Www Fill IoForm 202General InformationFillable Form 202General Information Certificate of 2021-2026

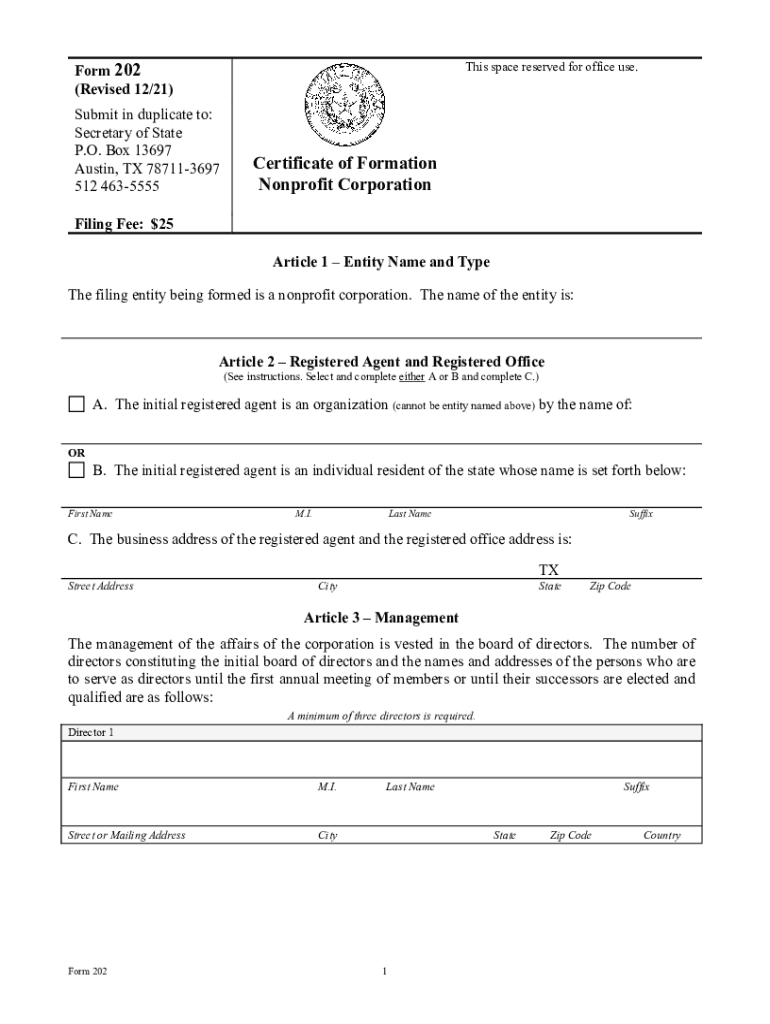

What is Form 202?

Form 202 is a crucial document used for the formation of nonprofit corporations in Texas. This form is essential for organizations seeking to establish themselves as nonprofit entities within the state. By completing and filing this form, organizations can gain legal recognition and operate under the protections and benefits afforded to nonprofit corporations.

Steps to Complete Form 202

Completing Form 202 requires careful attention to detail to ensure compliance with state regulations. Here are the steps to follow:

- Gather necessary information about your nonprofit, including its name, purpose, and the names and addresses of the initial directors.

- Ensure that the proposed name of the nonprofit complies with Texas naming requirements and is not already in use.

- Complete the form with accurate and complete information, including the nonprofit's mission and any specific provisions required by Texas law.

- Review the completed form for accuracy before submission.

- Submit the form to the Texas Secretary of State, either online or by mail, along with the required filing fee.

Legal Use of Form 202

Form 202 serves as the official application for establishing a nonprofit corporation in Texas. It is legally binding once filed with the appropriate state authorities. This form must be completed in accordance with Texas law to ensure that the nonprofit is recognized as a legal entity. Proper execution of the form allows the organization to operate legally, apply for tax-exempt status, and receive grants and donations.

Required Documents for Form 202

When filing Form 202, several supporting documents may be required to complete the application process. These documents typically include:

- Articles of Incorporation, which outline the nonprofit's purpose and structure.

- Bylaws that govern the internal management of the organization.

- Names and addresses of the initial directors and officers.

- Any additional documents required by the Texas Secretary of State.

Form Submission Methods

Form 202 can be submitted through various methods, providing flexibility for organizations. The submission methods include:

- Online submission through the Texas Secretary of State's website, which is often the fastest option.

- Mailing a physical copy of the form along with payment to the appropriate office.

- In-person submission at the Texas Secretary of State's office for those who prefer direct interaction.

Filing Deadlines and Important Dates

Understanding the filing deadlines for Form 202 is essential for nonprofit organizations. While there is no specific deadline for submitting Form 202, it is advisable to file as soon as possible to avoid delays in obtaining legal status. Organizations should also be aware of any deadlines related to tax-exempt status applications, which may have specific timeframes to adhere to.

Quick guide on how to complete wwwfillioform 202general informationfillable form 202general information certificate of

Prepare Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of on any device with airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of with ease

- Locate Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwfillioform 202general informationfillable form 202general information certificate of

Create this form in 5 minutes!

How to create an eSignature for the wwwfillioform 202general informationfillable form 202general information certificate of

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

How to make an e-signature for a PDF on Android

People also ask

-

What is form 202 and how does it work with airSlate SignNow?

Form 202 is a document template that can be utilized within airSlate SignNow for efficient electronic signing and management. Users can create, customize, and send form 202 for signatures, streamlining their workflow and ensuring quick turnaround times for important documents.

-

How can airSlate SignNow help me automate my form 202 processes?

airSlate SignNow offers powerful automation features that can optimize your form 202 workflows. By using templates, setting up automated reminders, and integrating with other applications, you can reduce manual tasks and enhance productivity when managing your documents.

-

What are the pricing options for using form 202 with airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to your needs, including options for individual users and businesses. Each plan includes access to key features for managing form 202 and other documents, ensuring you find a solution that fits your budget.

-

What integrations are available for form 202 in airSlate SignNow?

airSlate SignNow seamlessly integrates with numerous platforms such as Salesforce, Google Drive, and Zapier, enhancing the functionality of form 202. These integrations allow users to connect their existing tools and streamline document management processes, improving overall efficiency.

-

What are the main features of airSlate SignNow for handling form 202?

Key features of airSlate SignNow for form 202 include document templates, electronic signatures, advanced security options, and collaboration tools. These functionalities enable users to create and execute form 202 effortlessly while maintaining compliance and document integrity throughout the signing process.

-

Can airSlate SignNow provide tracking for form 202 signatures?

Yes, airSlate SignNow offers real-time tracking for all signatures on form 202. Users can see when documents are viewed, signed, and completed, providing transparency and ensuring that all parties are kept in the loop during the signing process.

-

Is it safe to use airSlate SignNow for signing form 202?

Absolutely, airSlate SignNow prioritizes security with top-notch encryption, authentication methods, and compliance with legal standards. This ensures that your form 202 and other documents are kept safe from unauthorized access while being legally binding.

Get more for Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of

Find out other Www fill ioForm 202General InformationFillable Form 202General Information Certificate Of

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile