Foreign for Profit Corporation Application I Form

What is the Foreign For Profit Corporation Application I

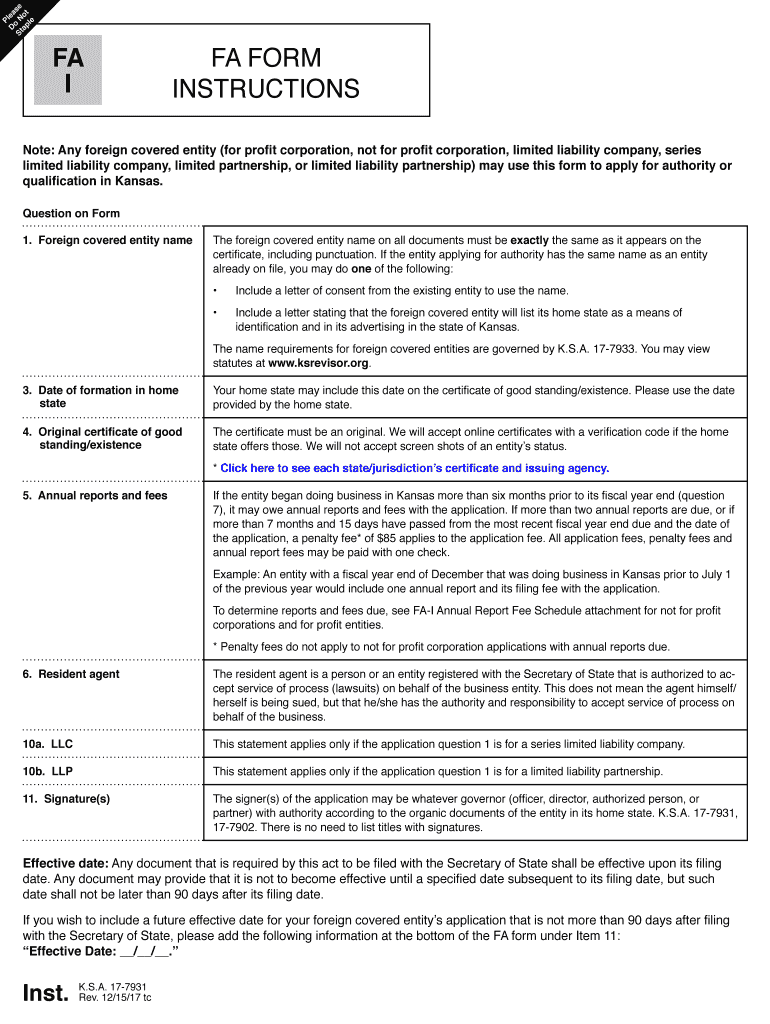

The Foreign For Profit Corporation Application I is a legal document used by businesses wishing to operate in a state outside their original incorporation. This application allows foreign corporations to register and conduct business legally within a new jurisdiction. It is essential for compliance with state laws, ensuring that these corporations meet all necessary regulatory requirements.

This form typically requires detailed information about the corporation, including its name, principal office address, and the state of incorporation. Additionally, it may ask for information regarding the corporation's registered agent in the new state, which is crucial for receiving legal documents.

Steps to complete the Foreign For Profit Corporation Application I

Completing the Foreign For Profit Corporation Application I involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the corporation, including its legal name, formation date, and the state in which it was originally incorporated.

Next, obtain the application form from the appropriate state agency, which may be available online or through direct request. Carefully fill out the form, ensuring all information is accurate and complete. It is important to review the form for any errors before submission.

Once the form is completed, it may need to be notarized, depending on state requirements. After notarization, submit the application along with any required fees to the designated state office. Keep a copy of the submitted application for your records.

Legal use of the Foreign For Profit Corporation Application I

The legal use of the Foreign For Profit Corporation Application I is crucial for compliance with state regulations. Filing this application allows a corporation to legally transact business in a state where it is not originally incorporated. This legal recognition is essential for protecting the corporation's interests and ensuring it can operate without legal hindrances.

Failure to file this application may result in penalties, including fines or restrictions on business operations. Therefore, understanding the legal implications and requirements associated with this form is vital for any corporation seeking to expand its operations across state lines.

Required Documents

When preparing to submit the Foreign For Profit Corporation Application I, certain documents are typically required. These may include:

- A copy of the corporation's certificate of good standing from its home state.

- Details about the corporation's registered agent in the new state.

- Identification of the corporation's officers and directors.

- Any additional state-specific documents as required by the jurisdiction.

It is important to check with the specific state agency for any additional requirements that may apply.

Form Submission Methods

The Foreign For Profit Corporation Application I can generally be submitted through various methods, depending on the state’s regulations. Common submission methods include:

- Online submission through the state’s business registration portal.

- Mailing the completed application to the appropriate state office.

- In-person submission at designated state agency locations.

Choosing the appropriate submission method is important for ensuring timely processing and compliance with state requirements.

Quick guide on how to complete foreign for profit corporation application i

Complete Foreign For Profit Corporation Application I effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Foreign For Profit Corporation Application I on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Foreign For Profit Corporation Application I with ease

- Obtain Foreign For Profit Corporation Application I and click on Get Form to commence.

- Employ the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow supplies specifically for this function.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, burdensome form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign Foreign For Profit Corporation Application I and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Foreign For Profit Corporation Application I?

The Foreign For Profit Corporation Application I is a document required for forming a foreign business entity in a state outside of its initial jurisdiction. This application allows businesses to operate legally while adhering to the regulations of the new state. Understanding and completing this application is essential for smoothly expanding your operations.

-

How much does it cost to file the Foreign For Profit Corporation Application I?

Filing fees for the Foreign For Profit Corporation Application I can vary depending on the state in which you are applying. Generally, fees can range from $100 to $500. It's important to check with the specific state's business division for precise pricing and any additional costs associated with the application.

-

What features does the airSlate SignNow platform offer for the Foreign For Profit Corporation Application I?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage tailored for the Foreign For Profit Corporation Application I. The platform streamlines the entire process from drafting to signing, making it simpler for businesses to manage their documentation. These features enhance efficiency and reduce the chances of errors.

-

What are the benefits of using airSlate SignNow for the Foreign For Profit Corporation Application I?

Using airSlate SignNow for the Foreign For Profit Corporation Application I offers several benefits, including increased efficiency and cost savings. The platform simplifies document handling and enhances collaboration among team members. Furthermore, eSigning adds convenience by allowing parties to sign from anywhere, improving the overall speed of processing applications.

-

Can airSlate SignNow help with additional documentation needed for the Foreign For Profit Corporation Application I?

Yes, airSlate SignNow can assist you in managing all accompanying documents required alongside the Foreign For Profit Corporation Application I. The platform supports document creation, sharing, and storage, ensuring you have all your necessary paperwork organized. This holistic approach ensures that you remain compliant with state regulations.

-

Is airSlate SignNow compliant with legal requirements for the Foreign For Profit Corporation Application I?

Absolutely! airSlate SignNow complies with all relevant legal and regulatory requirements for eSignatures and document management associated with the Foreign For Profit Corporation Application I. Our platform is designed to ensure that all transactions are legally binding and meet the necessary standards for validity, providing peace of mind to users.

-

What integrations does airSlate SignNow offer that can assist with the Foreign For Profit Corporation Application I?

airSlate SignNow integrates seamlessly with a range of tools like Google Drive, Dropbox, and CRM systems, enhancing the process related to the Foreign For Profit Corporation Application I. These integrations allow for easy access to documents and automated workflows that streamline filing and management. This interconnected approach can greatly enhance productivity.

Get more for Foreign For Profit Corporation Application I

- Letter from tenant to landlord about insufficient notice of rent increase south carolina form

- Letter tenant increase 497325669 form

- Sc increase rent 497325670 form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant south carolina form

- South carolina tenant form

- South carolina tenant 497325673 form

- Temporary lease agreement to prospective buyer of residence prior to closing south carolina form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497325675 form

Find out other Foreign For Profit Corporation Application I

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement