Non Commercial Invoice 2018

What is the Non Commercial Invoice

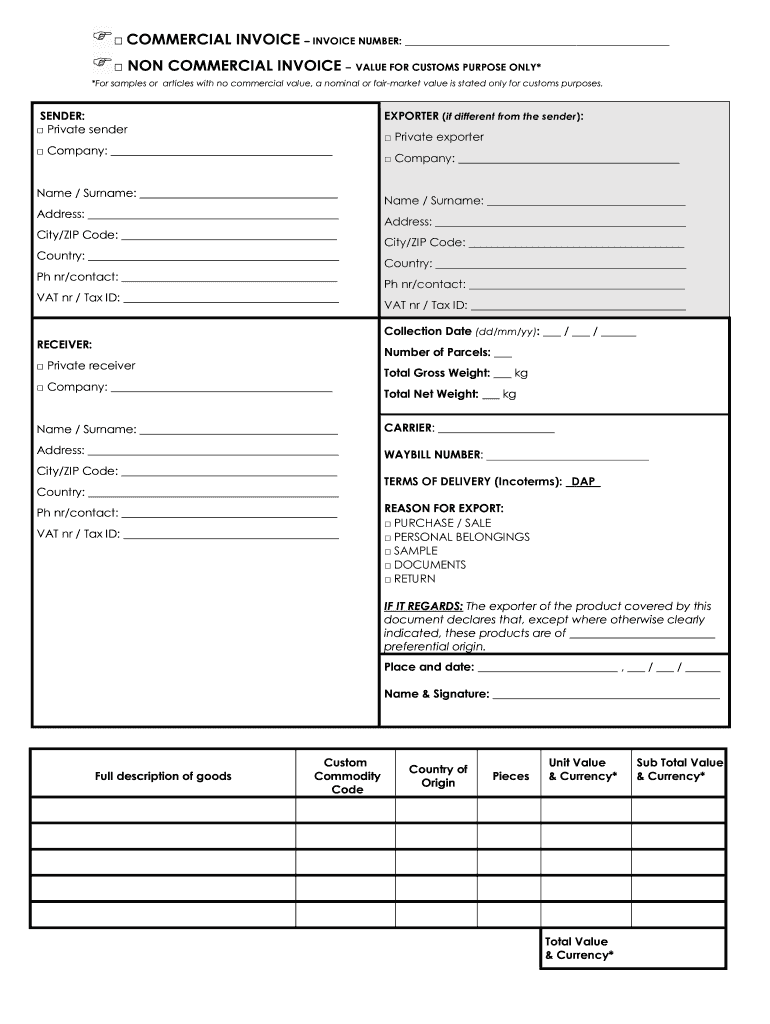

The non commercial invoice is a document used primarily for international shipments to declare the value of goods that are not intended for sale. It serves as a declaration to customs authorities, providing essential information about the items being shipped. This invoice is crucial for determining duties and taxes, even when the goods are not sold. It typically includes details such as the sender and recipient's information, a description of the goods, their value, and the reason for shipment. Understanding the non commercial invoice meaning is vital for businesses and individuals engaged in cross-border transactions.

Key Elements of the Non Commercial Invoice

When preparing a non commercial invoice, certain key elements must be included to ensure compliance and clarity. These elements typically consist of:

- Sender and Recipient Information: Names, addresses, and contact details of both parties.

- Description of Goods: A detailed account of the items being shipped, including quantity and type.

- Value of Goods: The declared value, which is essential for customs purposes.

- Reason for Shipment: A brief explanation of why the goods are being sent, such as a gift, personal use, or samples.

- Signature: The sender's signature may be required to validate the document.

Including these elements helps ensure that the non commercial invoice is accepted by customs and that the shipment proceeds smoothly.

Steps to Complete the Non Commercial Invoice

Completing the non commercial invoice involves several straightforward steps. Follow these guidelines to ensure accuracy:

- Gather Information: Collect all necessary details about the sender, recipient, and items being shipped.

- Fill Out the Invoice: Use a non commercial invoice template to enter the gathered information accurately.

- Declare the Value: Clearly state the value of the goods, ensuring it reflects their true worth.

- Specify the Reason: Indicate why the goods are being sent to avoid confusion with customs.

- Review and Sign: Double-check all entries for accuracy, then sign the invoice to validate it.

Following these steps will help ensure that your non commercial invoice is completed correctly and is ready for submission.

Legal Use of the Non Commercial Invoice

The non commercial invoice is not just a formality; it has legal implications in international shipping. It must comply with various regulations set forth by customs authorities. In the United States, the non commercial invoice must adhere to the guidelines established by the U.S. Customs and Border Protection (CBP). Proper use of this invoice can prevent legal issues, such as fines or delays in shipment. It is important to ensure that the information provided is accurate and truthful, as discrepancies can lead to complications during customs clearance.

Examples of Using the Non Commercial Invoice

There are various scenarios where a non commercial invoice is applicable. Some common examples include:

- Gifts: When sending personal gifts to friends or family overseas, a non commercial invoice is necessary to declare the value.

- Samples: Businesses may send product samples to potential clients, requiring this invoice to explain the shipment's purpose.

- Personal Use Items: Individuals moving abroad may need to declare personal belongings that are not for sale.

These examples illustrate the versatility of the non commercial invoice in various shipping contexts.

How to Obtain the Non Commercial Invoice

Obtaining a non commercial invoice can be done through several methods. Many businesses opt to use a non commercial invoice template, which can be easily downloaded online. These templates are designed to meet the requirements set by customs authorities and can be customized with specific details. Alternatively, businesses can create their own invoices using word processing or spreadsheet software, ensuring all necessary elements are included. It is essential to ensure that the invoice format complies with legal standards to avoid issues during shipping.

Quick guide on how to complete non commercial invoice

Accomplish Non Commercial Invoice seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Non Commercial Invoice across any platform with airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The easiest method to alter and eSign Non Commercial Invoice effortlessly

- Obtain Non Commercial Invoice and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or link invitation, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Non Commercial Invoice to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non commercial invoice

Create this form in 5 minutes!

How to create an eSignature for the non commercial invoice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non commercial invoice, and how is it used?

A non commercial invoice is a document that outlines the details of a sale or transaction that does not involve actual sale of goods, typically used for shipping or customs purposes. This type of invoice ensures that potential import duties and taxes are handled appropriately. Using airSlate SignNow, you can easily create and eSign non commercial invoices to facilitate smooth international shipping.

-

How can airSlate SignNow help me manage non commercial invoices?

airSlate SignNow offers an intuitive platform for generating, managing, and eSigning non commercial invoices quickly and efficiently. With customizable templates, you can create your invoices in minutes, ensuring they meet all necessary requirements for international shipping. Our solution allows you to streamline your invoicing processes while saving time and reducing errors.

-

Are there any costs associated with using airSlate SignNow for non commercial invoices?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs. You can choose from monthly or annual subscriptions, which grants access to features that make managing non commercial invoices easier. The value provided through our platform signNowly outweighs the cost, especially for businesses that frequently deal with international shipments.

-

Can I integrate airSlate SignNow with other tools for handling non commercial invoices?

Absolutely! airSlate SignNow supports integrations with various business tools, ensuring that you can streamline your workflow when managing non commercial invoices. Whether you use CRM systems or accounting software, our platform can connect seamlessly, allowing you to automate document workflows and enhance productivity.

-

Why should I choose airSlate SignNow for my non commercial invoices over other solutions?

Choosing airSlate SignNow for your non commercial invoices means opting for a user-friendly, cost-effective solution that prioritizes efficiency. Our platform combines essential features such as eSigning, document management, and templates tailored for non commercial invoices, within a single interface. This makes it easier for businesses to manage their transactions without the hassles of traditional invoicing methods.

-

What features does airSlate SignNow offer specifically for non commercial invoices?

airSlate SignNow offers features tailored for non commercial invoices, including customizable templates, eSignature capabilities, and document tracking. You can create invoices that meet specific customs requirements and quickly obtain signatures from necessary parties. These features make it easier to maintain compliance and manage your invoicing processes.

-

Is it safe to use airSlate SignNow for sending non commercial invoices?

Yes, it is very safe to use airSlate SignNow for sending non commercial invoices. We employ industry-standard security measures, including encryption and secure access protocols, to protect your sensitive information. Your peace of mind is our priority, ensuring that all your documents, including non commercial invoices, are securely handled.

Get more for Non Commercial Invoice

- Medicare part b patient intake form

- Wwwuslegalformscomform library490916 acclaimacclaim dermatology intake form us legal forms

- Patient enrollment form medexpress pharmacy

- Have you had a professional massage before form

- Oncology referral form new patient existing

- History form primary care mayo clinic health system

- Wwwsutterhealthorgpdffor patientssutter medical center sacramento and sutter sutter health form

- Download imaging patient form southern hills medical center

Find out other Non Commercial Invoice

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online