Irs Instructions 8915 Form 2019

What is the IRS Instructions 8915 Form

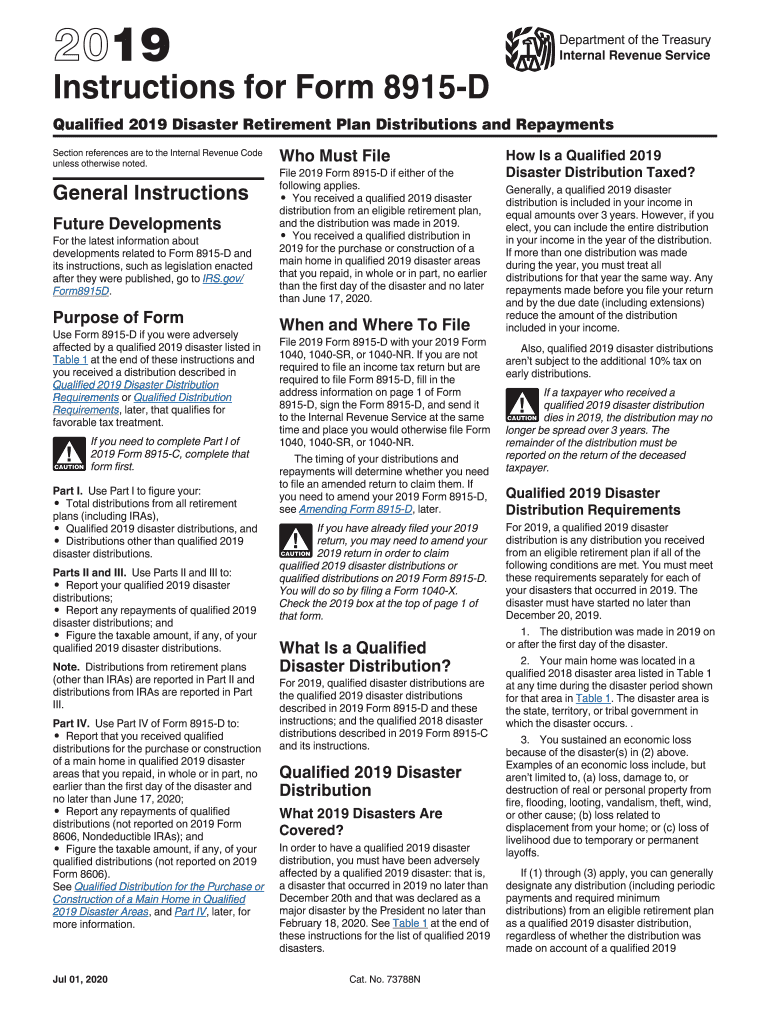

The IRS Instructions 8915 form is a crucial document used by taxpayers to report disaster-related distributions from retirement plans. This form provides guidance on how to accurately report these distributions, which may be subject to special tax treatment. Understanding the instructions is essential for ensuring compliance with IRS regulations and for maximizing available tax benefits related to disaster distributions.

Steps to Complete the IRS Instructions 8915 Form

Completing the IRS Instructions 8915 form involves several key steps:

- Gather relevant documentation, including your retirement plan information and details about the disaster.

- Carefully read the instructions to understand eligibility criteria and reporting requirements.

- Fill out the form accurately, ensuring all required fields are completed.

- Review your entries for accuracy before submission to avoid potential penalties.

Legal Use of the IRS Instructions 8915 Form

The IRS Instructions 8915 form is legally binding when completed and submitted according to IRS guidelines. It is important to follow the instructions carefully, as any discrepancies or inaccuracies may lead to penalties. The form is designed to ensure that taxpayers can take advantage of tax relief provisions related to disaster distributions, provided they meet the necessary criteria.

Filing Deadlines / Important Dates

Timely filing of the IRS Instructions 8915 form is essential to avoid penalties. The deadlines typically align with the tax filing season. For most taxpayers, the form must be submitted by April 15 of the following tax year. However, extensions may be available, and it is advisable to check the IRS website for any updates regarding specific deadlines related to disaster relief.

Examples of Using the IRS Instructions 8915 Form

There are various scenarios in which the IRS Instructions 8915 form may be utilized. For instance:

- A taxpayer who withdrew funds from their 401(k) due to a federally declared disaster would use this form to report the distribution.

- Individuals affected by natural disasters, such as hurricanes or wildfires, may qualify for special tax treatment when reporting their distributions.

Required Documents

To complete the IRS Instructions 8915 form, certain documents are required:

- Retirement account statements showing distributions taken.

- Documentation proving the occurrence of a disaster, such as FEMA declarations.

- Any previous tax returns that may affect the reporting of the distribution.

Who Issues the Form

The IRS Instructions 8915 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides the guidelines and regulations necessary for taxpayers to correctly report their disaster-related distributions, ensuring compliance with federal tax laws.

Quick guide on how to complete irs instructions 8915 form

Prepare Irs Instructions 8915 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Manage Irs Instructions 8915 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Irs Instructions 8915 Form without stress

- Locate Irs Instructions 8915 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Irs Instructions 8915 Form to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs instructions 8915 form

Create this form in 5 minutes!

How to create an eSignature for the irs instructions 8915 form

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What are the instructions 8915 for using airSlate SignNow?

The instructions 8915 for using airSlate SignNow involve a simple process to send and eSign documents. Begin by creating an account, uploading your documents, and following the step-by-step prompts to add signers. The platform is designed to be intuitive, ensuring you can easily manage your documents.

-

How does airSlate SignNow ensure the security of documents signed following instructions 8915?

AirSlate SignNow takes document security seriously, especially when adhering to instructions 8915. The platform utilizes encryption technology, secure servers, and ensures compliance with legal standards to protect your sensitive information. You can trust that your documents are safe throughout the signing process.

-

What pricing options are available for airSlate SignNow following instructions 8915?

Pricing for airSlate SignNow is flexible and starts at an affordable rate for small businesses. Following instructions 8915, you can choose from several plans that fit different business sizes and needs, ensuring you get the most value for your investment. Each plan offers features tailored to enhance your document signing experience.

-

What features does airSlate SignNow provide according to the instructions 8915?

According to instructions 8915, airSlate SignNow provides a wide range of features including seamless electronic signatures, document templates, and real-time tracking. These tools simplify the signing process, enhance productivity, and save time for your organization. Additionally, users can integrate with popular applications to streamline workflows.

-

How can businesses benefit from following instructions 8915 with airSlate SignNow?

Businesses that follow instructions 8915 can expect several benefits from using airSlate SignNow. The platform enhances efficiency by allowing quick document turnaround, reduces costs associated with printing and mailing, and provides a reliable way to manage document workflows. Overall, it fosters a more agile and productive work environment.

-

Does airSlate SignNow integrate with other software as per instructions 8915?

Yes, airSlate SignNow integrates seamlessly with various software applications, as indicated in instructions 8915. This includes popular tools like Google Drive, Salesforce, and Zapier. Such integrations allow businesses to streamline their processes and maintain a cohesive workflow across different platforms.

-

What types of documents can be signed using airSlate SignNow as per instructions 8915?

As per instructions 8915, airSlate SignNow supports a variety of document types that can be eSigned including contracts, agreements, and forms. This versatility enables businesses to manage all their signing needs in one place. The platform also allows for customization to meet specific requirements for different document types.

Get more for Irs Instructions 8915 Form

- 4th grade math test with answer key pdf form

- List of sss employer id number in the philippines form

- Ethiopian immigration office form

- Mobility allowance form

- Difnution tlphone form

- Kaiser application form

- Annexure h for passport form

- De 120pa attachment to notice of hearing proof of personal service probate decedents estates and guardianships and form

Find out other Irs Instructions 8915 Form

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document