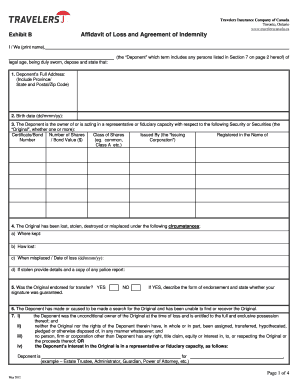

Affidavit of Loss and Agreement of Indemnity Form

What is the affidavit of loss and agreement of indemnity?

The affidavit of loss and agreement of indemnity is a legal document that serves to declare the loss of a specific item or document. This form is often required by institutions, such as banks or insurance companies, to verify the loss and to protect against potential fraud. By signing this affidavit, the individual agrees to indemnify the institution against any claims that may arise from the lost item. This document is essential for ensuring that all parties involved are protected and that the loss is formally acknowledged.

Key elements of the affidavit of loss and agreement of indemnity

Several key elements must be included in the affidavit of loss and agreement of indemnity to ensure its validity. These elements typically include:

- Identification of the affiant: The person declaring the loss must provide their full name and contact information.

- Description of the lost item: A detailed description of the item or document that has been lost, including any relevant identification numbers.

- Statement of loss: A clear declaration that the item has been lost, along with the date and circumstances of the loss.

- Indemnity clause: An agreement to indemnify the institution against any claims related to the lost item.

- Signature and date: The affiant must sign and date the document to validate it.

Steps to complete the affidavit of loss and agreement of indemnity

Completing the affidavit of loss and agreement of indemnity involves several steps that ensure the document is accurate and legally binding. Here are the steps to follow:

- Gather necessary information: Collect all relevant details about the lost item, including its description and any identification numbers.

- Fill out the form: Complete the affidavit with the required information, ensuring accuracy in every section.

- Review the document: Carefully check the affidavit for any errors or omissions before signing.

- Sign the affidavit: Sign and date the document in the presence of a notary public, if required.

- Submit the affidavit: Provide the completed affidavit to the relevant institution, following their submission guidelines.

Legal use of the affidavit of loss and agreement of indemnity

The affidavit of loss and agreement of indemnity is legally recognized in many jurisdictions, making it a valuable tool for individuals and businesses. Its legal standing ensures that the document can be used in court if disputes arise regarding the lost item. It is essential to understand the specific legal requirements in your state, as they may vary. Consulting with a legal professional can help clarify any questions regarding the document's use and enforceability.

How to obtain the affidavit of loss and agreement of indemnity

Obtaining the affidavit of loss and agreement of indemnity can often be done through various channels, depending on the institution's requirements. Here are common methods to acquire the form:

- Online resources: Many institutions provide downloadable versions of the affidavit on their websites.

- In-person requests: You can visit the institution's local office to request a physical copy of the form.

- Legal service providers: Some legal service companies offer templates or assistance in drafting the affidavit.

Examples of using the affidavit of loss and agreement of indemnity

The affidavit of loss and agreement of indemnity can be utilized in various scenarios. Common examples include:

- Lost checks: If a check is lost or stolen, the payee may need to submit this affidavit to the bank to stop payment and issue a new check.

- Missing insurance policies: Individuals may use the affidavit to declare a lost insurance policy document, allowing them to request a replacement.

- Lost identification documents: This affidavit can be required when reporting lost identification cards or passports to prevent identity theft.

Quick guide on how to complete affidavit of loss and agreement of indemnity

Manage Affidavit Of Loss And Agreement Of Indemnity effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Affidavit Of Loss And Agreement Of Indemnity on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to edit and eSign Affidavit Of Loss And Agreement Of Indemnity without difficulty

- Locate Affidavit Of Loss And Agreement Of Indemnity and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Mark important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Affidavit Of Loss And Agreement Of Indemnity and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Canada travelers insurance company?

A Canada travelers insurance company provides insurance coverage for individuals traveling within Canada or abroad. This coverage typically includes protection against trip cancellations, medical emergencies, lost luggage, and travel delays. Choosing the right Canada travelers insurance company can help safeguard your travel investment and ensure peace of mind during your trip.

-

How much does travelers insurance typically cost in Canada?

The cost of travelers insurance in Canada can vary widely based on several factors, including the length of your trip, your age, and the specific coverage you choose. On average, you might expect to pay between 4% to 10% of your total trip cost for a policy from a Canada travelers insurance company. It’s essential to compare different policies to find one that offers the best protection for your needs at a competitive price.

-

What features should I look for in a Canada travelers insurance company?

When selecting a Canada travelers insurance company, consider features such as comprehensive medical coverage, trip cancellation protection, emergency assistance, and 24/7 customer service. Look for companies that offer customizable policies to suit your travel preferences and needs. Additionally, check for exclusions and ensure that the policy covers common travel risks.

-

What are the benefits of using a Canada travelers insurance company?

Using a Canada travelers insurance company ensures that you have financial protection against unforeseen events during your travels. Benefits include coverage for medical emergencies, trip interruptions, and lost belongings, which can signNowly reduce your stress while traveling. Moreover, having insurance allows you to travel with confidence, knowing you're protected against unexpected challenges.

-

Can I purchase travelers insurance from a Canada travelers insurance company online?

Yes, many Canada travelers insurance companies offer the convenience of purchasing insurance online. This process typically involves filling out a straightforward application where you can customize your coverage options. Online purchases often provide instant quotes, allowing you to compare different plans quickly and efficiently.

-

Does travelers insurance cover COVID-19 related issues?

Coverage for COVID-19 related issues can vary signNowly among Canada travelers insurance companies. Some policies may cover trip cancellations due to COVID-19, while others may provide emergency medical coverage if you contract the virus while traveling. It's crucial to read the terms and conditions thoroughly and choose a policy that explicitly covers your concerns regarding the pandemic.

-

What should I do if I need to make a claim with my Canada travelers insurance company?

If you need to make a claim with your Canada travelers insurance company, start by contacting their customer service for guidance on the process. Gather all necessary documents, including receipts, medical reports, and proof of your claim-related expenses. Each company typically has specific procedures for claims, so ensure you follow their instructions closely to facilitate a smooth claims process.

Get more for Affidavit Of Loss And Agreement Of Indemnity

- Individual income tax forms 2022maine revenue services

- Dor use tax wisconsin department of revenue form

- Detroit city income tax forms state of michigan

- Plaintiff herein by complaining of the defendant alleges nycourts form

- Form it 203 tm group return for nonresident athletic team members tax year 2022

- Form it 252 investment tax credit for the financial services

- 2022 michigan homestead property tax credit claim for veterans form

- Section 606 credits against tax legislationny state senate form

Find out other Affidavit Of Loss And Agreement Of Indemnity

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple