TC 69, Utah State Business and Tax Registration 2022-2026

What is the TC-69, Utah State Business and Tax Registration?

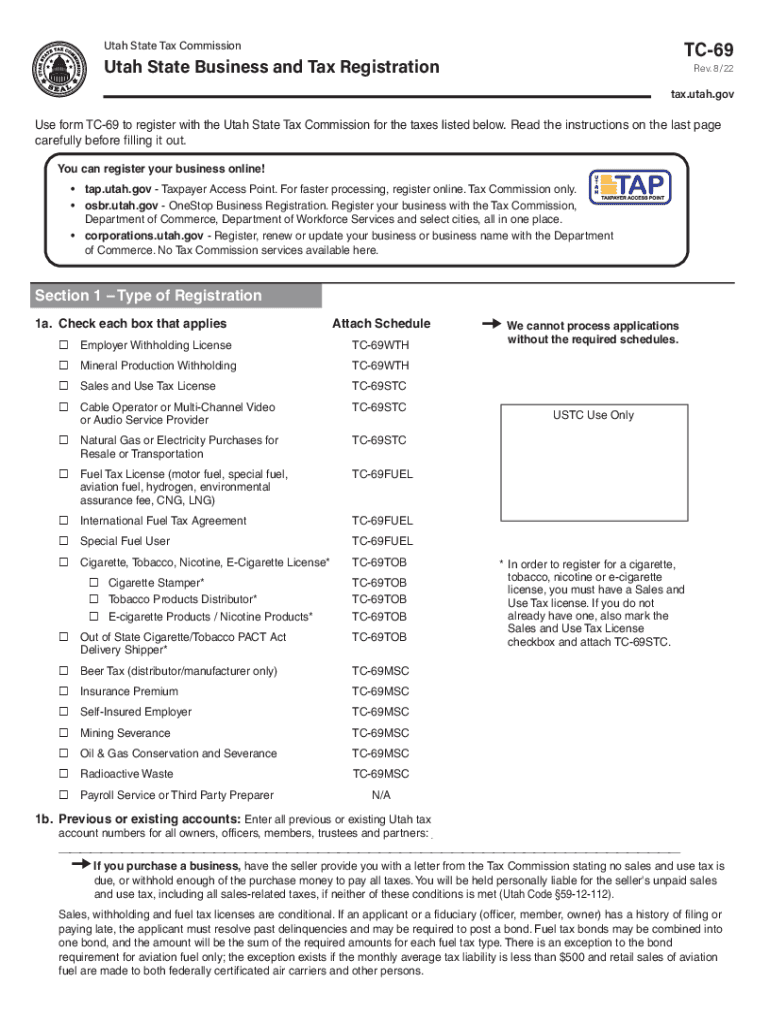

The TC-69 form is a crucial document for businesses operating in Utah, serving as the official application for business and tax registration. This form is essential for various types of business entities, including corporations, limited liability companies (LLCs), and partnerships. By completing the TC-69, businesses can register for state tax identification numbers, which are necessary for collecting and remitting taxes. This registration ensures compliance with state regulations and helps facilitate smooth business operations within Utah.

Steps to Complete the TC-69, Utah State Business and Tax Registration

Completing the TC-69 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including its legal name, address, and type of entity. Next, provide details regarding the owners and any relevant partners. It is also essential to specify the nature of your business activities, as this information helps determine applicable tax obligations. Once all information is compiled, carefully fill out the form, ensuring all sections are completed accurately. Finally, review the form for any errors before submission.

How to Obtain the TC-69, Utah State Business and Tax Registration

The TC-69 form can be obtained through the Utah State Tax Commission's official website. It is available for download in a printable format, allowing businesses to fill it out by hand or electronically. Additionally, businesses can request a physical copy by contacting the Tax Commission directly. Ensuring you have the correct and most recent version of the form is vital, as outdated forms may lead to processing delays.

Legal Use of the TC-69, Utah State Business and Tax Registration

The TC-69 form holds legal significance as it is required for compliance with Utah's business regulations. Properly completing and submitting this form ensures that your business is recognized by the state and can legally operate. The information provided on the TC-69 is used by the Utah State Tax Commission to assign tax identification numbers, which are necessary for tax reporting and compliance. Failure to submit this form can result in penalties and hinder your ability to conduct business legally in Utah.

