Ps Form 3881 X

What is the PS Form 3881 X?

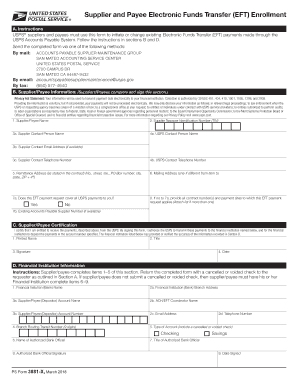

The PS Form 3881 X is a critical document used by the United States Postal Service (USPS) for supplier enrollment. This form facilitates the electronic funds transfer (EFT) process, allowing suppliers to receive payments directly to their bank accounts. It is essential for businesses that provide goods or services to the USPS, ensuring timely and secure payment transactions.

How to use the PS Form 3881 X

Using the PS Form 3881 X involves several steps to ensure proper completion and submission. First, gather all necessary information, including your business details, bank account information, and tax identification number. Next, fill out the form accurately, ensuring that all fields are completed. Once the form is filled out, it can be submitted electronically or via mail, depending on the USPS guidelines.

Steps to complete the PS Form 3881 X

Completing the PS Form 3881 X requires careful attention to detail. Here are the steps to follow:

- Download the PS Form 3881 X from the USPS website or obtain a physical copy.

- Provide your business name and address in the designated fields.

- Enter your bank account information, including the account number and routing number.

- Include your tax identification number to ensure compliance with IRS regulations.

- Review the completed form for accuracy and completeness.

- Submit the form according to USPS submission guidelines.

Legal use of the PS Form 3881 X

The PS Form 3881 X must be used in compliance with federal regulations governing electronic payments. It is legally binding when completed correctly, ensuring that suppliers can securely receive payments. Adhering to the guidelines set forth by the USPS and relevant legal frameworks is crucial for maintaining the integrity of the enrollment process.

Key elements of the PS Form 3881 X

The PS Form 3881 X contains several key elements that are essential for its validity:

- Business Information: Accurate details about the supplier's business.

- Bank Account Information: Essential for facilitating EFT payments.

- Tax Identification Number: Required for tax compliance.

- Signature: Must be signed by an authorized representative of the business.

Form Submission Methods

The PS Form 3881 X can be submitted through various methods, depending on the preferences of the supplier and the requirements of the USPS. Options include:

- Online Submission: Completing the form electronically and submitting it through the USPS online portal.

- Mail Submission: Printing the completed form and sending it via postal mail to the appropriate USPS address.

Quick guide on how to complete ps form 3881 x

Complete Ps Form 3881 X effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the required form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without obstacles. Manage Ps Form 3881 X on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Ps Form 3881 X without hassle

- Find Ps Form 3881 X and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the information and click on the Done button to keep your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Ps Form 3881 X and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ps form 3881 x

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a USPS supplier and how does it relate to airSlate SignNow?

A USPS supplier provides services and products related to the United States Postal Service. With airSlate SignNow, businesses can integrate shipping solutions with their eSigning processes, enabling seamless document management and dispatch. This allows users to improve their workflows and enhance operational efficiency.

-

How can I integrate a USPS supplier with airSlate SignNow?

Integrating a USPS supplier with airSlate SignNow is straightforward. The platform supports various integrations and API connections that allow users to incorporate USPS shipping features directly into their eSigning processes. This helps streamline document delivery and enhances the overall user experience.

-

What are the pricing options for using airSlate SignNow with a USPS supplier?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those that require USPS supplier integration. These plans provide flexibility, allowing users to choose the features and services that best fit their operations. For detailed pricing information, visiting the official airSlate SignNow website is recommended.

-

What features does airSlate SignNow offer that benefit USPS suppliers?

airSlate SignNow provides a range of features that can signNowly benefit USPS suppliers, including customizable templates, advanced security options, and real-time tracking. These features enable suppliers to manage documentation efficiently and securely, ensuring compliance and enhancing customer satisfaction.

-

Are there any specific benefits of using airSlate SignNow as a USPS supplier?

Yes, using airSlate SignNow as a USPS supplier offers numerous benefits, such as increased speed in document processing and improved delivery tracking. It facilitates a smoother workflow by combining eSigning and shipping, allowing businesses to manage their documentation and logistics from a single platform.

-

Can I use airSlate SignNow for international shipping through a USPS supplier?

Absolutely! airSlate SignNow can be used in conjunction with USPS suppliers for both domestic and international shipping. This capability allows businesses to manage global document logistics efficiently while ensuring that all paperwork is properly signed and tracked.

-

What types of documents can I send through airSlate SignNow and a USPS supplier?

With airSlate SignNow, users can send a wide variety of documents, including contracts, agreements, and invoices, by utilizing a USPS supplier for shipping. This versatility helps businesses handle different types of documentation seamlessly while ensuring secure eSigning and delivery.

Get more for Ps Form 3881 X

- Warranty deed from individual to three individuals wisconsin form

- Wisconsin transfer death form

- Transfer death beneficiary form

- Quitclaim deed life estate 497430531 form

- Release estate form 497430532

- Notice intent file form

- Quitclaim deed from individual to two individuals in joint tenancy wisconsin form

- Renunciation and disclaimer of joint tenant or tenancy interest wisconsin form

Find out other Ps Form 3881 X

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online