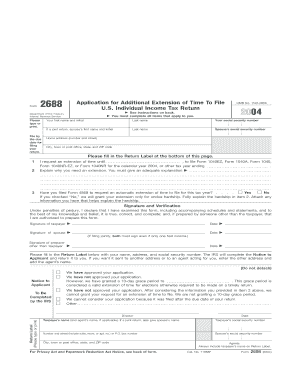

Form 2688 Application for Additional Extension of Time to File U S Individual Income Tax Return 2004-2026

What is the Form 2688 Application for Additional Extension of Time to File U.S. Individual Income Tax Return

The Form 2688 is an official document issued by the Internal Revenue Service (IRS) that allows taxpayers to request an additional extension of time to file their U.S. individual income tax return. This form is particularly useful for individuals who may need more time beyond the standard extension period to gather necessary documents or complete their tax returns accurately. Filing this application does not extend the time to pay any taxes owed; it solely extends the filing deadline.

Steps to Complete the Form 2688 Application for Additional Extension of Time to File U.S. Individual Income Tax Return

Completing the Form 2688 involves several straightforward steps:

- Obtain the Form: The form can be accessed directly from the IRS website or through tax software that supports IRS forms.

- Provide Personal Information: Fill in your name, address, and Social Security number. Ensure that all information is accurate to avoid processing delays.

- Specify the Reason for Extension: Indicate why you are requesting additional time. Common reasons include needing more time to gather documentation or personal circumstances.

- Sign and Date the Form: Your signature certifies that the information provided is true and correct. Make sure to date the form appropriately.

- Submit the Form: Follow the submission guidelines for either online or mail submission, ensuring it is sent before the original filing deadline.

IRS Guidelines for Filing the Form 2688

The IRS has specific guidelines regarding the use of Form 2688. It is essential to file the form before the original due date of your tax return. The IRS typically grants an additional six months to file, but this does not affect the deadline for any tax payments. If you owe taxes, it is advisable to pay as much as possible by the original due date to avoid penalties and interest.

Eligibility Criteria for the Form 2688 Application

To be eligible to file Form 2688, taxpayers must meet certain criteria:

- The taxpayer must be an individual filing a U.S. individual income tax return.

- The request for an extension must be made prior to the original due date of the tax return.

- The taxpayer must have a valid reason for requesting additional time, which should be clearly stated on the form.

Form Submission Methods for Form 2688

Taxpayers can submit Form 2688 through various methods:

- Online Submission: Some tax software allows for electronic filing of Form 2688, which is often the quickest method.

- Mail: If filing by mail, send the completed form to the address specified in the IRS instructions for the form.

- In-Person: Taxpayers may also visit local IRS offices to submit the form directly, though this is less common.

Filing Deadlines for Form 2688

It is crucial to be aware of the filing deadlines associated with Form 2688. The application must be submitted before the original due date of the tax return, which is typically April 15 for most taxpayers. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these deadlines helps ensure compliance and avoids penalties.

Quick guide on how to complete form 2688 application for additional extension of time to file us individual income tax return

Prepare Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without any hold-ups. Handle Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return without hassle

- Find Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that function.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you would prefer to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you choose. Edit and eSign Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2688 application for additional extension of time to file us individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 2688 application for additional extension of time to file us individual income tax return

The best way to make an e-signature for a PDF file in the online mode

The best way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the process to IRS file tax return using airSlate SignNow?

To IRS file tax return with airSlate SignNow, simply upload your tax documents, add necessary signatures, and send them securely. The platform allows you to manage all your tax-related documents in one place. With an intuitive interface, you can complete the IRS file tax return process quickly and efficiently.

-

How does airSlate SignNow ensure the security of my IRS file tax return?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and authentication protocols. Your IRS file tax return is protected against unauthorized access, ensuring sensitive information remains confidential. With a secure cloud storage solution, you can have peace of mind when managing your tax documents.

-

Are there any costs associated with using airSlate SignNow for IRS file tax return?

airSlate SignNow offers competitive pricing plans that cater to different user needs, making it cost-effective for IRS file tax return. Plans include features tailored to simplify document signing and management. Explore our subscription models to find the best fit for your business at an affordable rate.

-

What features does airSlate SignNow offer for managing IRS file tax return?

airSlate SignNow comes equipped with powerful features such as document templates, in-app chat, and collaborative signing for IRS file tax return. You can customize workflows to suit your business needs and automate reminders for document completion. This saves you time and streamlines the entire tax return process.

-

Can I integrate airSlate SignNow with other software for IRS file tax return?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software, allowing you to efficiently handle your IRS file tax return. This connectivity enables better workflow management and document sharing across platforms. Our integration options are designed to enhance your productivity and simplify the tax filing process.

-

Is airSlate SignNow user-friendly for IRS file tax return processes?

Absolutely! airSlate SignNow is designed for ease of use, so you don't need to be tech-savvy to IRS file tax return. The platform features an intuitive interface that guides users through uploading, signing, and sending documents without any hassle. Our aim is to make tax filing as straightforward as possible.

-

What types of documents can I manage for IRS file tax return with airSlate SignNow?

You can manage a variety of documents necessary for IRS file tax return using airSlate SignNow, including W-2s, 1099s, and other tax-related forms. With the platform's versatile document handling capabilities, you can easily upload, share, and sign your tax documents. This versatility makes it an essential tool for tax professionals and businesses alike.

Get more for Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return

- Authorization letter to withdraw money from bdo form

- Louis armstrong worksheet pdf form

- Car wash employment contract form

- Neck disability index spanish pdf form

- Indemnity form

- Pp 412 conservators report rev 9 12 19 pdf maine form

- Court excuse for work form

- Affidavit responding to changing child support alberta courts form

Find out other Form 2688 Application For Additional Extension Of Time To File U S Individual Income Tax Return

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast