62A307 9 05 TAX YEAR Commonwealth of Kentucky Qpublic Form

Understanding the 62A307 9 05 Tax Year Commonwealth of Kentucky Qpublic

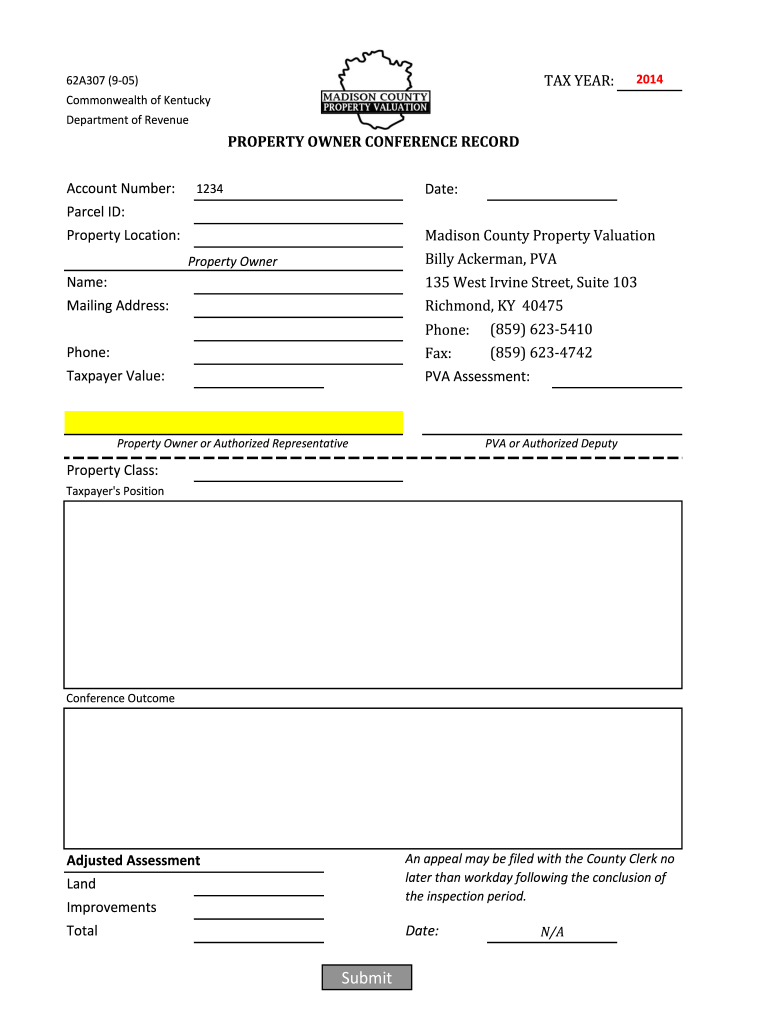

The 62A307 9 05 tax form is essential for property owners in Kentucky, specifically related to property valuation assessments. This form is used to report property values for tax purposes and is crucial for ensuring that property taxes are calculated accurately. Property owners must provide detailed information regarding their property, including its current market value, to facilitate proper assessment by local authorities.

Steps to Complete the 62A307 9 05 Tax Year Commonwealth of Kentucky Qpublic

Completing the 62A307 9 05 tax form involves several important steps:

- Gather necessary information about your property, including its location, size, and any improvements made.

- Determine the current market value of your property, which may require a professional appraisal.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate local tax authority by the specified deadline.

Legal Use of the 62A307 9 05 Tax Year Commonwealth of Kentucky Qpublic

The legal use of the 62A307 9 05 form is critical for compliance with Kentucky property tax laws. By accurately reporting property values, owners can avoid potential penalties for underreporting or misrepresenting their property’s worth. The completed form serves as a legal document that can be referenced in disputes regarding property tax assessments, ensuring that property owners are treated fairly under the law.

Filing Deadlines for the 62A307 9 05 Tax Year Commonwealth of Kentucky Qpublic

Filing deadlines for the 62A307 9 05 form are typically set annually by local tax authorities. It is essential for property owners to be aware of these deadlines to ensure timely submission and avoid penalties. Generally, the form must be filed by a specific date in the spring, and property owners should check with their local tax office for exact dates and any changes that may occur each year.

Required Documents for the 62A307 9 05 Tax Year Commonwealth of Kentucky Qpublic

When completing the 62A307 9 05 tax form, property owners may need to provide several supporting documents, including:

- Proof of property ownership, such as a deed or title.

- Recent property tax assessments or appraisals.

- Documentation of any improvements or renovations made to the property.

- Previous tax returns related to property income or deductions.

Who Issues the 62A307 9 05 Tax Year Commonwealth of Kentucky Qpublic

The 62A307 9 05 form is issued by the Kentucky Department of Revenue or the local property valuation administrator (PVA) in each county. These authorities are responsible for managing property assessments and ensuring compliance with state tax laws. Property owners should contact their local PVA for specific guidance on completing and submitting the form.

Quick guide on how to complete 62a307 9 05 tax year commonwealth of kentucky qpublic

Complete 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to alter and eSign 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic effortlessly

- Obtain 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or hide sensitive content with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 62a307 9 05 tax year commonwealth of kentucky qpublic

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is pva tax and how does it affect businesses?

PVA tax, or property value assessment tax, is a tax levied on properties based on their assessed value. For businesses, understanding pva tax is crucial as it can impact overall financial planning and budgeting. It's essential to stay compliant with pva tax regulations to avoid penalties and ensure smooth operations.

-

How can airSlate SignNow assist with managing pva tax documents?

AirSlate SignNow streamlines the process of managing documents related to pva tax. With its easy-to-use interface, businesses can quickly send, sign, and store pva tax forms, ensuring secure handling and easy retrieval. This helps companies maintain organization and compliance with pva tax regulations.

-

What are the pricing options for airSlate SignNow when dealing with pva tax-related documents?

AirSlate SignNow offers various pricing plans suited for businesses handling pva tax documents. These plans provide different levels of features, allowing users to choose the best option that fits their budget and needs. By opting for airSlate SignNow, businesses can save both time and money while efficiently managing pva tax paperwork.

-

Can airSlate SignNow integrate with other tax software for pva tax management?

Yes, airSlate SignNow integrates seamlessly with various tax software solutions, enhancing your ability to manage pva tax efficiently. This integration ensures that data flows smoothly, reducing manual entry and the chance of errors. By using airSlate SignNow in conjunction with tax software, businesses can simplify their pva tax processes.

-

What features of airSlate SignNow can help streamline pva tax submissions?

AirSlate SignNow offers features like electronic signatures, templates, and automatic reminders that signNowly streamline pva tax submissions. These tools help ensure that essential documents are signed and submitted on time, reducing potential delays. By leveraging these features, businesses can enhance their efficiency in handling pva tax matters.

-

Is airSlate SignNow compliant with pva tax regulations?

Absolutely! AirSlate SignNow is designed to comply with various legal standards, including those related to pva tax. By adhering to these regulations, businesses can trust that their electronic signatures and document management practices are legally valid and secure.

-

How does using airSlate SignNow benefit businesses in handling pva tax?

Using airSlate SignNow provides numerous benefits for businesses dealing with pva tax, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for real-time collaboration, making it easy for teams to work on pva tax documents together. Ultimately, this leads to quicker processing and submission of essential pva tax forms.

Get more for 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic

- Quitclaim deed from corporation to corporation wisconsin form

- Warranty deed from corporation to corporation wisconsin form

- Quitclaim deed from corporation to two individuals wisconsin form

- Warranty deed from corporation to two individuals wisconsin form

- Warranty deed from individual to a trust wisconsin form

- Warranty deed from husband and wife to a trust wisconsin form

- Mortgage wisconsin form

- Wi promissory note form

Find out other 62A307 9 05 TAX YEAR Commonwealth Of Kentucky Qpublic

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now