Tax Facts Comptroller of Maryland 2020

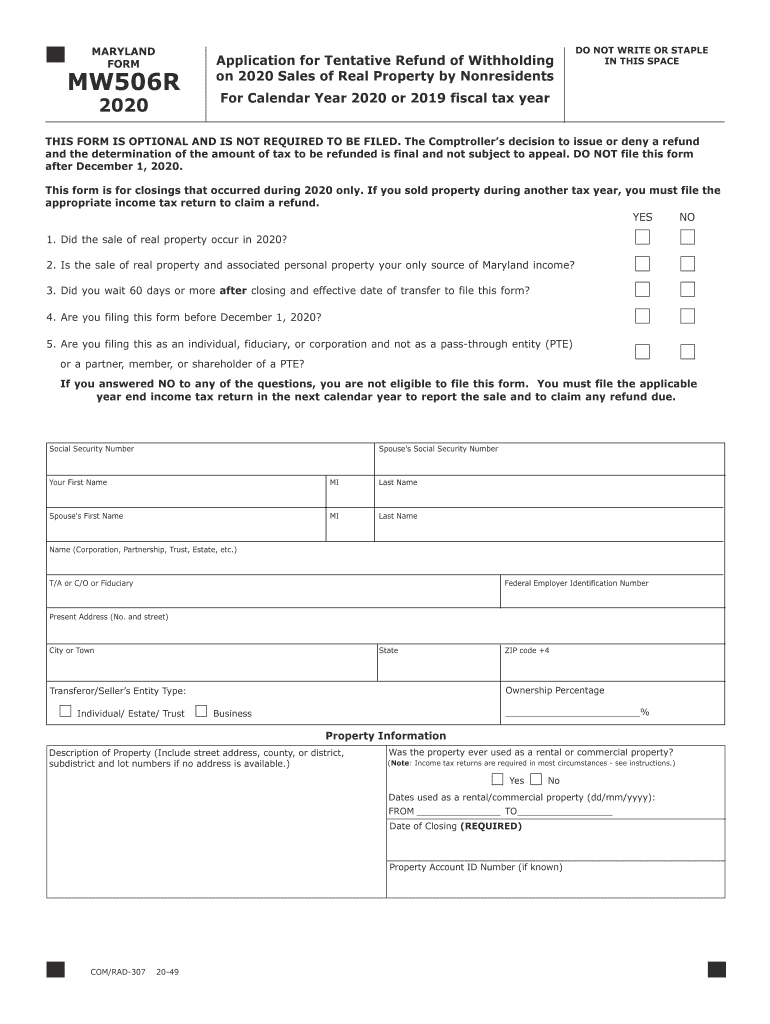

What is the Maryland MW506R Form?

The Maryland MW506R form, also known as the Maryland Tentative Refund Withholding form, is utilized by individuals and businesses to request a refund of state income tax withheld. This form is particularly relevant for those who have overpaid their withholding taxes throughout the year. By completing the MW506R, taxpayers can ensure they receive the appropriate refund amount based on their income and tax situation.

Steps to Complete the Maryland MW506R Form

Completing the Maryland MW506R form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal and financial information, including your Social Security number, income details, and any relevant tax documents. Next, fill out the form by providing your basic information and detailing your withholding amounts. Make sure to double-check all entries for accuracy. After completing the form, sign and date it before submitting it to the appropriate Maryland tax authority.

Legal Use of the Maryland MW506R Form

The Maryland MW506R form is legally recognized as a valid request for a refund of over-withheld state taxes. To ensure its legal standing, it must be completed accurately and submitted within the designated time frame set by the Maryland Comptroller. Compliance with state tax laws is essential, as inaccuracies or late submissions may result in delays or denial of the requested refund.

Filing Deadlines for the Maryland MW506R Form

Timely submission of the Maryland MW506R form is crucial for taxpayers seeking a refund. The form must typically be filed within a specific period following the end of the tax year. It is advisable to check the Maryland Comptroller's website or official publications for the exact deadlines, as they can vary based on changes in tax regulations or specific circumstances affecting taxpayers.

Required Documents for the Maryland MW506R Form

When filing the Maryland MW506R form, certain documents may be required to support your request for a refund. These documents typically include copies of your W-2 forms, any 1099 forms showing income, and documentation of the taxes withheld. Having these documents on hand can streamline the process and ensure that your refund request is processed efficiently.

Form Submission Methods for the Maryland MW506R

The Maryland MW506R form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the Maryland Comptroller's website, which allows for quicker processing. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so it is beneficial to choose the one that best fits your needs.

Key Elements of the Maryland MW506R Form

Understanding the key elements of the Maryland MW506R form is essential for accurate completion. The form typically includes sections for personal identification, details of income, and the amount of tax withheld. Additionally, it may require information about previous tax filings and any adjustments needed for the current year's withholding. Familiarizing yourself with these elements can help ensure that your submission is complete and accurate.

Quick guide on how to complete tax facts comptroller of maryland

Finish Tax Facts Comptroller Of Maryland effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your papers swiftly and without obstacles. Manage Tax Facts Comptroller Of Maryland on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to adjust and eSign Tax Facts Comptroller Of Maryland effortlessly

- Obtain Tax Facts Comptroller Of Maryland and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Select important sections of your documents or redact sensitive information with tools specifically created by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Tax Facts Comptroller Of Maryland and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax facts comptroller of maryland

Create this form in 5 minutes!

How to create an eSignature for the tax facts comptroller of maryland

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the maryland mw506r form and how does it work?

The maryland mw506r form is a tax form used for withholding tax in Maryland. It allows businesses to report and remit withholding taxes for employees in a streamlined manner. Utilizing airSlate SignNow can make submitting the maryland mw506r more efficient, reducing the potential for errors.

-

How does airSlate SignNow help with completing the maryland mw506r?

airSlate SignNow simplifies the process of completing the maryland mw506r by providing easy eSigning capabilities and secure document sharing. Users can fill out the form digitally and send it for signatures in minutes. This enhances both speed and accuracy in tax reporting.

-

Is there a cost associated with using airSlate SignNow for the maryland mw506r?

Yes, airSlate SignNow offers a cost-effective pricing structure that allows businesses to choose a plan that fits their needs. Pricing can vary based on the features and volume of documents processed, ensuring that businesses utilizing the maryland mw506r can find an affordable solution.

-

What features does airSlate SignNow offer for managing the maryland mw506r?

AirSlate SignNow offers features such as templates, cloud storage, and automated workflows tailored for handling the maryland mw506r. These features help streamline your document management process, saving time and reducing the risk of errors when submitting tax forms.

-

Can I integrate airSlate SignNow with other software for the maryland mw506r?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive and SharePoint, enhancing your workflow for the maryland mw506r form. This compatibility allows users to easily access and send documents without switching platforms.

-

What benefits does eSigning provide for the maryland mw506r?

eSigning offers quick turnaround times for the maryland mw506r, ensuring that your documents are signed and submitted on time. This digital approach also helps maintain compliance and enhances the security of sensitive information, which is crucial for tax-related forms.

-

How does airSlate SignNow ensure the security of my maryland mw506r submissions?

Security is a top priority for airSlate SignNow, which employs advanced encryption techniques to protect your maryland mw506r submissions. Additionally, the platform complies with industry standards for data protection, ensuring that your information remains confidential and secure.

Get more for Tax Facts Comptroller Of Maryland

- Wpf drpscu 010150 order washington form

- Washington personal service form

- Notice military form

- Washington service publication form

- Wpf drpscu 010265 order for service of summons by publication washington form

- Order show cause file form

- Motion order dismissal form

- Wpf drpscu 010560 order of dismissal washington form

Find out other Tax Facts Comptroller Of Maryland

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe