Sample Earnings Form

What is the Sample Earnings

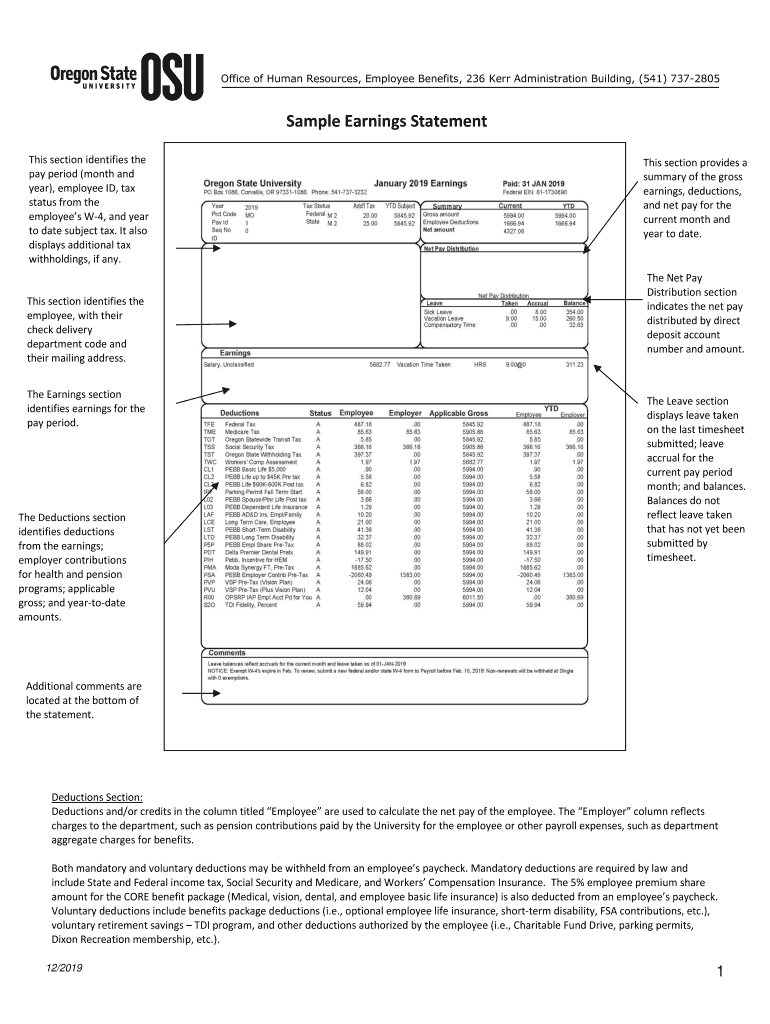

The sample earnings form is a crucial document used to report income for various purposes, including tax filings and financial assessments. It typically includes details such as the taxpayer's name, social security number, and the total earnings for the reporting period. This form is essential for individuals and businesses to accurately disclose their income to the Internal Revenue Service (IRS) and other relevant authorities.

How to use the Sample Earnings

Using the sample earnings form involves several straightforward steps. First, gather all necessary financial documents, such as pay stubs or previous tax returns, to ensure accurate reporting. Next, fill out the form with the required information, including your earnings and any applicable deductions. Once completed, review the form for accuracy before submission. This careful approach helps avoid errors that could lead to penalties or delays in processing.

Steps to complete the Sample Earnings

Completing the sample earnings form can be broken down into clear steps:

- Collect all relevant financial documents, including income statements and previous tax returns.

- Fill in your personal information, such as name, address, and social security number.

- Report your total earnings for the specified period, ensuring all figures are accurate.

- Include any deductions or adjustments that apply to your earnings.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Sample Earnings

The legal use of the sample earnings form is governed by regulations set forth by the IRS and other relevant authorities. To ensure the form is legally valid, it must be completed accurately and submitted on time. Compliance with federal and state laws is essential, as inaccuracies or late submissions can result in penalties. Additionally, using a secure platform for electronic submission can enhance the legal standing of the document.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the sample earnings form. These guidelines include instructions on the types of income that must be reported, the deadlines for submission, and the penalties for non-compliance. It is important to consult the IRS website or a tax professional for the most current information and to ensure adherence to all requirements.

Required Documents

To complete the sample earnings form, certain documents are typically required. These may include:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for freelance or contract work.

- Records of any additional income, such as rental income or interest earned.

- Documentation of deductions or credits that may apply.

Form Submission Methods

The sample earnings form can be submitted through various methods, including:

- Online submission via the IRS e-file system or authorized e-filing software.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete sample earnings

Complete Sample Earnings effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Sample Earnings on any device using airSlate SignNow's Android or iOS applications and simplify your document tasks today.

The easiest way to modify and electronically sign Sample Earnings without any hassle

- Obtain Sample Earnings and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sample Earnings to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are sample earnings when using airSlate SignNow?

Sample earnings refer to the potential financial benefits that businesses can gain from using airSlate SignNow. By streamlining document management and eSigning processes, companies can save time, reduce operational costs, and ultimately enhance their profitability, thus leading to improved sample earnings.

-

How does airSlate SignNow pricing work for maximizing sample earnings?

airSlate SignNow offers tiered pricing plans designed to fit various business needs and budgets. The right plan can help optimize your operational efficiency, which can positively impact your sample earnings. Choosing a plan that scales with your business ensures you get maximum returns.

-

What features of airSlate SignNow contribute to better sample earnings?

AirSlate SignNow is packed with features like customizable templates, secure eSigning, and real-time status tracking that enhance productivity. These features minimize delays and errors, ensuring quicker document processing, which in turn can boost your sample earnings.

-

Can airSlate SignNow help improve my business's sample earnings?

Yes, airSlate SignNow can signNowly improve your business's sample earnings by automating and simplifying your document workflows. This not only saves time but also allows your team to focus on more revenue-generating activities, leading to higher sample earnings.

-

What integrations does airSlate SignNow offer to enhance sample earnings?

AirSlate SignNow integrates seamlessly with various popular applications like Google Drive, Salesforce, and more. These integrations facilitate smoother workflows and data transfers, ultimately contributing to higher operational efficiency and better sample earnings for your business.

-

Is there any customer support for maximizing sample earnings with airSlate SignNow?

Absolutely! AirSlate SignNow provides comprehensive customer support to help you utilize the platform effectively. With the right guidance, you can adopt best practices that lead to increased operational efficiency and improved sample earnings.

-

How can I measure my business's sample earnings after using airSlate SignNow?

To measure your sample earnings after implementing airSlate SignNow, track key performance indicators like time saved on document processing and reduction in errors. Analyzing these metrics will help you quantify the financial impact of using the service and understand how it has influenced your sample earnings.

Get more for Sample Earnings

Find out other Sample Earnings

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document