About Form 6198, at Risk Limitations 2024-2026

Understanding the 2020 Form 6198 and At-Risk Limitations

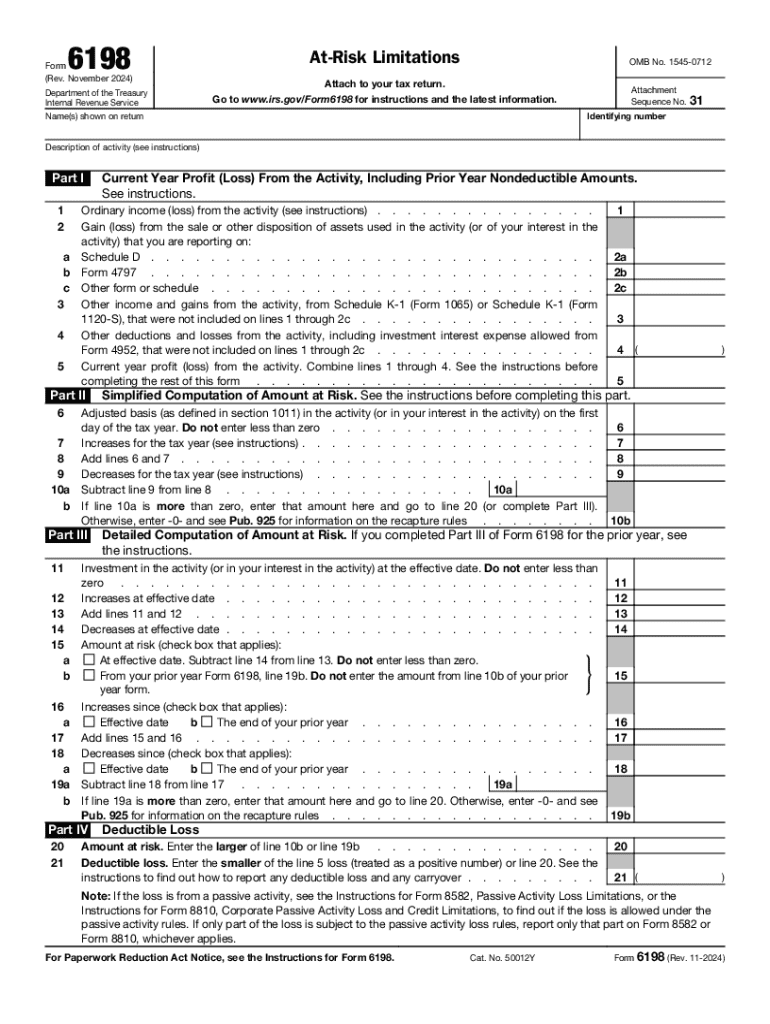

The 2020 Form 6198 is used to calculate the amount of loss a taxpayer can deduct from their income based on at-risk limitations. This form is particularly relevant for individuals involved in business activities, as it helps determine how much of their investment is considered at risk. The at-risk rules are designed to prevent taxpayers from deducting losses that exceed their actual investment in a business venture.

At-risk limitations apply to various types of investments, including partnerships, S corporations, and other business entities. Taxpayers must evaluate their investments to ascertain the amount they can claim as a loss, ensuring they adhere to IRS regulations.

Steps to Complete the 2020 Form 6198

Completing the 2020 Form 6198 involves several key steps:

- Gather necessary information: Collect details about your investments, including the amount at risk and any losses incurred.

- Fill out the form: Begin with your personal information, followed by the details of your investments and losses.

- Calculate at-risk amounts: Use the form’s instructions to determine your at-risk amounts for each investment.

- Report losses: Enter your calculated losses on the appropriate lines of the form.

- Review and sign: Ensure all information is accurate before signing and dating the form.

Obtaining the 2020 Form 6198

The 2020 Form 6198 can be easily obtained from the IRS website or through tax preparation software. It is available in both printable and fillable PDF formats, allowing users to choose their preferred method of completion. Additionally, tax professionals can provide the form as part of their services.

For those who prefer a digital experience, the fillable version allows for easy entry of information and automatic calculations, streamlining the filing process.

IRS Guidelines for Form 6198

The IRS provides specific guidelines for completing Form 6198, including detailed instructions on how to calculate at-risk amounts and the types of losses that can be claimed. Taxpayers should refer to the IRS instructions accompanying the form to ensure compliance with all regulations.

It is crucial to understand how at-risk limitations apply to various business structures and investments, as this can significantly impact the amount of loss that can be deducted. Familiarity with these guidelines can help taxpayers maximize their deductions while remaining compliant with tax laws.

Filing Deadlines for the 2020 Form 6198

Filing deadlines for the 2020 Form 6198 align with the general tax filing deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following year. If additional time is needed, a taxpayer may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

It is essential to keep track of these deadlines to ensure timely submission and avoid any issues with the IRS.

Key Elements of the 2020 Form 6198

Key elements of the 2020 Form 6198 include sections for reporting personal information, detailing investments, and calculating the at-risk amounts. The form also includes specific lines for entering losses and any adjustments that may apply. Understanding these elements is vital for accurate completion and compliance.

Taxpayers should pay close attention to the definitions and instructions provided within the form to ensure all relevant information is captured correctly.

Create this form in 5 minutes or less

Find and fill out the correct about form 6198 at risk limitations

Create this form in 5 minutes!

How to create an eSignature for the about form 6198 at risk limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 6198 form and why is it important?

The 2020 6198 form is a tax document used by businesses to report income and expenses related to certain activities. Understanding this form is crucial for accurate tax reporting and compliance. Using airSlate SignNow, you can easily eSign and send your 2020 6198 form securely.

-

How can airSlate SignNow help with the 2020 6198 form?

airSlate SignNow simplifies the process of completing and signing the 2020 6198 form. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can send it directly to clients or partners for their signatures.

-

Is there a cost associated with using airSlate SignNow for the 2020 6198 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are cost-effective and designed to provide value, especially for those frequently handling documents like the 2020 6198 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2020 6198 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the 2020 6198 form. These tools enhance efficiency and ensure that your documents are handled securely and professionally. You can also integrate with other applications for a seamless workflow.

-

Can I integrate airSlate SignNow with other software for the 2020 6198 form?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easy to manage your 2020 6198 form alongside other business tools. This integration capability helps streamline your processes and improves overall productivity.

-

What are the benefits of using airSlate SignNow for the 2020 6198 form?

Using airSlate SignNow for the 2020 6198 form offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are signed quickly and stored safely, allowing you to focus on your core business activities.

-

Is airSlate SignNow user-friendly for completing the 2020 6198 form?

Yes, airSlate SignNow is designed with user experience in mind. The platform is intuitive and easy to navigate, making it simple for anyone to complete the 2020 6198 form without extensive training. You can get started quickly and efficiently.

Get more for About Form 6198, At Risk Limitations

- Shriram transport finance 15g form online submission

- Hicaps add provider 64632056 form

- Jukebox labels template microsoft word form

- Authorization letter for form 137

- Ocrg so form no 1 pdf download

- Dental inventory spreadsheet pdf form

- Consent for the child to travel abroad pdf form

- Limited liability company foreign form

Find out other About Form 6198, At Risk Limitations

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure