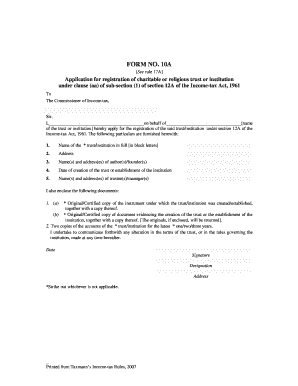

Religious Trust Form

What is the Religious Trust

A religious trust is a legal entity established to hold and manage assets for religious purposes. This type of trust is often created to support a specific religious organization or to further religious activities. It can provide tax benefits and ensure that the assets are used in accordance with the organization's mission. The trust is governed by specific rules and regulations that may vary by state, making it essential for trustees to understand the legal framework surrounding these entities.

How to use the Religious Trust

Utilizing a religious trust involves several key steps. First, the trust must be properly established, which includes drafting a trust document that outlines its purpose, management, and distribution of assets. Once established, the trust can receive donations, grants, and other forms of income. The trustees are responsible for managing these assets in a manner that aligns with the trust's objectives, ensuring compliance with both state and federal laws. Regular reporting and transparency are critical to maintain trust and accountability among stakeholders.

Steps to complete the Religious Trust

Completing a religious trust involves a systematic approach:

- Draft the Trust Document: Clearly define the purpose, terms, and conditions of the trust.

- Appoint Trustees: Select individuals or organizations to manage the trust.

- Fund the Trust: Transfer assets into the trust, ensuring they are used for religious purposes.

- File Necessary Documents: Submit any required forms to state authorities to establish the trust legally.

- Maintain Compliance: Regularly review trust activities and ensure adherence to legal requirements.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for religious trusts, particularly regarding tax-exempt status. To qualify, a trust must operate exclusively for religious purposes and comply with the IRS regulations. This includes filing the appropriate forms, such as Form 1023 for tax-exempt status, and maintaining detailed records of income and expenditures. Understanding these guidelines is crucial for trustees to ensure that the trust remains compliant and benefits from tax exemptions.

Eligibility Criteria

Eligibility for establishing a religious trust typically includes the following criteria:

- The trust must be created for religious purposes, such as supporting a church or religious organization.

- Trustees must be individuals or entities that are legally capable of managing the trust.

- The trust must comply with state laws regarding the formation and operation of trusts.

Meeting these criteria is essential for the trust to function effectively and maintain its legal standing.

Required Documents

Establishing a religious trust requires several important documents:

- Trust Document: Outlines the purpose, management, and distribution of assets.

- IRS Form 1023: Application for tax-exempt status.

- Financial Statements: Records of income and expenditures for transparency.

- Trustee Agreements: Documents outlining the responsibilities and authority of trustees.

Having these documents prepared and organized is vital for the smooth operation of the trust.

Quick guide on how to complete religious trust

Accomplish Religious Trust effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without holdups. Manage Religious Trust on any platform using airSlate SignNow’s Android or iOS applications, and streamline any document-related task today.

The easiest way to modify and eSign Religious Trust effortlessly

- Obtain Religious Trust and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Adjust and eSign Religious Trust while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form 10a income tax download, and why do I need it?

The form 10a income tax download is a crucial document used to declare your income details for taxation purposes. It helps ensure your tax returns are filed accurately, minimizing the risk of errors and potential fines. By downloading this form, you can streamline your tax filing process with ease.

-

How can I download the form 10a using airSlate SignNow?

To download the form 10a using airSlate SignNow, simply navigate to our user-friendly platform, select the form, and click the download button. Our seamless interface ensures that you can access and save the form quickly, ready for immediate use in your income tax filing.

-

Is there a cost associated with the form 10a income tax download on airSlate SignNow?

Yes, while airSlate SignNow offers a range of features, the form 10a income tax download may come with certain subscription fees based on your plan. We provide transparent pricing options that cater to various business needs, ensuring you get the best value for your tax document management.

-

What features does airSlate SignNow offer for managing my form 10a income tax download?

airSlate SignNow offers features such as electronic signatures, document sharing, and secure storage specifically for your form 10a income tax download. These functionalities enhance your efficiency, making it easier to manage and submit your tax documents without hassle.

-

Can I integrate airSlate SignNow with other accounting software for my form 10a income tax download?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, enhancing your workflow. This allows you to automatically upload your form 10a income tax download directly into your preferred accounting system, saving you time and effort.

-

What are the benefits of using airSlate SignNow for my form 10a income tax download?

Using airSlate SignNow for your form 10a income tax download simplifies the process of signing and sharing tax documents. With our user-friendly interface, you can reduce turnaround times and increase accuracy, ensuring a smoother experience when filing your income taxes.

-

Is it secure to download and manage my form 10a income tax documents on airSlate SignNow?

Yes, security is our top priority at airSlate SignNow. We use advanced encryption and compliance standards to protect your form 10a income tax download and ensure your sensitive information remains confidential and secure throughout the process.

Get more for Religious Trust

Find out other Religious Trust

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed