Www Templateroller Comgroup863Instructions for IRS Form 1098 "Mortgage Interest Statement"

Understanding IRS Form 1098: Mortgage Interest Statement

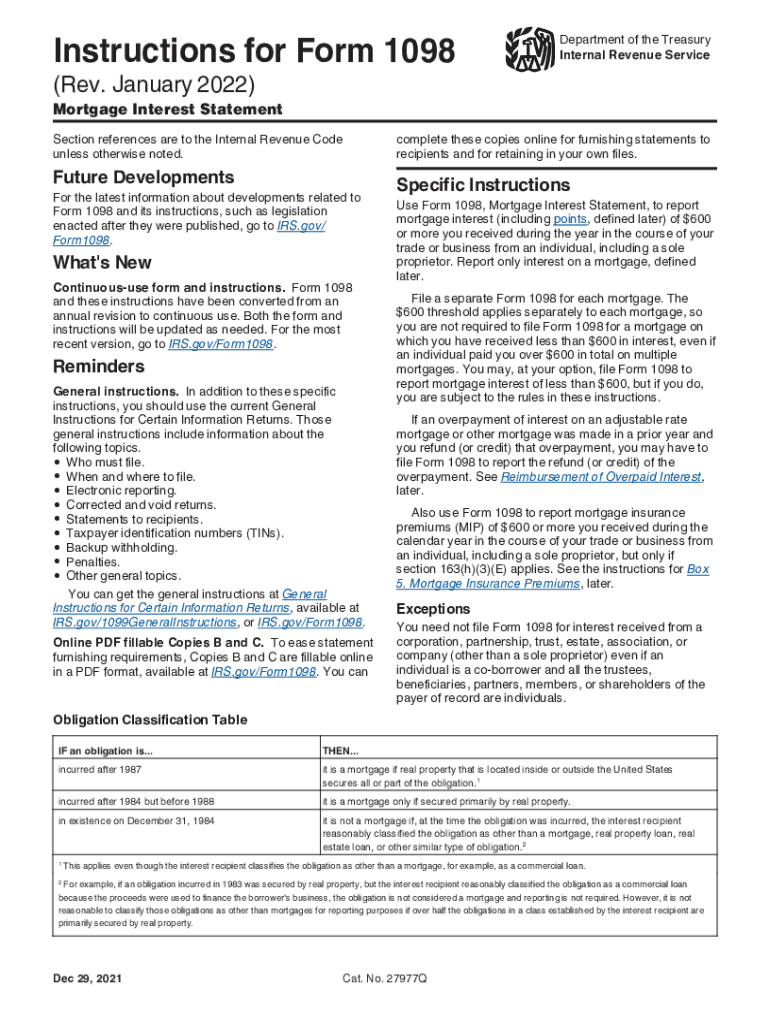

The IRS Form 1098, also known as the Mortgage Interest Statement, is a crucial document for homeowners in the United States. This form is issued by lenders to report the amount of mortgage interest paid by the borrower during the tax year. It is essential for taxpayers who wish to claim mortgage interest deductions on their federal income tax returns. The form provides detailed information, including the total interest paid, points paid on the purchase of the principal residence, and any mortgage insurance premiums. Understanding the components of this form can help homeowners accurately report their financial information and maximize their tax benefits.

Steps to Complete IRS Form 1098

Completing the IRS Form 1098 requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather necessary documents, including your mortgage statements and any relevant tax information.

- Locate the section on the form where the lender's information is required, including their name, address, and taxpayer identification number.

- Fill in your personal information, ensuring that your name and address are correct.

- Report the total amount of mortgage interest you paid during the tax year in the appropriate box.

- Include any points paid on the mortgage and mortgage insurance premiums, if applicable.

- Review the completed form for accuracy before submission.

Key Elements of IRS Form 1098

Several key elements are essential for understanding IRS Form 1098. These include:

- Borrower Information: This section includes the borrower's name, address, and taxpayer identification number.

- Lender Information: The lender's name, address, and taxpayer identification number must be accurately filled out.

- Total Mortgage Interest Paid: This figure indicates the total amount of interest paid on the mortgage during the tax year.

- Points Paid: If points were paid to reduce the interest rate, this amount should be reported.

- Mortgage Insurance Premiums: Any premiums paid for mortgage insurance should be included to maximize deductions.

IRS Guidelines for Form 1098

The IRS provides specific guidelines for completing and submitting Form 1098. Taxpayers must ensure that the form is filled out correctly to avoid penalties. The IRS requires that the form be issued by January 31 of the year following the tax year in which the interest was paid. Additionally, the information reported must match the records maintained by the lender to ensure compliance. Taxpayers should retain a copy of the form for their records, as it may be needed for future reference or audits.

Filing Deadlines for Form 1098

Filing deadlines for IRS Form 1098 are critical for compliance. The form must be provided to the borrower by January 31 of the year following the tax year. If the form is filed electronically, it must be submitted to the IRS by March 31. For paper filings, the deadline is also March 31. It is important for both lenders and borrowers to adhere to these deadlines to avoid potential penalties and ensure accurate tax reporting.

Legal Use of IRS Form 1098

The legal use of IRS Form 1098 is essential for both lenders and borrowers. The form serves as an official record of mortgage interest payments, which can be used to substantiate tax deductions. For the borrower, this form is a critical component of their tax return, allowing them to claim deductions for mortgage interest. Lenders must ensure that the information provided is accurate and complies with IRS regulations to avoid legal issues. Properly completing and submitting Form 1098 helps maintain transparency and accountability in the mortgage lending process.

Quick guide on how to complete wwwtemplaterollercomgroup863instructions for irs form 1098 ampquotmortgage interest statementampquot

Prepare Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement" effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement" on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement" with ease

- Find Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement" and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow sections of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement" and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwtemplaterollercomgroup863instructions for irs form 1098 ampquotmortgage interest statementampquot

The best way to generate an e-signature for your PDF document online

The best way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the form i1098 and why is it important?

The form i1098 is a tax document used to report mortgage interest received by lenders from borrowers. Understanding how to access and utilize the form i1098 is important for both homeowners and tax professionals in ensuring accurate tax filings and deductions.

-

How can I get the form i1098 using airSlate SignNow?

To get the form i1098 through airSlate SignNow, you can easily create, send, and eSign the document electronically. Our user-friendly platform streamlines the process, ensuring you have quick access to the form i1098 for efficient record-keeping.

-

Is there a fee to use airSlate SignNow for form i1098 eSignatures?

airSlate SignNow offers various pricing plans that cater to different business needs. While some features are included at no cost, accessing premium features such as the ability to manage the form i1098 may require a subscription. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for handling the form i1098?

airSlate SignNow provides several features to enhance the handling of the form i1098, including real-time document tracking, reusable templates, and secure storage. These features make it easier for users to efficiently manage and eSign important documents.

-

Can I integrate airSlate SignNow with other applications to use form i1098?

Yes, airSlate SignNow offers integration capabilities with various applications such as CRM systems and cloud storage services. This allows users to streamline their workflow and easily access the form i1098 from multiple platforms, enhancing overall productivity.

-

How does airSlate SignNow ensure the security of my form i1098?

airSlate SignNow prioritizes the security of your documents, including the form i1098, by implementing advanced encryption protocols and secure access controls. This ensures that your sensitive information remains protected throughout the entire eSigning process.

-

What are the benefits of using airSlate SignNow for the form i1098?

Using airSlate SignNow for the form i1098 offers key benefits such as improved efficiency, cost savings, and enhanced compliance. The platform simplifies the eSigning process, enabling users to resolve documents faster and reduce the need for paper-based workflows.

Get more for Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement"

- Health triangle self assessment form

- Acr performa for clerk haryana education department

- Psmas online registration form

- Songwriter split sheets form

- Publication 6744 answer key form

- How to fill outward remittance application form bank of baroda

- Mainstreet organization of realtors cook county residential lease form

- Texas standard residential lease agreement template form

Find out other Www templateroller comgroup863Instructions For IRS Form 1098 "Mortgage Interest Statement"

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now