Required Documents for the TC-69, Utah State Business and Tax Registration

When completing the TC-69 form, certain documents may be required to support your application. These documents typically include proof of business formation, such as articles of incorporation or organization, and identification for the business owners. Additionally, any relevant licenses or permits that pertain to your business activities should be included. Having these documents ready can expedite the registration process and ensure compliance with state requirements.

Filing Deadlines for the TC-69, Utah State Business and Tax Registration

Timely submission of the TC-69 form is crucial for compliance with state regulations. While there are no specific deadlines for initial registration, businesses should aim to complete the form before commencing operations to avoid potential penalties. Additionally, if there are changes in business structure or ownership, an updated TC-69 form should be submitted promptly. Staying informed about any changes in state regulations regarding filing deadlines is also important for maintaining compliance.

Quick guide on how to complete tc 69 utah state business and tax registration

Effortlessly complete TC 69, Utah State Business And Tax Registration on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle TC 69, Utah State Business And Tax Registration on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign TC 69, Utah State Business And Tax Registration with ease

- Obtain TC 69, Utah State Business And Tax Registration and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or mask sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign TC 69, Utah State Business And Tax Registration and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 69 utah state business and tax registration

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help with tax Utah needs?

airSlate SignNow is a comprehensive electronic signature platform designed to streamline document workflows. For businesses dealing with tax Utah, it allows seamless eSigning of important tax documents, ensuring compliance and efficiency. This helps reduce turnaround time and simplifies the entire tax filing process.

-

What features does airSlate SignNow offer for tax Utah documentation?

airSlate SignNow provides a variety of features ideal for managing tax Utah documents, including customizable templates, secure storage, and real-time tracking of document statuses. Additionally, the platform supports team collaboration, which is essential for efficient tax preparation. This can greatly enhance productivity for both individuals and businesses.

-

How does pricing work for airSlate SignNow for tax Utah users?

airSlate SignNow offers flexible pricing plans to accommodate different needs, making it affordable for tax Utah users. Plans are designed based on the volume of documents and users, ensuring you only pay for what you use. Furthermore, a free trial is available, allowing users to explore its features before committing.

-

Can I integrate airSlate SignNow with other tools for tax Utah management?

Yes, airSlate SignNow is highly integrative, allowing you to connect with various tools essential for tax Utah management, such as CRM systems, cloud storage services, and accounting software. This ensures a smoother workflow by enabling you to manage documents and data in one cohesive environment. Integration helps maintain organization and enhances efficiency.

-

Is airSlate SignNow compliant with tax Utah regulations?

Absolutely, airSlate SignNow is fully compliant with local and federal electronic signature laws, making it a reliable choice for handling tax Utah documents. Its security features protect sensitive information, aligning with compliance requirements for secure transactions. This adds an extra layer of trust for users managing financial documentation.

-

What are the benefits of using airSlate SignNow for tax Utah documentation?

The primary benefits of using airSlate SignNow for tax Utah documentation include increased efficiency, cost savings, and improved accuracy. By reducing paper use and streamlining document signing, users can focus more on core tax tasks. Additionally, automated reminders help ensure nothing gets overlooked during the busy tax season.

-

How user-friendly is airSlate SignNow for those new to tax Utah software?

airSlate SignNow is designed with user-friendliness in mind, making it easy even for those unfamiliar with tax Utah software. The intuitive interface guides users through the eSigning process, ensuring that all necessary steps are clear and straightforward. Comprehensive tutorials and customer support are also available to assist new users.

Get more for TC 69, Utah State Business And Tax Registration

- Mutual wills package with last wills and testaments for married couple with adult and minor children oklahoma form

- Legal last will and testament form for a widow or widower with adult children oklahoma

- Legal last will and testament form for widow or widower with minor children oklahoma

- Legal last will form for a widow or widower with no children oklahoma

- Legal last will and testament form for a widow or widower with adult and minor children oklahoma

- Legal last will and testament form for divorced and remarried person with mine yours and ours children oklahoma

- Legal last will and testament form with all property to trust called a pour over will oklahoma

- Written revocation of will oklahoma form

Find out other TC 69, Utah State Business And Tax Registration

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney