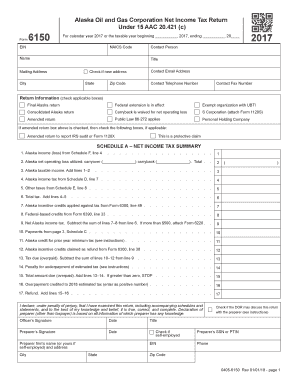

under 15 AAC 20 2017

What is the Under 15 AAC 20

The Under 15 AAC 20 form is a specific document used within the legal framework of the United States, particularly relevant to certain regulatory requirements. This form may pertain to various administrative processes, often requiring detailed information about individuals or entities involved. Understanding its purpose is crucial for compliance with applicable laws and regulations.

How to obtain the Under 15 AAC 20

Obtaining the Under 15 AAC 20 form typically involves visiting the appropriate regulatory agency's website or office. Most forms can be downloaded directly from official sources, ensuring that you have the latest version. In some cases, you may also request the form via mail or in person at designated locations. Ensure that you have the necessary identification and information ready to facilitate the process.

Steps to complete the Under 15 AAC 20

Completing the Under 15 AAC 20 form requires careful attention to detail. Start by gathering all necessary information, including personal details and any supporting documents. Follow these steps:

- Read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all sections are completed.

- Review your entries for any errors or omissions.

- Sign and date the form as required.

Legal use of the Under 15 AAC 20

The legal validity of the Under 15 AAC 20 form hinges on compliance with specific regulations. When completed and submitted correctly, this form can hold significant legal weight. It is essential to ensure that all information provided is truthful and accurate to avoid potential legal repercussions. Utilizing a reliable electronic signature solution can further enhance the form's legitimacy.

Key elements of the Under 15 AAC 20

Several key elements are critical when working with the Under 15 AAC 20 form. These include:

- Identification of the parties involved.

- Clear descriptions of the purpose of the form.

- Accurate dates and signatures.

- Any required supporting documentation.

Ensuring these elements are present and correctly filled out can significantly impact the form's acceptance and processing.

Form Submission Methods (Online / Mail / In-Person)

The Under 15 AAC 20 form can typically be submitted through various methods, depending on the requirements of the issuing agency. Common submission methods include:

- Online submission via the agency's official website.

- Mailing the completed form to the designated address.

- In-person submission at the relevant office or agency.

Choosing the appropriate method can affect processing times and the overall efficiency of your submission.

Quick guide on how to complete under 15 aac 20

Complete Under 15 AAC 20 effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Under 15 AAC 20 across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and eSign Under 15 AAC 20 effortlessly

- Locate Under 15 AAC 20 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Shade relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all your information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, exhaustive form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Under 15 AAC 20 while ensuring clear communication at every stage of the document preparation pipeline with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct under 15 aac 20

Create this form in 5 minutes!

How to create an eSignature for the under 15 aac 20

How to create an electronic signature for the Under 15 Aac 20 online

How to make an eSignature for your Under 15 Aac 20 in Chrome

How to make an electronic signature for signing the Under 15 Aac 20 in Gmail

How to create an electronic signature for the Under 15 Aac 20 straight from your smart phone

How to generate an eSignature for the Under 15 Aac 20 on iOS devices

How to make an eSignature for the Under 15 Aac 20 on Android

People also ask

-

What is Under 15 AAC 20 and how does it relate to eSignatures?

Under 15 AAC 20 refers to specific regulations governing the use of electronic signatures in Alaska. This regulation ensures that eSignatures, such as those provided by airSlate SignNow, are legally binding and compliant with state laws. By using airSlate SignNow, businesses can confidently manage their document signing processes while adhering to Under 15 AAC 20.

-

How does airSlate SignNow ensure compliance with Under 15 AAC 20?

airSlate SignNow is designed to meet various legal requirements, including Under 15 AAC 20. Our platform incorporates secure authentication methods and audit trails, which are essential for compliance. By utilizing airSlate SignNow, businesses can rest assured that their electronic signatures are valid under this regulation.

-

What features does airSlate SignNow offer for Under 15 AAC 20 compliance?

To comply with Under 15 AAC 20, airSlate SignNow provides features such as secure document storage, customizable workflows, and detailed tracking of signature events. These features help ensure that your documents are securely managed and that all signing actions are documented in accordance with the regulations. This makes it easy for businesses to maintain compliance while streamlining their signing processes.

-

Is airSlate SignNow cost-effective for businesses needing Under 15 AAC 20 compliance?

Yes, airSlate SignNow offers a cost-effective solution for businesses that require compliance with Under 15 AAC 20. Our pricing plans are designed to accommodate businesses of all sizes, providing essential features without breaking the bank. Investing in airSlate SignNow not only helps with compliance but also enhances efficiency in document management.

-

Can airSlate SignNow integrate with other tools while maintaining Under 15 AAC 20 compliance?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, all while ensuring compliance with Under 15 AAC 20. Whether you're using CRM systems, document management software, or other platforms, our integrations help streamline your workflow without compromising on security or compliance.

-

What are the benefits of using airSlate SignNow for businesses in Alaska under Under 15 AAC 20?

Using airSlate SignNow for businesses in Alaska enables efficient document signing while ensuring compliance with Under 15 AAC 20. The platform's user-friendly interface allows for quick adoption and increased productivity. Additionally, businesses can enjoy reduced turnaround times and improved customer satisfaction through our reliable eSignature solution.

-

How can I get started with airSlate SignNow to comply with Under 15 AAC 20?

Getting started with airSlate SignNow is simple! Sign up for a free trial on our website, where you can explore the features tailored for compliance with Under 15 AAC 20. Our onboarding resources and customer support are available to help you set up your account and start sending documents securely.

Get more for Under 15 AAC 20

Find out other Under 15 AAC 20

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now