Form IRS Instructions 8915 D Fill Online, Printable 2021

What is the IRS Instructions 8915 Form?

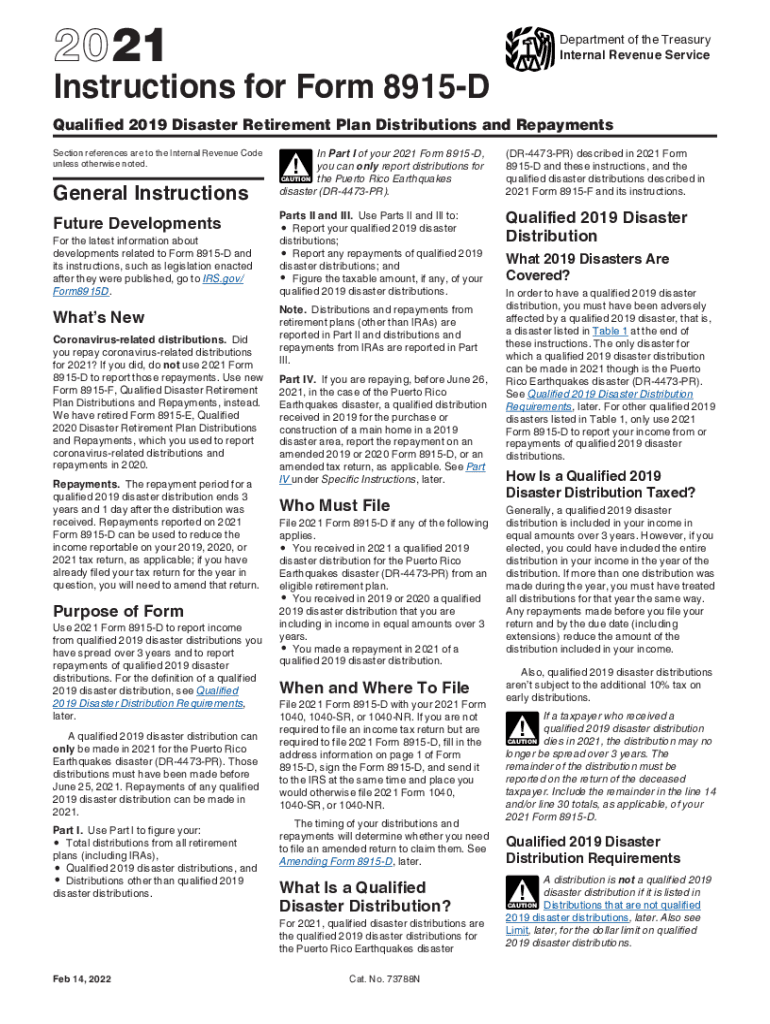

The IRS Instructions 8915 form is a crucial document for individuals who have taken distributions from retirement plans and need to report these transactions accurately. This form specifically addresses the tax implications of qualified plan distributions and repayments. It provides guidance on how to report any distributions received, including those that may be eligible for repayment under specific circumstances. Understanding this form is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

Steps to Complete the IRS Instructions 8915 Form

Completing the IRS Instructions 8915 form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation related to your retirement plan distributions. This may include statements from your plan administrator and any records of repayments made. Next, follow the instructions carefully, filling out each section of the form with the relevant information. Pay special attention to the sections regarding the amounts distributed, any repayments, and the applicable tax implications. Finally, review the completed form for accuracy before submission.

Legal Use of the IRS Instructions 8915 Form

The legal use of the IRS Instructions 8915 form is vital for taxpayers who wish to report their retirement plan distributions correctly. This form ensures that individuals comply with tax laws regarding distributions and repayments. When filled out accurately, it serves as a legal document that can be used to substantiate claims made on tax returns. It is important to adhere to the guidelines provided in the instructions to maintain the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Instructions 8915 form are critical to avoid penalties. Generally, the form must be submitted along with your annual tax return. For most taxpayers, this means filing by April 15 of the following year. However, if you have received an extension for your tax return, ensure that the form is submitted by the extended deadline. Staying informed about these dates helps in maintaining compliance with IRS regulations.

Required Documents

To complete the IRS Instructions 8915 form accurately, you will need several key documents. These include:

- Statements from your retirement plan showing distributions.

- Records of any repayments made to the plan.

- Your previous tax returns, if applicable, for reference.

- Any correspondence from the IRS related to your retirement plan.

Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Eligibility Criteria

Eligibility to use the IRS Instructions 8915 form depends on specific criteria related to your retirement plan distributions. Generally, this form is applicable to individuals who have taken distributions from qualified retirement plans and are considering repayments. It is important to determine whether your distribution qualifies under IRS guidelines, as this will affect your reporting obligations and potential tax liabilities.

Examples of Using the IRS Instructions 8915 Form

There are various scenarios in which the IRS Instructions 8915 form may be utilized. For instance, if an individual has taken a distribution from a 401(k) plan due to financial hardship and later repays that amount, they must report this transaction using the form. Another example includes someone who has received a distribution from an IRA and wishes to repay it to avoid tax penalties. In both cases, accurately completing the form is essential for proper tax reporting and compliance.

Quick guide on how to complete 2019 form irs instructions 8915 d fill online printable

Complete Form IRS Instructions 8915 D Fill Online, Printable with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form IRS Instructions 8915 D Fill Online, Printable on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form IRS Instructions 8915 D Fill Online, Printable effortlessly

- Obtain Form IRS Instructions 8915 D Fill Online, Printable and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form IRS Instructions 8915 D Fill Online, Printable and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form irs instructions 8915 d fill online printable

Create this form in 5 minutes!

How to create an eSignature for the 2019 form irs instructions 8915 d fill online printable

How to create an e-signature for your PDF file in the online mode

How to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

What is the IRS Instructions 8915 form and why do I need it?

The IRS Instructions 8915 form is used for reporting qualified disaster distributions and repayments. Understanding this form is crucial for businesses and individuals affected by disasters, as it helps ensure compliance with tax regulations. Utilizing the IRS Instructions 8915 form correctly can prevent penalties and facilitate easier filing.

-

How can airSlate SignNow assist with completing the IRS Instructions 8915 form?

airSlate SignNow simplifies the process of completing the IRS Instructions 8915 form by providing an intuitive eSignature platform where users can easily fill out and submit their documents. Our solution allows you to securely manage and store forms and ensure all required fields are completed accurately. With airSlate SignNow, you can focus more on compliance and less on paperwork.

-

Is there a cost associated with using airSlate SignNow for IRS Instructions 8915 form processing?

Yes, airSlate SignNow operates on a subscription pricing model that provides different tiers based on features and usage. Our pricing is designed to be cost-effective, giving you access to essential features while ensuring you can easily manage your IRS Instructions 8915 form and other documents. You can choose a plan that best suits your needs without breaking the bank.

-

Are there any integrations available with airSlate SignNow for handling the IRS Instructions 8915 form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications and tools that can help you manage your IRS Instructions 8915 form efficiently. Whether you're using CRM systems, accounting software, or document management tools, our integrations streamline the workflow and enhance productivity.

-

What features does airSlate SignNow provide for eSigning the IRS Instructions 8915 form?

airSlate SignNow provides various features for eSigning the IRS Instructions 8915 form, including customizable templates, secure electronic signatures, and real-time tracking. Our platform ensures your documents are signed quickly and securely, allowing you to stay compliant while saving time. With a user-friendly interface, you can effortlessly eSign forms from any device.

-

Can I use airSlate SignNow for collaborative editing of the IRS Instructions 8915 form?

Yes, airSlate SignNow supports collaborative editing, allowing multiple users to work on the IRS Instructions 8915 form simultaneously. This feature is particularly useful for teams needing input from several stakeholders. Collaboration promotes faster completion times and ensures all necessary information is included.

-

How secure is airSlate SignNow for handling sensitive documents like the IRS Instructions 8915 form?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and comply with stringent regulations to protect your sensitive documents, including the IRS Instructions 8915 form. You can rest assured that your data is safe from unauthorized access while using our platform.

Get more for Form IRS Instructions 8915 D Fill Online, Printable

- Creek nation citizenship application form

- The willed body program form

- Wwwpdffillercom539775281 breast order formfillable online breast order form name phone fax bold are

- Memorialhermannorg mediabreast order form physician name information print phone

- Preoperative day of surgery orders spotidoccom form

- Laser hair removal consent form

- Medical director contract form

- Aba model diversity survey form

Find out other Form IRS Instructions 8915 D Fill Online, Printable

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed