Form 6198 at Risk Limitations from GetFormsOnline It's Quick 2001

What is the Form 6198 At Risk Limitations From GetFormsOnline It's Quick

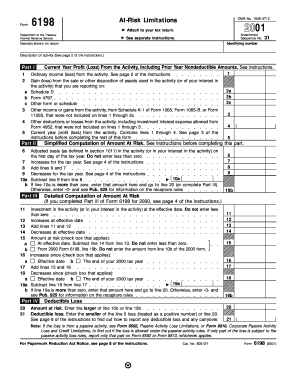

The Form 6198, titled "At-Risk Limitations," is a tax form used by individuals and entities to report their at-risk amounts in various business ventures. This form is essential for determining the extent to which taxpayers can deduct losses from their investments. The at-risk rules limit the amount of loss a taxpayer can claim to the amount they have at risk in the activity. This ensures that taxpayers cannot deduct losses beyond their actual investment in a business or property.

How to use the Form 6198 At Risk Limitations From GetFormsOnline It's Quick

Using Form 6198 involves several steps to ensure accurate reporting of at-risk amounts. Taxpayers must first gather relevant financial information related to their investments. This includes details about cash contributions, property contributions, and any loans for which they are personally liable. Once the necessary information is collected, taxpayers can fill out the form, providing details of their investments and calculating their at-risk amounts. It is crucial to follow the IRS guidelines closely to ensure compliance and accuracy.

Steps to complete the Form 6198 At Risk Limitations From GetFormsOnline It's Quick

Completing Form 6198 involves a systematic approach:

- Gather Financial Information: Collect all relevant documents regarding your investments.

- Fill Out Personal Information: Enter your name, Social Security number, and other identifying details at the top of the form.

- Detail Your Investments: List each investment, including the amount at risk for each activity.

- Calculate Total At-Risk Amounts: Use the provided sections to compute your total at-risk amounts based on your contributions and liabilities.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete before submission.

Legal use of the Form 6198 At Risk Limitations From GetFormsOnline It's Quick

The legal use of Form 6198 is governed by IRS regulations that dictate how at-risk amounts are calculated and reported. Taxpayers must ensure that they adhere to these regulations to avoid penalties or issues during audits. Properly completing this form allows taxpayers to claim deductions for losses that align with their actual financial risk in business activities. Failure to comply with the at-risk rules can result in disallowed deductions and potential legal ramifications.

Eligibility Criteria for Form 6198 At Risk Limitations From GetFormsOnline It's Quick

To be eligible to use Form 6198, taxpayers must be involved in business activities where they have a financial stake. This includes sole proprietors, partners in partnerships, and shareholders in S corporations. Additionally, taxpayers must have amounts at risk in these activities, which can include cash, property, and personal guarantees on loans. Understanding these eligibility criteria is essential for correctly filing the form and claiming allowable deductions.

Filing Deadlines for Form 6198 At Risk Limitations From GetFormsOnline It's Quick

Filing deadlines for Form 6198 coincide with the general tax filing deadlines. Typically, individual taxpayers must file their federal income tax returns by April 15 of each year. If additional time is needed, taxpayers can request an extension, which grants an additional six months to file. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 2017 form 6198 at risk limitations from getformsonline its quick

Effortlessly Prepare Form 6198 At Risk Limitations From GetFormsOnline It's Quick on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute to conventional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage Form 6198 At Risk Limitations From GetFormsOnline It's Quick on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Form 6198 At Risk Limitations From GetFormsOnline It's Quick effortlessly

- Obtain Form 6198 At Risk Limitations From GetFormsOnline It's Quick and click on Get Form to begin.

- Utilize the resources we provide to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Form 6198 At Risk Limitations From GetFormsOnline It's Quick and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 6198 at risk limitations from getformsonline its quick

Create this form in 5 minutes!

People also ask

-

What is Form 6198 At Risk Limitations From GetFormsOnline It's Quick?

Form 6198 At Risk Limitations From GetFormsOnline It's Quick is a crucial IRS form that helps taxpayers determine how much of their investment is at risk. This form is essential for reporting losses related to business activities, allowing you to calculate your at-risk amount accurately while minimizing tax liability.

-

How does airSlate SignNow assist with Form 6198 At Risk Limitations From GetFormsOnline It's Quick?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form 6198 At Risk Limitations From GetFormsOnline It's Quick. The streamlined process saves time and eliminates the need for paper forms, ensuring your submissions are sent securely and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet the needs of different businesses. Each plan includes features specifically designed to enhance your experience with documents such as Form 6198 At Risk Limitations From GetFormsOnline It's Quick, ensuring you get the best value for your investment.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial that allows potential users to explore the features available for Form 6198 At Risk Limitations From GetFormsOnline It's Quick at no cost. This trial enables you to evaluate whether the platform meets your electronic signing and document management needs.

-

What features does airSlate SignNow offer for managing legal documents?

AirSlate SignNow includes features such as document templates, real-time collaboration, and advanced security options, making it an ideal choice for managing legal documents. Users can easily handle Form 6198 At Risk Limitations From GetFormsOnline It's Quick and other necessary forms with enhanced efficiency and reduced risk.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow allows easy integration with various applications such as Google Drive, Dropbox, and CRM systems. This integration supports the management of Form 6198 At Risk Limitations From GetFormsOnline It's Quick and other documents seamlessly, increasing your overall productivity.

-

What benefits does electronic signing provide for Form 6198 At Risk Limitations From GetFormsOnline It's Quick?

Using electronic signing for Form 6198 At Risk Limitations From GetFormsOnline It's Quick enhances the speed and security of your document processing. It eliminates the wait for physical signatures, helps to maintain compliance, and provides a reliable way to track the status of your submissions.

Get more for Form 6198 At Risk Limitations From GetFormsOnline It's Quick

Find out other Form 6198 At Risk Limitations From GetFormsOnline It's Quick

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document