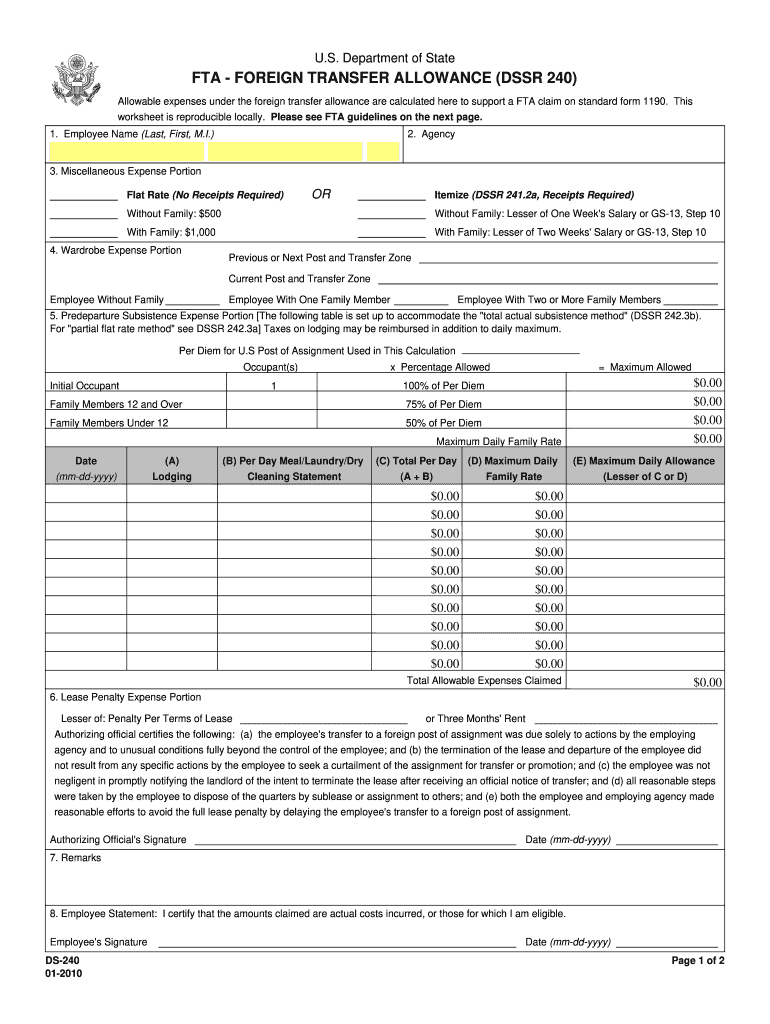

Dssr 240 Form

What is the DS-240?

The DS-240, also known as the FTA Foreign Transfer Allowance, is a form used by individuals seeking to report foreign income or assets for tax purposes in the United States. This form is essential for U.S. citizens and residents who have financial interests outside the country. The DS-240 helps ensure compliance with IRS regulations regarding foreign income, allowing taxpayers to accurately declare their financial activities abroad.

Steps to Complete the DS-240

Completing the DS-240 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding your foreign income and assets. This includes documentation such as bank statements, investment records, and any relevant tax documents from foreign jurisdictions.

Next, fill out the form by providing your personal information, including your Social Security number and details about your foreign income. Be sure to report all sources of foreign income, including wages, dividends, and interest. After completing the form, review it thoroughly to ensure all information is accurate and complete before submission.

Legal Use of the DS-240

The DS-240 is legally binding when completed and submitted in accordance with IRS regulations. It is crucial to understand the legal implications of filing this form, as inaccuracies or omissions can lead to penalties or audits. The form must be filed by the appropriate deadlines to avoid any legal repercussions. Compliance with the Foreign Account Tax Compliance Act (FATCA) and other relevant laws is essential for legal use.

Required Documents

To complete the DS-240, you will need several supporting documents. These typically include:

- Proof of foreign income, such as pay stubs or tax returns from foreign entities.

- Bank statements from foreign accounts.

- Documentation of any foreign investments or assets.

- Previous years' tax returns if applicable.

Having these documents ready will facilitate the completion of the form and ensure that all information reported is accurate and verifiable.

Eligibility Criteria

Eligibility for filing the DS-240 primarily depends on your status as a U.S. citizen or resident with foreign income or assets. Individuals who have earned income from foreign sources or hold financial accounts outside the United States must file this form. Additionally, certain thresholds may apply, such as minimum income levels or asset values, which determine the necessity of filing the DS-240.

Form Submission Methods

The DS-240 can be submitted through various methods, depending on your preference and the requirements set forth by the IRS. Common submission methods include:

- Online submission through the IRS e-file system.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices or tax assistance centers.

Choosing the right submission method can help streamline the process and ensure timely filing.

Quick guide on how to complete dssr 240

Effortlessly Prepare Dssr 240 on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers you all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Dssr 240 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Dssr 240 Without Stress

- Obtain Dssr 240 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Dssr 240 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dssr 240

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is the fta foreign transfer allowance?

The fta foreign transfer allowance refers to a specific monetary limit on the transfer of funds abroad for certain purposes. Understanding this allowance is crucial for businesses looking to operate internationally. It ensures compliance with financial regulations while allowing for efficient cross-border transactions.

-

How does airSlate SignNow support the fta foreign transfer allowance?

airSlate SignNow offers a seamless platform to manage documents associated with the fta foreign transfer allowance. By digitizing document workflows, businesses can efficiently prepare, sign, and manage the necessary paperwork for foreign transfers. This ensures a smooth and compliant transaction process.

-

What are the pricing options for using airSlate SignNow with regard to the fta foreign transfer allowance?

airSlate SignNow offers competitive pricing plans tailored for businesses looking to manage their fta foreign transfer allowance efficiently. Each plan includes features essential for effective document management and eSigning. Customers can choose from monthly or annual subscriptions to match their needs.

-

Can I integrate airSlate SignNow with other financial tools for managing the fta foreign transfer allowance?

Yes, airSlate SignNow integrates easily with various financial and accounting tools to streamline the management of the fta foreign transfer allowance. These integrations enhance workflow efficiency and facilitate comprehensive tracking of foreign fund transfers. This ensures your documents and financial operations work in harmony.

-

What features of airSlate SignNow are particularly beneficial for the fta foreign transfer allowance?

Key features of airSlate SignNow that benefit the fta foreign transfer allowance include automated document workflows, secure eSigning, and real-time collaboration. These features simplify the processes involved in preparing and executing documents while ensuring compliance with regulations. This enhances overall operational efficiency for businesses dealing with foreign transfers.

-

How does using airSlate SignNow improve compliance with the fta foreign transfer allowance?

Using airSlate SignNow helps improve compliance with the fta foreign transfer allowance by providing a secure environment for document creation and signing. The platform ensures that all necessary documentation is properly prepared and stored, minimizing the risk of errors. This is crucial for businesses to meet regulatory requirements when making foreign transfers.

-

Is there customer support available for queries related to the fta foreign transfer allowance?

Absolutely! airSlate SignNow provides customer support for all users, including those with questions about the fta foreign transfer allowance. Our support team is equipped to assist with technical issues, onboarding, and best practices to ensure you can effectively manage your foreign transfer needs.

Get more for Dssr 240

- Manager managed limited liability company operating agreement with classes of members form

- Sample letter for earth day form

- Exemption applications form

- Property management multiple form

- Sample letter for presidents day form

- Exemption letter for essential businesses ca form

- Sample letter new year form

- Sample accident form

Find out other Dssr 240

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement