TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications

What is the TC-90CB, Renter Refund Application

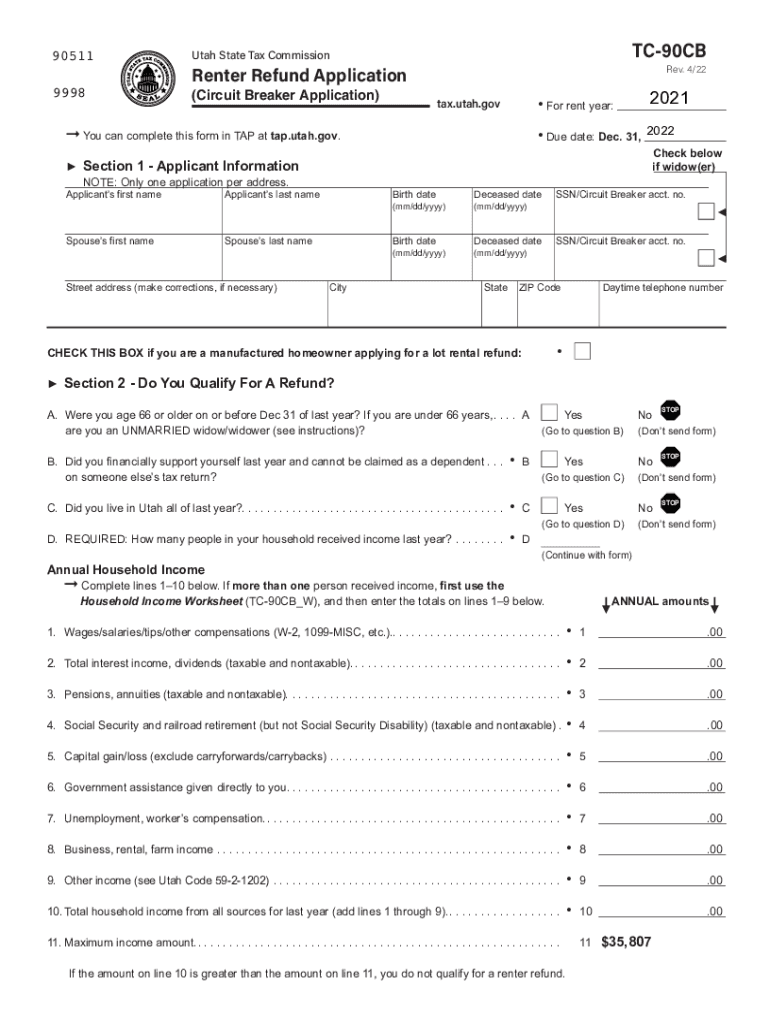

The TC-90CB, also known as the Renter Refund Application, is a crucial form used in the United States for individuals seeking a refund on their rental payments. This form is specifically designed for renters who meet certain eligibility criteria set by state tax authorities. It allows eligible renters to apply for a refund based on their rental expenses, which can help alleviate some financial burdens. Understanding the details of this form is essential for anyone looking to benefit from potential tax refunds related to their rental payments.

Eligibility Criteria for the TC-90CB

To qualify for the TC-90CB, applicants must meet specific eligibility requirements. Generally, these may include:

- Being a resident of the state where the application is filed.

- Having a valid rental agreement for the property in question.

- Meeting income limits as defined by state tax regulations.

- Providing proof of rental payments made during the tax year.

Each state may have additional criteria, so it is important to review local guidelines to ensure compliance before submitting the application.

Steps to Complete the TC-90CB

Completing the TC-90CB involves several straightforward steps to ensure accuracy and compliance:

- Gather required documents, such as proof of rental payments and identification.

- Fill out the TC-90CB form with accurate information regarding your rental history and personal details.

- Review the completed form for any errors or missing information.

- Submit the form through the designated method, whether online, by mail, or in person, as per state guidelines.

Following these steps can help streamline the application process and improve the chances of a successful refund application.

Required Documents for the TC-90CB

When applying for the TC-90CB, certain documents are necessary to support your application. These typically include:

- Proof of rental payments, such as receipts or bank statements.

- A copy of your rental agreement or lease.

- Identification documents, such as a driver's license or state ID.

- Any additional documentation required by your state tax authority.

Having these documents ready can facilitate a smoother application process and help avoid delays in processing your refund.

Form Submission Methods for the TC-90CB

The TC-90CB can be submitted through various methods, depending on state regulations. Common submission options include:

- Online submission via the state tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or designated locations.

Choosing the appropriate submission method is important to ensure timely processing of your application.

Legal Use of the TC-90CB

The TC-90CB is legally recognized as a valid application for rental refunds, provided it is completed accurately and submitted in accordance with state laws. It is essential to ensure that all information is truthful and that all required documents are included. Misrepresentation or failure to comply with legal requirements can lead to penalties or denial of the refund.

Quick guide on how to complete tc 90cb renter refund application circuit breaker forms ampamp publications

Complete TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications effortlessly on any device

Online document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications with ease

- Locate TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or mask sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and bears the same legal authority as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications and guarantee exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of a tax commission renter in managing rental properties?

A tax commission renter plays a crucial role in ensuring that rental property agreements comply with local tax regulations. By understanding tax implications, they help landlords maintain financial transparency and adhere to tax guidelines effectively. This ensures that property owners can focus on their investments without worrying about tax compliance.

-

How can airSlate SignNow help tax commission renters streamline their documentation process?

AirSlate SignNow provides tax commission renters with a platform to easily create, send, and electronically sign important documents. This allows for quicker processing times and reduces the risk of losing critical paperwork. With its user-friendly interface, renting agreements and tax-related forms can be managed seamlessly.

-

What are the pricing options for airSlate SignNow for tax commission renters?

AirSlate SignNow offers flexible pricing plans designed to fit various needs, including those of tax commission renters. Plans range from basic individual options to comprehensive business packages, ensuring affordability and value. By choosing the right plan, tax commission renters can access essential features without overspending.

-

What features does airSlate SignNow offer that benefit tax commission renters?

AirSlate SignNow includes features such as document templates, in-person signing, and workflow automation, all of which greatly benefit tax commission renters. These tools enhance efficiency by simplifying the signing process and reducing turnaround times for documentation. Additionally, users can track document statuses in real-time, keeping them informed and organized.

-

How secure is airSlate SignNow for tax commission renters?

Security is a top priority for airSlate SignNow, especially for tax commission renters who handle sensitive financial documents. The platform uses advanced encryption and secure cloud storage to protect your data. This means that you can confidently send and store documents, knowing they are safeguarded against unauthorized access.

-

Can airSlate SignNow integrate with other applications for tax commission renters?

Yes, airSlate SignNow offers numerous integrations with popular applications that tax commission renters may already use, such as CRM systems and accounting software. This enables users to streamline their workflow and enhance productivity by connecting tools they are familiar with. The integration capabilities make managing documents and taxes more efficient.

-

What benefits do tax commission renters gain by using airSlate SignNow?

Tax commission renters benefit from increased efficiency, reduced paperwork, and faster transaction times by using airSlate SignNow. The ability to eSign documents instantly helps expedite rental agreements and tax forms, improving client satisfaction. Additionally, the convenient mobile access allows renters to handle documents on-the-go, enhancing flexibility.

Get more for TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications

- Quitclaim deed from husband and wife to trust oklahoma form

- Oklahoma mineral deed 497323434 form

- Mineral trust 497323435 form

- Ok quitclaim 497323436 form

- Deed trust form ok

- Legal last will and testament form for single person with no children oklahoma

- Legal last will and testament form for a single person with minor children oklahoma

- Legal last will and testament form for single person with adult and minor children oklahoma

Find out other TC 90CB, Renter Refund Application Circuit Breaker Forms & Publications

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free