6198 Form 2020

What is the 6198 Form

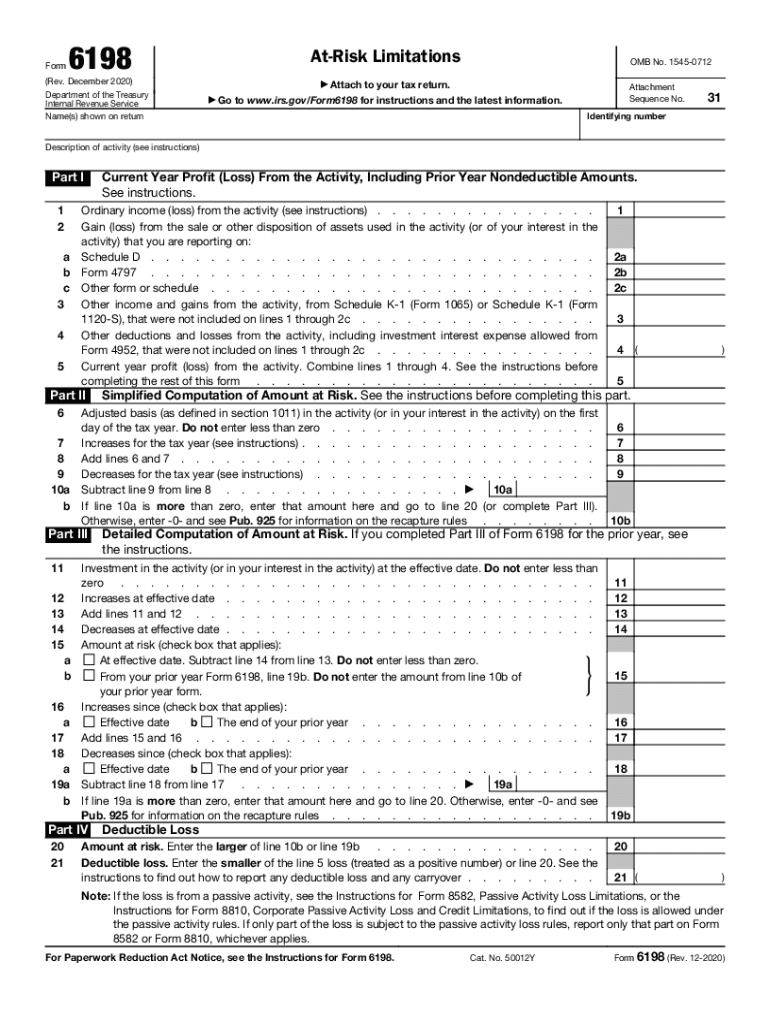

The 2 form, also known as the IRS 6198, is utilized by taxpayers to report at-risk limitations for certain activities. This form is particularly relevant for individuals engaged in partnerships or S corporations, where they need to determine the amount of loss they can deduct for tax purposes. The form helps in calculating the deductible losses from activities in which the taxpayer is at risk, ensuring compliance with IRS regulations.

How to use the 6198 Form

Using the 2 form involves several steps. Taxpayers must first gather relevant financial information related to their investments and activities. The form requires details about the taxpayer’s share of income, losses, and contributions to the activity. After filling out the necessary sections, the form must be submitted along with the taxpayer’s annual tax return. It is essential to ensure that all information is accurate to avoid issues with the IRS.

Steps to complete the 6198 Form

Completing the 2 form requires careful attention to detail. Here are the steps to follow:

- Begin by entering your personal information, including your name and Social Security number.

- Identify the activity for which you are reporting at-risk limitations.

- List your investments and any amounts you have contributed to the activity.

- Calculate your share of income and losses from the activity.

- Determine the total amount at risk and the allowable loss for the tax year.

- Review the form for accuracy before submission.

Legal use of the 6198 Form

The 2 form must be filled out accurately to ensure its legal validity. It is essential to comply with IRS guidelines related to at-risk limitations. The form serves as a legal document that can affect a taxpayer’s ability to claim deductions. Therefore, understanding the legal implications and ensuring all information is truthful and complete is crucial to avoid penalties.

Filing Deadlines / Important Dates

For the 2020 tax year, the deadline for submitting the 6198 form coincides with the annual tax return due date, typically April 15 of the following year. If additional time is needed, taxpayers may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Examples of using the 6198 Form

Taxpayers may find the 2 form useful in various scenarios. For instance, an individual who invests in a rental property through a partnership would use this form to report their at-risk amounts. Similarly, someone involved in a business venture with limited liability may need to complete the form to determine their deductible losses. These examples illustrate the form's significance in accurately reporting tax liabilities.

Quick guide on how to complete 2020 6198 form

Complete 6198 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage 6198 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign 6198 Form without hassle

- Locate 6198 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which is quick and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 6198 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 6198 form

Create this form in 5 minutes!

People also ask

-

What is the 2020 6198 form?

The 2020 6198 form is a crucial document that relates to the reporting of income and expenses for businesses. It is used by taxpayers to calculate their allowable deductions for business use of their vehicle. Completing the 2020 6198 form accurately is essential for compliance with tax regulations.

-

How can airSlate SignNow help with the 2020 6198 form?

airSlate SignNow simplifies the process of sending and eSigning the 2020 6198 form. With its user-friendly interface, you can easily share the form with your team or clients and get electronic signatures quickly. This streamlining saves time and enhances overall productivity.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to different business needs. Each plan includes features that help facilitate the completion of documents like the 2020 6198 form efficiently. You can choose a monthly or annual subscription based on your usage.

-

Are there any features specific to the 2020 6198 form available in airSlate SignNow?

Yes, airSlate SignNow provides features specifically designed to enhance the management of forms like the 2020 6198 form. You can access templates, automated reminders, and tracking tools to ensure your form is completed accurately and on time.

-

Is airSlate SignNow secure for signing forms like the 2020 6198 form?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your information when signing documents, including the 2020 6198 form. Advanced encryption and secure cloud storage ensure that your data remains safe throughout the signing process.

-

Can I integrate airSlate SignNow with my existing systems for the 2020 6198 form?

Yes, airSlate SignNow offers integrations with numerous third-party applications to streamline the preparation and signing of the 2020 6198 form. This compatibility enhances your workflow and allows you to manage documents seamlessly across platforms.

-

What benefits does airSlate SignNow provide for businesses handling the 2020 6198 form?

Using airSlate SignNow for the 2020 6198 form brings several benefits, including time savings and improved accuracy. The service reduces paperwork through digital signatures and helps maintain a professional image while ensuring compliance with tax regulations.

Get more for 6198 Form

- Assignment of deed of trust by corporate mortgage holder utah form

- Waiver and release upon final payment corporation utah form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property utah form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497427501 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property utah form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential utah form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property utah form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property utah form

Find out other 6198 Form

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer