California Los Angeles Tax 2021-2026

What is the homeowners property tax exemption?

The homeowners property tax exemption is a benefit that reduces the amount of property tax owed by eligible homeowners. This exemption is designed to provide financial relief to those who own and occupy their primary residence. In California, for instance, the exemption can significantly lower the assessed value of the property, thereby reducing the overall tax burden. Homeowners must meet specific criteria to qualify, including residency requirements and ownership status.

Eligibility Criteria for the homeowners property tax exemption

To qualify for the homeowners property tax exemption, applicants typically need to meet several criteria. These may include:

- Ownership of the property as your primary residence.

- Being a legal resident of the state where the exemption is claimed.

- Meeting income limits, if applicable, although many states do not impose income restrictions.

- Filing the exemption application by the designated deadline.

It is essential to check specific state regulations, as eligibility criteria can vary across different jurisdictions.

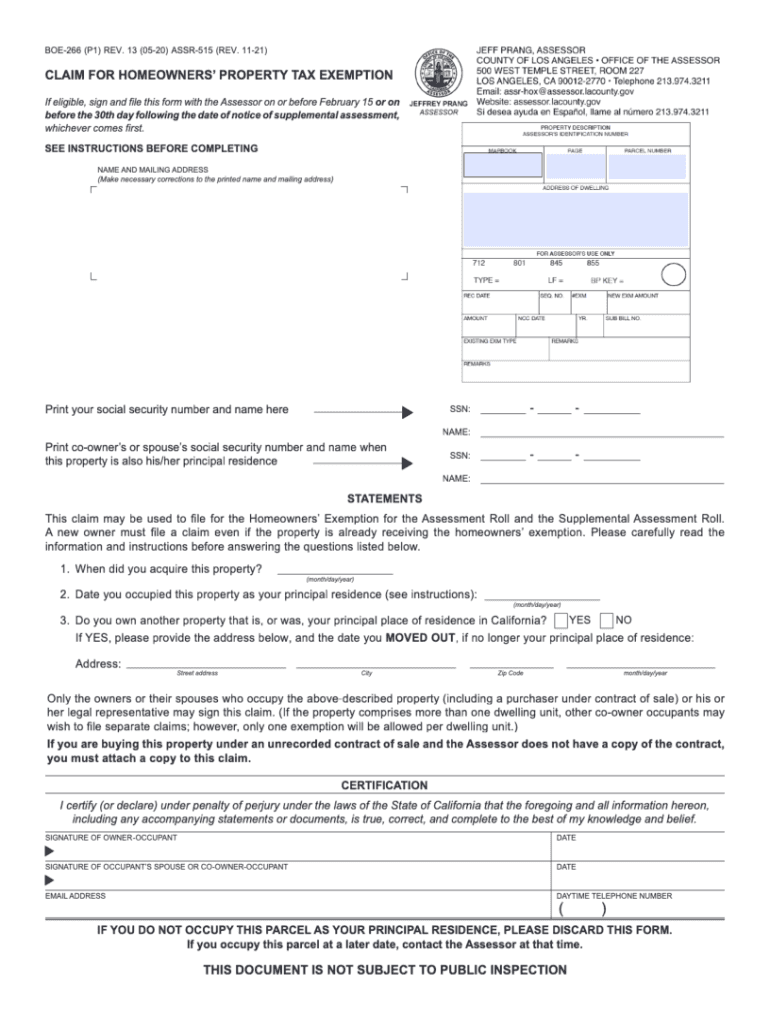

Steps to complete the homeowners property tax exemption form

Completing the homeowners property tax exemption form generally involves several straightforward steps. Here’s a typical process:

- Gather necessary documentation, such as proof of ownership and residency.

- Obtain the homeowners property tax exemption form from the local tax assessor's office or online.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form by mail, in person, or through an online portal if available.

Timeliness is crucial, as forms must be submitted by specific deadlines to ensure eligibility for the exemption.

Required documents for the homeowners property tax exemption

When applying for the homeowners property tax exemption, certain documents are typically required to verify eligibility. Commonly needed documents include:

- Proof of ownership, such as a deed or title.

- Identification that confirms residency, like a driver's license or utility bill.

- Any previous tax documents that may be relevant to the application.

Having these documents ready can streamline the application process and help ensure that all necessary information is provided.

Form submission methods for the homeowners property tax exemption

Homeowners can submit their property tax exemption forms through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local tax assessor's website.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax assessor's office.

Choosing the appropriate submission method can enhance the likelihood of timely processing and approval of the exemption.

Penalties for non-compliance with the homeowners property tax exemption

Failing to comply with the requirements for the homeowners property tax exemption can result in penalties. These may include:

- Loss of the exemption for the current tax year, leading to higher property taxes.

- Potential fines or interest on unpaid taxes if the exemption is not properly claimed.

- In some cases, legal action may be pursued by the tax authority for fraudulent claims.

Understanding these penalties underscores the importance of adhering to the application guidelines and deadlines.

Quick guide on how to complete 2021 california los angeles tax

Easily Prepare California Los Angeles Tax on Any Device

Digital document management has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage California Los Angeles Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign California Los Angeles Tax Effortlessly

- Find California Los Angeles Tax and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign California Los Angeles Tax and ensure outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 california los angeles tax

Create this form in 5 minutes!

People also ask

-

How do I calculate California sales tax?

The California (CA) state sales tax rate is 7.25%. This rate is made up of a base rate of 6%, plus a mandatory local rate of 1.25% that goes directly to city and county tax authorities. Depending on local sales tax jurisdictions, the total tax rate can be as high as 10.25%.

-

How much is LA income tax?

Determination of Tax Effective January 1, 2009Effective January 1, 2022 First $25,000 2 percent 1.85 percent Next $75,000 4 percent 3.50 percent Over $100,000 6 percent 4.25 percent6 more rows

-

What is the tax rate in California 2021?

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.50%.

-

What is the city of Los Angeles property tax rate?

Some estimates ballpark the average Los Angeles County property tax rate at 1.25% when additional assessments are taken into account. The annual property tax isn't just a one-time expense—it's a recurring cost that will impact your finances year after year.

-

How much is California state tax on $100,000 income?

If you make $100,000 a year living in the region of California, USA, you will be taxed $29,959. That means that your net pay will be $70,041 per year, or $5,837 per month. Your average tax rate is 30.0% and your marginal tax rate is 42.6%.

-

What is the California state tax rate for 2021?

Withholding Formula ><(California Effective 2021)< Head of Household If the Amount of Taxable Income Is:The Amount of California Tax Withholding Should Be: $ 0 $ 17,876 1.100% 17,876 42,353 2.200% >42,353 54,597 4.400%8 more rows

-

What are California income tax rates?

California income tax brackets and rates 2024 Tax rateTaxable income bracketTax owed 1% $0 to $21,512. 1% of taxable income. 2% $21,513 to $50,998. $215.12 plus 2% of the amount over $21,512. 4% $50,999 to $80,490. $804.84 plus 4% of the amount over $50,998. 6% $80,491 to $111,732. $1,984.52 plus 6% of the amount over $80,490.6 more rows • Oct 28, 2024

-

What is Los Angeles income tax?

California Income Tax Calculator 2023-2024. If you make $70,000 a year living in California you will be taxed $10,448. Your average tax rate is 10.94% and your marginal tax rate is 22%.

Get more for California Los Angeles Tax

- Tax free exchange package west virginia form

- Landlord tenant sublease package west virginia form

- Buy sell agreement package west virginia form

- Option to purchase package west virginia form

- Amendment of lease package west virginia form

- Annual financial checkup package west virginia form

- Bill of sale package west virginia form

- Living wills and health care package west virginia form

Find out other California Los Angeles Tax

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF