Efficiencyvermont Forms

Understanding the Vermont Tax Exemption Certificate

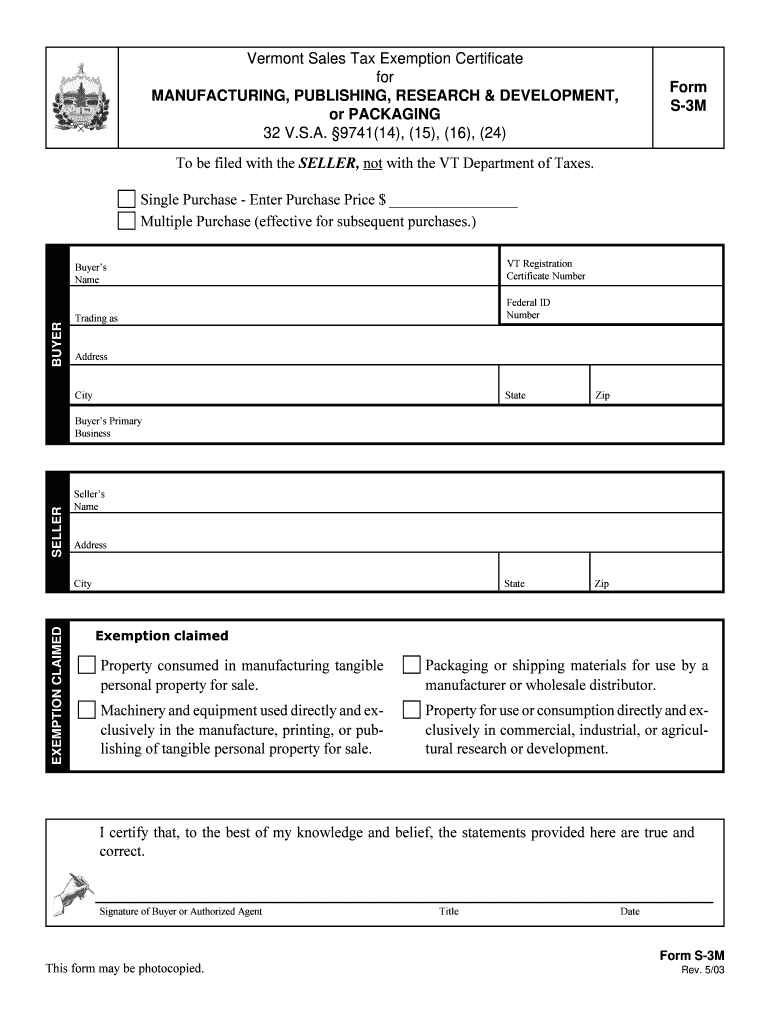

The Vermont tax exemption certificate, often referred to as the VT exemption, is a crucial document for businesses and individuals looking to claim exemptions from sales tax. This certificate allows eligible entities to make tax-exempt purchases for specific purposes, such as resale or certain types of services. Understanding the requirements and implications of this certificate is essential for compliance with Vermont tax laws.

Steps to Complete the Vermont Tax Exemption Form

Completing the Vermont tax exemption form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, the reason for the exemption, and any relevant identification numbers. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, sign it electronically using a secure eSignature solution, which will provide a legally binding signature. Finally, submit the form as required, either online or through traditional methods.

Eligibility Criteria for the Vermont Tax Exemption

To qualify for the Vermont tax exemption, applicants must meet specific eligibility criteria. Generally, businesses must be registered in Vermont and have a valid sales tax permit. Additionally, the purchases made under the exemption must be for resale or for specific exempt purposes outlined by the state. Understanding these criteria is essential to avoid potential penalties for non-compliance.

Legal Use of the Vermont Tax Exemption Certificate

The legal use of the Vermont tax exemption certificate is governed by state tax laws. It is important to use the certificate only for eligible purchases, as misuse can lead to penalties. The certificate must be presented to vendors at the time of purchase, and it is advisable to keep a copy for your records. Compliance with the legal requirements ensures that the exemption remains valid and protects against audits.

Form Submission Methods for the Vermont Tax Exemption

The Vermont tax exemption form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient, allowing for quick processing and confirmation. If submitting by mail, ensure that the form is sent to the correct address and that it is postmarked by any relevant deadlines. In-person submissions may be made at designated state offices, providing an opportunity to ask questions directly if needed.

Key Elements of the Vermont Tax Exemption Form

When filling out the Vermont tax exemption form, several key elements must be included to ensure its validity. These include the name and address of the purchaser, the reason for the exemption, and any applicable identification numbers. Additionally, the form must be signed and dated to confirm the authenticity of the information provided. Each element plays a critical role in the acceptance of the form by vendors and tax authorities.

Quick guide on how to complete efficiencyvermont forms

Effortlessly prepare Efficiencyvermont Forms on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and efficiently. Manage Efficiencyvermont Forms on any device using airSlate SignNow's Android or iOS applications, and enhance your document-related processes today.

The simplest way to modify and eSign Efficiencyvermont Forms effortlessly

- Obtain Efficiencyvermont Forms then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important parts of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Efficiencyvermont Forms and ensure excellent communication at each step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the efficiencyvermont forms

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the vt exemption online process?

The vt exemption online process allows users to submit their exemption requests digitally, streamlining the entire procedure. With airSlate SignNow, businesses can easily manage these documents, ensuring all submissions are accurate and timely. This method increases efficiency and minimizes paperwork.

-

How does airSlate SignNow support vt exemption online submissions?

airSlate SignNow provides a user-friendly platform that simplifies vt exemption online submissions. Our tool enables users to upload necessary documents, fill out forms, and add electronic signatures seamlessly. This integration promotes a hassle-free experience for managing your exemption requests.

-

What are the pricing options for using airSlate SignNow for vt exemption online?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including plans specifically designed for handling vt exemption online requests. You can choose between monthly or annual subscriptions, providing cost-effective solutions regardless of your business size. Check our pricing page for detailed options.

-

Are there any benefits to using airSlate SignNow for vt exemption online?

Absolutely! Using airSlate SignNow for vt exemption online not only saves time but also enhances accuracy in submissions. The platform reduces the risk of errors, ensures compliance with regulations, and keeps your documents securely stored. These benefits streamline your workflow signNowly.

-

Is airSlate SignNow secure for managing vt exemption online documents?

Yes, airSlate SignNow prioritizes the security of your vt exemption online documents with advanced encryption and secure data storage. Our platform complies with industry standards to protect sensitive information. You can trust us to keep your submissions confidential and safe.

-

What features are included in the airSlate SignNow plan for vt exemption online?

Our airSlate SignNow plan for vt exemption online includes robust features like document templates, customizable signing workflows, and real-time tracking. These tools help you efficiently manage exemption requests while ensuring all necessary documentation is in order. Explore our features to enhance your experience.

-

Can I integrate airSlate SignNow with other software for vt exemption online?

Yes, airSlate SignNow supports integrations with various software solutions to simplify the vt exemption online process. You can connect our platform with CRM systems, accounting software, and more to create a seamless workflow. This flexibility allows for better data management and collaboration.

Get more for Efficiencyvermont Forms

Find out other Efficiencyvermont Forms

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF