Www Irs Govpubirs TegeForm 4461 a Attachment IRS Tax Forms 2017-2026

What is the IRS Form 4461 and Its Purpose?

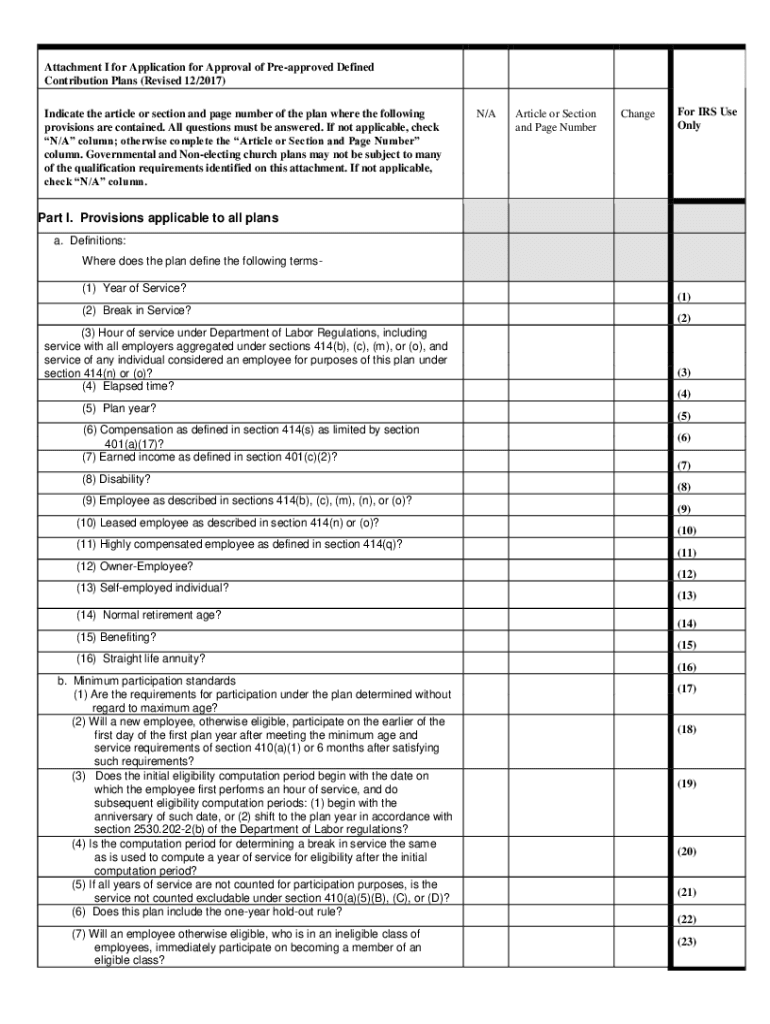

The IRS Form 4461, also known as the Internal Revenue Service application form, is essential for organizations seeking pre-approved defined contribution plans. This form serves as a request for approval from the IRS, allowing entities to establish retirement plans that meet specific regulatory requirements. By submitting this form, organizations can ensure compliance with federal guidelines while offering employees a structured retirement savings option.

Steps to Complete the IRS Form 4461

Completing the IRS Form 4461 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about the organization, including its legal name, address, and Employer Identification Number (EIN). Next, provide details about the plan, such as the type of defined contribution plan being proposed. Ensure that all sections of the form are filled out completely, as incomplete submissions may lead to delays in processing. Finally, review the form for accuracy before submission to avoid potential issues with the IRS.

Legal Use of the IRS Form 4461

The IRS Form 4461 must be used in accordance with federal regulations to maintain its legal validity. Organizations are required to adhere to the guidelines set forth by the IRS when establishing defined contribution plans. This includes ensuring that the plan meets the necessary requirements for tax-advantaged status. Utilizing electronic signatures through a compliant platform can enhance the legal standing of the completed form, as it provides a secure and verifiable method of signing.

Form Submission Methods for IRS Form 4461

Organizations can submit the IRS Form 4461 through various methods, including online, by mail, or in person. For electronic submissions, ensure that the platform used complies with IRS regulations for eSignatures. If submitting by mail, it is advisable to send the form via certified mail to confirm delivery. In-person submissions can be made at designated IRS offices, providing an opportunity for immediate confirmation of receipt.

Eligibility Criteria for IRS Form 4461

To be eligible to submit the IRS Form 4461, organizations must meet specific criteria outlined by the IRS. This includes being a qualified entity that intends to establish a defined contribution plan. Additionally, the organization must comply with all relevant federal regulations regarding retirement plans. Understanding these eligibility requirements is crucial for ensuring a smooth application process.

Filing Deadlines for IRS Form 4461

Timely submission of the IRS Form 4461 is critical to avoid penalties and ensure compliance. Organizations should be aware of the filing deadlines, which can vary based on the type of plan being established. Generally, it is advisable to submit the form well in advance of any intended plan implementation dates to allow for IRS processing time. Keeping track of these deadlines helps organizations maintain their compliance status and avoid unnecessary complications.

Quick guide on how to complete wwwirsgovpubirs tegeform 4461 a attachment irs tax forms

Effortlessly Prepare Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents quickly without any hold-ups. Manage Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

A Simple Way to Edit and Electronically Sign Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms

- Acquire Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms and click Get Form to begin.

- Make use of the tools we supply to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks, from any device you prefer. Edit and electronically sign Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs tegeform 4461 a attachment irs tax forms

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the internal revenue service application and how can it benefit my business?

The internal revenue service application allows businesses to efficiently manage their tax documents and forms through electronic signatures. This streamlines the filing process and reduces the chances of errors, making tax season smoother and more efficient for your business.

-

How does airSlate SignNow integrate with the internal revenue service application?

airSlate SignNow seamlessly integrates with the internal revenue service application, enabling users to eSign crucial tax documents directly within the platform. This integration enhances productivity by simplifying the workflow, allowing for quick access to documents without jumping between multiple systems.

-

What are the pricing options for the internal revenue service application with airSlate SignNow?

airSlate SignNow offers competitive pricing plans for businesses looking to utilize the internal revenue service application. Plans are designed to suit various business sizes, with options for monthly or annual billing, ensuring that you find a solution that fits your budget.

-

Can I customize documents for the internal revenue service application using airSlate SignNow?

Absolutely! airSlate SignNow lets you customize your documents for the internal revenue service application to meet your specific needs. You can add unique fields, logos, and signatures to ensure that your documents align with your brand and comply with IRS requirements.

-

Is airSlate SignNow secure for handling internal revenue service application documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your internal revenue service application documents are protected. The platform employs advanced encryption and security measures, complying with regulations to give you peace of mind while managing sensitive tax documents.

-

How does the eSigning process work for the internal revenue service application?

The eSigning process for the internal revenue service application with airSlate SignNow is straightforward and user-friendly. Simply upload your document, specify the signers, and send it out for signatures. The platform tracks the signing process in real-time, making it easy to manage documentation effectively.

-

What features does airSlate SignNow offer for the internal revenue service application?

airSlate SignNow provides a variety of features for the internal revenue service application, including templates, automated workflows, and reminders. These features help streamline your document management process, allowing you to focus on your core business activities without the hassle of manual paperwork.

Get more for Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms

- Final judgment form 497431368

- Order and notice for hearing final account and final settlement formal administration wisconsin

- Formal administration 497431370

- Formal administration 497431371

- Formal administration wisconsin

- Wi personal representative form

- Termination life estate form

- Wi tenancy termination form

Find out other Www irs govpubirs tegeForm 4461 A Attachment IRS Tax Forms

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now