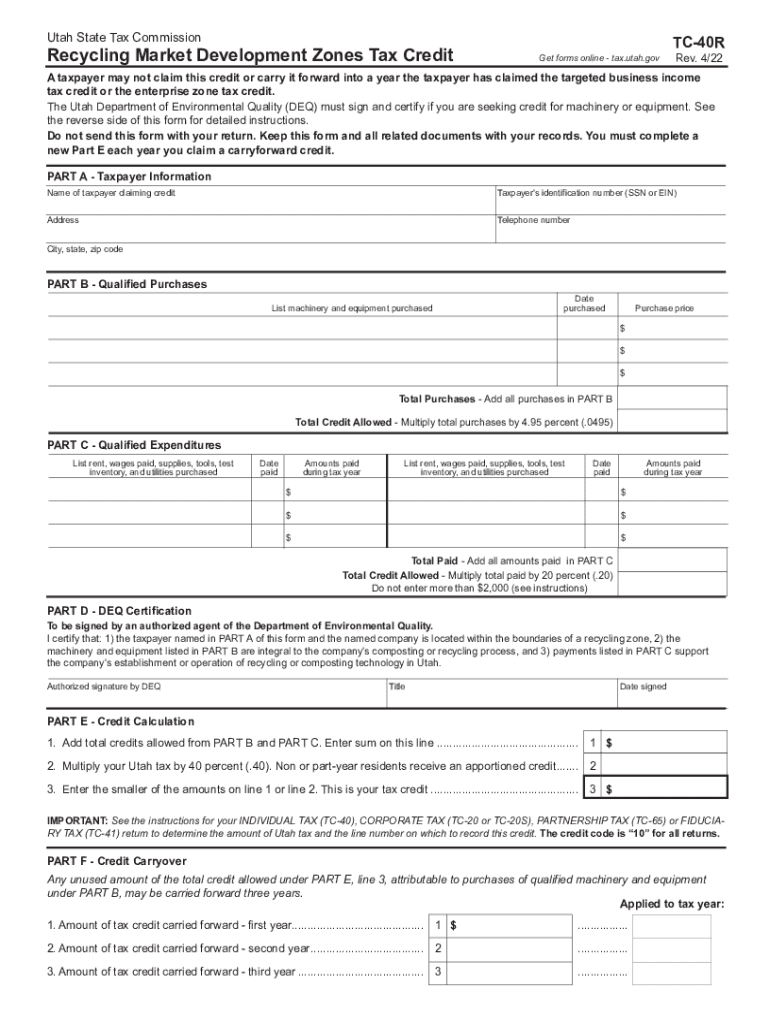

TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications 2022

Understanding the 1099 Form in Utah

The 1099 form is a crucial document for reporting various types of income other than wages, salaries, and tips. In Utah, businesses and individuals use the 1099 form to report payments made to independent contractors, freelancers, and other non-employees. This form helps the state and federal government track income for tax purposes, ensuring compliance with tax laws. It is essential for anyone who has received payments totaling $600 or more from a single payer in a calendar year.

Filing Deadlines for the 1099 Form in Utah

The deadline for filing the 1099 form in Utah typically aligns with federal deadlines. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the payments were made. If filing electronically, the deadline may extend to March second. It is important to meet these deadlines to avoid penalties and ensure that all income is accurately reported.

Eligibility Criteria for Using the 1099 Form

To use the 1099 form, payers must determine if the payments made qualify for reporting. Common scenarios include payments to independent contractors, rent payments, and payments for services provided. If a business pays an individual or entity $600 or more in a year, they are generally required to issue a 1099 form. Additionally, specific rules apply to different types of payments, so it is advisable to consult tax guidelines to ensure compliance.

Required Documents for Filing the 1099 Form

When preparing to file the 1099 form, certain information is necessary. This includes the payer's and recipient's names, addresses, and taxpayer identification numbers (TINs). It is also important to have accurate records of the payments made throughout the year. Keeping organized records will facilitate the completion of the form and help avoid discrepancies that could lead to audits or penalties.

Submission Methods for the 1099 Form

The 1099 form can be submitted in various ways. Payers may choose to file electronically through the IRS e-file system, which is often more efficient and allows for quicker processing. Alternatively, the form can be mailed to the IRS. If filing by mail, ensure that the form is sent to the correct address and that it is postmarked by the filing deadline. Some businesses may also provide copies to recipients electronically, provided they obtain consent.

Penalties for Non-Compliance with 1099 Filing

Failing to file the 1099 form or filing it late can result in significant penalties. The IRS imposes fines based on how late the form is filed, with penalties ranging from fifty dollars to several hundred dollars per form, depending on the delay. Additionally, if the information provided is incorrect, further penalties may apply. It is essential to ensure timely and accurate filing to avoid these financial repercussions.

Taxpayer Scenarios for the 1099 Form

Different taxpayer scenarios may affect how the 1099 form is used. For instance, self-employed individuals must report their income using the 1099 form, while businesses must ensure they issue this form to contractors and freelancers. Understanding the specific requirements for each scenario is vital for compliance and accurate tax reporting. Each situation may have unique considerations regarding deductions and tax obligations.

Quick guide on how to complete tc 40r utah recycling market development zones tax credit forms ampamp publications

Accomplish TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications without stress

- Find TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow has specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, and errors that require you to print new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 40r utah recycling market development zones tax credit forms ampamp publications

Create this form in 5 minutes!

People also ask

-

What is a 1099 form in Utah?

A 1099 form in Utah is a tax document used to report income received by independent contractors and freelancers. It is essential for accurately reporting earnings to the IRS and ensuring compliance with state tax regulations. Understanding how to fill out a 1099 form utah is crucial for both businesses and contractors.

-

How can airSlate SignNow help with 1099 forms in Utah?

airSlate SignNow simplifies the process of sending and eSigning 1099 forms in Utah. With our user-friendly interface, you can quickly upload, send, and collect signatures for your tax documents. This saves time and ensures your 1099 forms are processed efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for 1099 forms in Utah?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Whether you are a small business or a large enterprise, the cost for managing 1099 forms in Utah is competitive and well worth the investment for the convenience and efficiency provided.

-

What features does airSlate SignNow offer for managing 1099 forms in Utah?

airSlate SignNow offers features such as secure eSigning, document tracking, and customizable templates for 1099 forms in Utah. These tools enable businesses to streamline their document workflow, reduce errors, and ensure timely submissions for tax purposes.

-

Can airSlate SignNow integrate with other software for handling 1099 forms in Utah?

Yes, airSlate SignNow seamlessly integrates with various accounting and business software for managing 1099 forms in Utah. This integration helps you automate your workflow, reducing the need for manual data entry and ensuring all your documents are synced across platforms.

-

What are the benefits of using airSlate SignNow for 1099 forms in Utah?

Using airSlate SignNow for 1099 forms in Utah provides numerous benefits, including improved efficiency, enhanced security, and reduced turnaround times. With our solution, you can ensure your documents are processed in compliance with tax regulations, giving you peace of mind.

-

How secure is airSlate SignNow for storing 1099 forms in Utah?

airSlate SignNow prioritizes user security, employing encryption and secure cloud storage for all 1099 forms in Utah. Your documents are protected against unauthorized access, ensuring that sensitive information remains confidential and secure.

Get more for TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications

- Last will and testament for other persons oklahoma form

- Notice to beneficiaries of being named in will oklahoma form

- Estate planning questionnaire and worksheets oklahoma form

- Document locator and personal information package including burial information form oklahoma

- Oklahoma copy form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497323470 form

- Bill of sale of automobile and odometer statement oregon form

- Bill of sale for automobile or vehicle including odometer statement and promissory note oregon form

Find out other TC 40R, Utah Recycling Market Development Zones Tax Credit Forms & Publications

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy