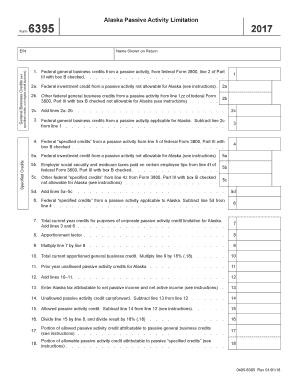

Specified Credits 2017

What is the Specified Credits

The specified credits refer to a category of tax credits that can reduce the amount of tax owed by individuals or businesses. These credits are often designed to incentivize specific behaviors, such as investing in renewable energy, hiring certain types of employees, or supporting educational initiatives. Understanding these credits is essential for maximizing tax benefits and ensuring compliance with IRS regulations.

How to use the Specified Credits

Using specified credits involves several steps. First, identify the specific credits applicable to your situation. This may require reviewing IRS guidelines or consulting with a tax professional. Once identified, gather the necessary documentation to support your claim. When filing your taxes, include the relevant forms and schedules that detail the specified credits you are claiming. Accurate record-keeping is crucial to ensure you can substantiate your claims if audited.

Steps to complete the Specified Credits

Completing the specified credits involves a systematic approach:

- Determine eligibility by reviewing the criteria outlined by the IRS.

- Gather required documentation, such as income statements, receipts, or proof of qualifying activities.

- Fill out the appropriate tax forms, ensuring all information is accurate and complete.

- Submit your tax return by the designated deadline, either electronically or via mail.

Legal use of the Specified Credits

To legally use specified credits, it is essential to adhere to IRS guidelines and state regulations. This includes ensuring that all claims are substantiated with adequate documentation and that the credits are applicable to your tax situation. Misuse of specified credits can lead to penalties, including fines or audits. Therefore, it is advisable to stay informed about current laws and regulations governing these credits.

Eligibility Criteria

Eligibility for specified credits varies based on the type of credit and the individual or business circumstances. Common criteria include income thresholds, types of expenses incurred, and specific actions taken that align with the credit's purpose. For instance, some credits may only apply to individuals in certain income brackets or businesses that meet particular operational criteria. It is important to review the specific requirements for each credit to ensure compliance.

IRS Guidelines

The IRS provides detailed guidelines regarding specified credits, including eligibility, required documentation, and filing procedures. These guidelines are essential for taxpayers to understand how to properly claim credits and avoid common pitfalls. Taxpayers should regularly consult the IRS website or official publications to stay updated on any changes to the credits or filing requirements.

Filing Deadlines / Important Dates

Filing deadlines for specified credits typically align with the general tax filing deadlines. For most individuals, this is April 15 of each year. However, there may be extensions or specific deadlines for certain types of credits. It is crucial to be aware of these dates to ensure timely submission and avoid penalties. Marking your calendar with important dates can help maintain compliance and maximize your tax benefits.

Quick guide on how to complete specified credits

Complete Specified Credits effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without complications. Manage Specified Credits on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to edit and eSign Specified Credits with ease

- Locate Specified Credits and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Annotate important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Specified Credits to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct specified credits

Create this form in 5 minutes!

How to create an eSignature for the specified credits

How to generate an electronic signature for your Specified Credits in the online mode

How to make an electronic signature for the Specified Credits in Chrome

How to create an electronic signature for putting it on the Specified Credits in Gmail

How to generate an electronic signature for the Specified Credits from your smartphone

How to generate an electronic signature for the Specified Credits on iOS

How to generate an electronic signature for the Specified Credits on Android

People also ask

-

What are Specified Credits in airSlate SignNow?

Specified Credits are a flexible payment option within airSlate SignNow that allow businesses to purchase credits for sending and signing documents. This system offers a cost-effective way to manage document workflows without committing to a subscription plan, making it ideal for businesses with varying document needs.

-

How do Specified Credits work for document signing?

When you purchase Specified Credits, each credit corresponds to a document sent for eSignature within airSlate SignNow. This means you can easily scale your usage based on your current needs, ensuring you only pay for what you use, which helps optimize your budgeting for document management.

-

Are there any discounts available for purchasing Specified Credits?

Yes, airSlate SignNow often provides discounts for bulk purchases of Specified Credits. By buying credits in larger quantities, businesses can take advantage of cost savings, making it an economical choice for companies that frequently handle document signing.

-

Can I integrate Specified Credits into my existing workflow?

Absolutely! airSlate SignNow allows you to seamlessly integrate Specified Credits into your existing document management workflows. This integration ensures that your team can efficiently manage eSignatures without disrupting your current processes.

-

What features are included when using Specified Credits?

When utilizing Specified Credits in airSlate SignNow, you gain access to a variety of features including secure eSignatures, document tracking, and customizable templates. These features enhance your document management experience, making it easier to send, sign, and store documents securely.

-

Is there a limit to how many Specified Credits I can purchase?

There is no strict limit to how many Specified Credits you can purchase in airSlate SignNow. Businesses can buy as many credits as they need, allowing for maximum flexibility in managing document workflows based on their unique requirements.

-

How do Specified Credits benefit small businesses?

Specified Credits are particularly beneficial for small businesses as they provide a cost-effective way to manage eSignature needs without the commitment of a full subscription. This allows small enterprises to scale their document signing processes according to their fluctuating needs, ensuring they only pay for what they actually use.

Get more for Specified Credits

Find out other Specified Credits

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple