Form 1116

What is the Form 1116

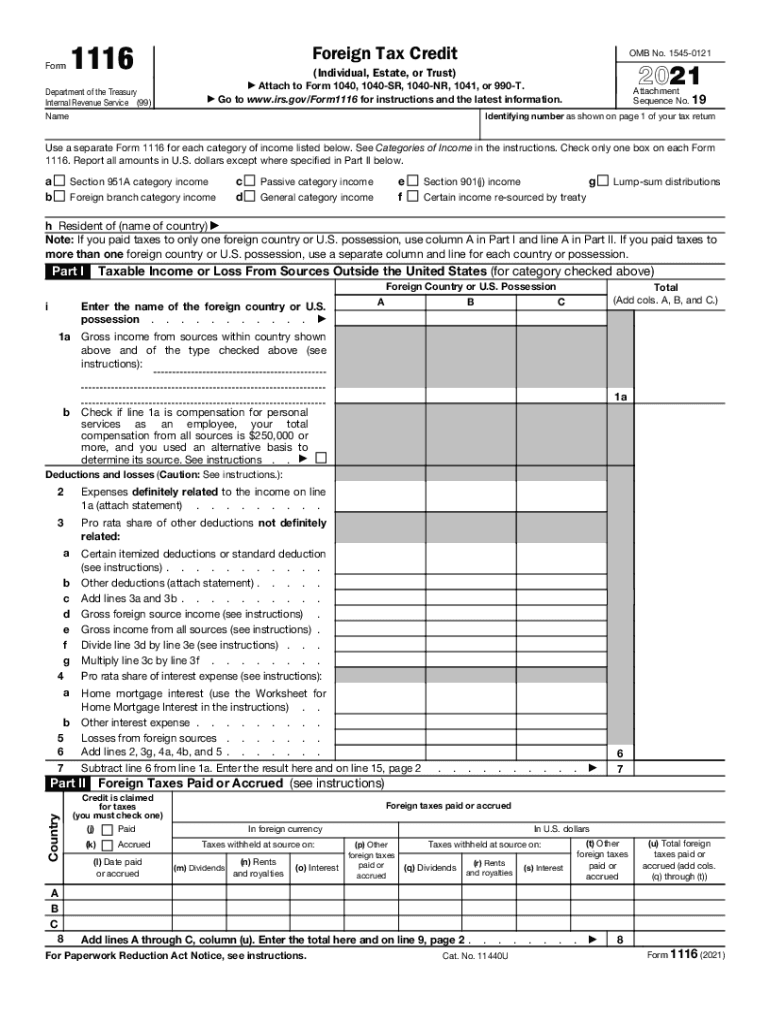

The IRS Form 1116 is a tax document used by U.S. taxpayers to claim the foreign tax credit. This credit is designed to reduce the double taxation that occurs when income is earned abroad and taxed by both the foreign country and the United States. By filing this form, taxpayers can offset their U.S. tax liability with the taxes they have already paid to foreign governments.

How to use the Form 1116

To use the IRS Form 1116, taxpayers must first determine their eligibility for the foreign tax credit. This involves identifying the foreign taxes paid or accrued during the tax year and ensuring that these taxes qualify under IRS guidelines. Once eligibility is established, the taxpayer fills out the form by providing details about the foreign income, taxes paid, and other relevant information. The completed form is then submitted with the taxpayer's annual tax return.

Steps to complete the Form 1116

Completing the IRS Form 1116 involves several key steps:

- Gather necessary documentation, including proof of foreign taxes paid and income earned abroad.

- Determine the type of foreign income and the corresponding tax rates.

- Fill out the form, detailing the foreign taxes paid and the income associated with those taxes.

- Calculate the allowable foreign tax credit based on the information provided.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Form 1116

The legal use of the IRS Form 1116 requires compliance with IRS regulations regarding foreign tax credits. Taxpayers must ensure that the foreign taxes claimed are legitimate and properly documented. Additionally, the form must be filed within the appropriate time frame to avoid penalties. Utilizing a reliable eSigning platform can help ensure that the form is signed and submitted securely, maintaining compliance with legal standards.

Key elements of the Form 1116

Key elements of the IRS Form 1116 include sections for reporting foreign income, taxes paid, and the calculation of the credit. The form typically requires information such as:

- Foreign country or U.S. possession where the income was earned.

- Type of income (e.g., wages, dividends, interest).

- Amount of foreign taxes paid or accrued.

- Calculation of the credit based on the taxpayer's overall U.S. tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1116 align with the general tax return deadlines. Typically, individual taxpayers must file their tax returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It's important to keep track of these dates to ensure timely submission and compliance.

Quick guide on how to complete form 1116

Complete Form 1116 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents quickly and without holdups. Handle Form 1116 on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-centric process today.

The most efficient way to adjust and eSign Form 1116 with ease

- Obtain Form 1116 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1116 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the IRS 1116 form and why is it important?

The IRS 1116 form is used by taxpayers to claim a foreign tax credit for taxes paid to foreign governments. It's important because it helps prevent double taxation of your income. By utilizing the IRS 1116 form correctly, you can ensure your tax liabilities are managed efficiently.

-

How does airSlate SignNow facilitate the completion of the IRS 1116?

AirSlate SignNow provides an easy-to-use platform allowing users to eSign and send documents, including the IRS 1116 form. With its intuitive interface, you can fill out the IRS 1116 quickly, ensuring accurate submission. The platform streamlines the process, so you can focus on your tax preparation.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans designed to fit various business needs, whether you are a freelancer or a large enterprise. Each plan includes access to features for managing documents, including the IRS 1116 form. You can find a cost-effective solution that fits your budget while ensuring compliance with tax requirements.

-

Are there any special features for tax-related forms like the IRS 1116?

Yes, airSlate SignNow includes features tailored for tax-related documentation, such as templates for common forms like the IRS 1116. Additionally, it ensures secure signing and storage, making it perfect for sensitive documents. These features help you streamline document management and ensure compliance.

-

Can I integrate airSlate SignNow with other software for IRS 1116 processing?

Absolutely! AirSlate SignNow offers integrations with popular accounting and tax software to streamline the processing of forms like the IRS 1116. By connecting your preferred platforms, you can efficiently transfer data and minimize manual entry, saving you time during the tax filing process.

-

What benefits does eSigning the IRS 1116 provide?

eSigning your IRS 1116 form through airSlate SignNow provides several benefits, including faster submission and enhanced security. Digital signatures are legally binding and help you expedite the filing process. Additionally, eSigning allows you to securely store your documents in the cloud for easy access and organization.

-

How secure is my information when using airSlate SignNow for IRS 1116?

AirSlate SignNow prioritizes the security of your information, implementing advanced encryption and secure storage protocols. When using the platform for your IRS 1116 form, you can trust that your data is protected against unauthorized access. Regular security updates ensure your sensitive information remains safe throughout the document handling process.

Get more for Form 1116

- Warranty deed from husband and wife to corporation utah form

- Utah divorce contested 497427421 form

- Subcontractors request for notice of preliminary notice received individual form

- Utah husband wife 497427424 form

- Warranty deed from husband and wife to llc utah form

- Utah satisfaction of judgment utah form

- Suppliers ampamp subcontractors guide utah state construction form

- Utah alternate form

Find out other Form 1116

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form