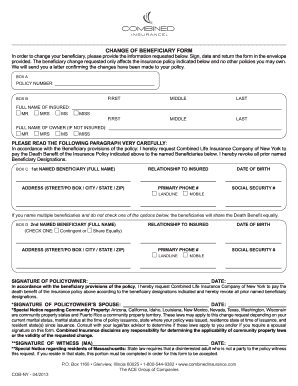

The combined insurance beneficiary form is a legal document that allows policyholders to designate individuals or entities to receive benefits from an insurance policy upon the policyholder's death. This form is essential for ensuring that benefits are distributed according to the policyholder's wishes. It typically requires the policyholder to provide personal information, including the names and contact details of the beneficiaries, as well as any specific instructions regarding the distribution of benefits. Understanding the importance of this form can help ensure that loved ones are cared for in the event of an unforeseen circumstance.

Steps to complete the combined insurance beneficiary form

Completing the combined insurance beneficiary form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your insurance policy number and the details of your beneficiaries. Next, carefully fill out the form, ensuring that all names are spelled correctly and that contact information is accurate. If applicable, include any specific instructions regarding the distribution of benefits. After completing the form, review it thoroughly for any errors before signing and dating it. Finally, submit the form according to your insurance provider's guidelines, which may include online submission, mailing, or in-person delivery.

Legal use of the combined insurance beneficiary form

The legal use of the combined insurance beneficiary form is governed by various regulations and standards that ensure its validity. For the form to be legally binding, it must be signed by the policyholder and, in some cases, witnessed or notarized. Compliance with federal and state laws is crucial, as these laws dictate the requirements for beneficiary designations and the execution of the form. Additionally, understanding the implications of designating beneficiaries, such as tax considerations and potential disputes, can help policyholders make informed decisions about their insurance benefits.

Required documents for the combined insurance beneficiary form

When completing the combined insurance beneficiary form, certain documents may be required to verify the information provided. These documents typically include a copy of the policyholder's identification, such as a driver's license or passport, to confirm their identity. Additionally, documentation that supports the relationship between the policyholder and the beneficiaries may be necessary, especially in cases where the beneficiary is not an immediate family member. Gathering these documents in advance can streamline the process and ensure that the form is processed without delays.

Form submission methods for the combined insurance beneficiary form

Submitting the combined insurance beneficiary form can be done through various methods, depending on the insurance provider's policies. Common submission methods include online submission via the provider's website, mailing a physical copy of the form to the designated address, or delivering it in person to a local office. Each method may have specific requirements, such as additional documentation or confirmation of receipt, so it is important to follow the guidelines provided by the insurance company to ensure that the form is processed correctly.

Examples of using the combined insurance beneficiary form

There are several scenarios in which the combined insurance beneficiary form is utilized. For instance, a policyholder may wish to update their beneficiaries after significant life events, such as marriage, divorce, or the birth of a child. In another example, a business owner may use the form to designate beneficiaries for a key person insurance policy, ensuring that the business remains financially stable in the event of the key person's passing. Understanding these examples can highlight the importance of regularly reviewing and updating beneficiary designations to reflect current circumstances.

Quick guide on how to complete change of beneficiary form combined insurance

Manage CHANGE OF BENEFICIARY FORM Combined Insurance effortlessly on any device

Digital document management has become favored by both organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without complications. Handle CHANGE OF BENEFICIARY FORM Combined Insurance on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign CHANGE OF BENEFICIARY FORM Combined Insurance with ease

- Find CHANGE OF BENEFICIARY FORM Combined Insurance and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with instruments specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign CHANGE OF BENEFICIARY FORM Combined Insurance to guarantee exceptional communication through every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a combined insurance beneficiary?

A combined insurance beneficiary refers to an individual or entity designated to receive benefits from multiple insurance policies. This term often arises in the context of life insurance and health coverage, where policyholders can specify primary or contingent beneficiaries for their combined insurance. Properly naming your combined insurance beneficiary ensures that the right person or organization receives funds without delays.

-

How does airSlate SignNow handle combined insurance beneficiary documentation?

airSlate SignNow simplifies the process of managing documents related to combined insurance beneficiaries. With its user-friendly eSignature tools, you can easily send, sign, and store important beneficiary forms securely. This ensures that your combined insurance beneficiary information is always up to date and easily accessible.

-

What are the pricing options for using airSlate SignNow to manage combined insurance beneficiary forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling combined insurance beneficiary documentation. You can choose from various plans based on your usage requirements, ensuring cost-effectiveness. The features available at each pricing tier help you efficiently manage any combined insurance beneficiary paperwork.

-

Can I integrate airSlate SignNow with other insurance management software?

Yes, airSlate SignNow seamlessly integrates with various insurance management software to streamline your workflow. This integration allows you to manage combined insurance beneficiary documents efficiently alongside other crucial data. By using these integrations, you can enhance the overall effectiveness of your insurance management processes.

-

What features does airSlate SignNow offer for managing beneficiaries?

airSlate SignNow provides several features specifically designed to simplify the management of combined insurance beneficiaries. These features include document templates, automated workflows, and secure cloud storage for easy access. By utilizing these tools, you can ensure that your combined insurance beneficiary documentation is completed accurately and efficiently.

-

How secure is the information related to my combined insurance beneficiary?

Security is a top priority at airSlate SignNow. We implement advanced security measures, including encryption and access controls, to protect all information regarding your combined insurance beneficiary. This commitment to security ensures that your sensitive documents remain confidential and are only accessible to authorized individuals.

-

What are the benefits of using airSlate SignNow for combined insurance beneficiaries?

Using airSlate SignNow for managing combined insurance beneficiaries provides numerous benefits, including streamlined document processing, enhanced security, and easy collaboration. Our platform allows you to electronically sign and store important documents, reducing paperwork and saving time. This means you can focus more on providing quality service and less on administrative tasks.

Get more for CHANGE OF BENEFICIARY FORM Combined Insurance

Find out other CHANGE OF BENEFICIARY FORM Combined Insurance

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template