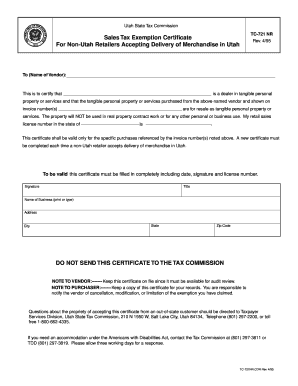

TC 721NR 1995

What is the TC 721NR

The TC 721NR is a specific form used primarily in the context of tax reporting and compliance in the United States. This form is essential for individuals and businesses to accurately report certain financial information to the appropriate tax authorities. Understanding the purpose of the TC 721NR is crucial for ensuring compliance with federal and state tax regulations. It typically involves the declaration of income, deductions, and other relevant financial data that may impact tax liabilities.

How to use the TC 721NR

Using the TC 721NR involves several key steps that ensure accurate completion and submission. First, gather all necessary financial documents and information that pertain to the reporting period. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is advisable to review the form for any errors before submission. Once completed, the TC 721NR can be submitted electronically or via traditional mail, depending on the requirements set by the tax authority.

Steps to complete the TC 721NR

Completing the TC 721NR requires a systematic approach. Begin by downloading the form from the official tax authority website. Fill in your personal information, including your name, address, and taxpayer identification number. Next, provide the financial details required, such as income sources and deductions. After entering all necessary information, double-check for accuracy. Finally, sign and date the form before submitting it according to the specified guidelines.

Legal use of the TC 721NR

The TC 721NR must be used in compliance with all applicable laws and regulations. This includes adhering to guidelines set forth by the Internal Revenue Service (IRS) and state tax agencies. The form serves as a legal document, and any inaccuracies or omissions can lead to penalties or audits. Therefore, it is essential to ensure that all information is truthful and complete to maintain legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the TC 721NR are critical for compliance. Typically, the form must be submitted by a specific date that aligns with the tax reporting period. It is important to stay informed about these deadlines to avoid late fees or penalties. Mark your calendar with the relevant dates, and consider setting reminders to ensure timely submission.

Who Issues the Form

The TC 721NR is issued by the relevant tax authority, which is typically the Internal Revenue Service (IRS) at the federal level. State tax agencies may also have their own versions or requirements related to this form. Understanding which authority issues the TC 721NR is important for ensuring that you are using the correct form and following the appropriate guidelines for submission.

Quick guide on how to complete tc 721nr

Complete TC 721NR effortlessly on any device

Digital document management has become favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage TC 721NR on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign TC 721NR with ease

- Obtain TC 721NR and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you would prefer to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign TC 721NR and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 721nr

Create this form in 5 minutes!

How to create an eSignature for the tc 721nr

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What is TC 721NR and how does it relate to airSlate SignNow?

TC 721NR refers to a specific compliance form that is essential for businesses utilizing electronic signatures. airSlate SignNow ensures that your eSigning processes are compliant with TC 721NR regulations, providing a seamless experience for users.

-

What are the key features of airSlate SignNow for TC 721NR compliance?

AirSlate SignNow offers robust features such as a user-friendly interface, customizable templates, and advanced security options specifically designed for TC 721NR compliance. These features help streamline your document management while ensuring adherence to legal standards.

-

How does airSlate SignNow ensure the security of documents related to TC 721NR?

Security is paramount when it comes to TC 721NR documents. AirSlate SignNow implements advanced encryption, multi-factor authentication, and secure storage to protect sensitive information throughout the signing process.

-

Is airSlate SignNow cost-effective for businesses handling TC 721NR?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes dealing with TC 721NR documentation. This cost-effective solution allows organizations to manage their eSignature needs without compromising on quality or compliance.

-

Can I integrate airSlate SignNow with other tools for TC 721NR management?

Absolutely! AirSlate SignNow integrates seamlessly with various business software solutions, enhancing your TC 721NR management process. This ensures that you can work efficiently by connecting your existing tools with our eSigning platform.

-

What benefits does airSlate SignNow provide for managing TC 721NR documents?

By using airSlate SignNow for TC 721NR documents, businesses can increase efficiency, reduce paper usage, and improve turnaround times on critical agreements. The platform streamlines the signing process, making it easier for teams to stay compliant and productive.

-

How user-friendly is airSlate SignNow for businesses dealing with TC 721NR?

AirSlate SignNow is designed with user experience in mind, making it incredibly user-friendly for managing TC 721NR documentation. Whether you are tech-savvy or a beginner, our intuitive interface helps you navigate the eSigning process with ease.

Get more for TC 721NR

- N d bhatt engineering drawing book solutions pdf download form

- Standard industrialcommercial single tenant lease gross form

- Non commercial invoice form

- Esic form 18 for maternity leave download pdf

- Lifeline program application form

- Vehicle registration new registrations form

- Application to make deposit or redeposit civil service form

- Motor vehicle transporter license plates application form

Find out other TC 721NR

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application