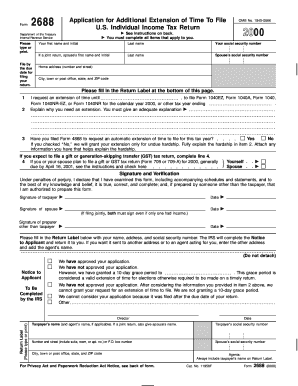

Irs Income Tax Return Form 2000

What is the IRS Income Tax Return Form

The IRS income tax return form is a crucial document that individuals and businesses use to report their income, calculate their tax liability, and determine if they owe additional taxes or are entitled to a refund. This form is submitted annually to the Internal Revenue Service (IRS) and serves as a comprehensive summary of a taxpayer's financial activities over the year. The most common form for individuals is the Form 1040, which allows for various income types, deductions, and credits to be reported. Understanding the purpose and structure of this form is essential for accurate tax reporting and compliance with federal regulations.

Steps to Complete the IRS Income Tax Return Form

Completing the IRS income tax return form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, choose the appropriate form based on your filing status and income level. For most individuals, the Form 1040 is suitable. Fill out the form by entering your personal information, income details, and applicable deductions. After completing the form, review all entries for accuracy, and ensure that you have included all required signatures. Finally, submit the form either electronically or by mail, depending on your preference and the specific instructions provided by the IRS.

Legal Use of the IRS Income Tax Return Form

The IRS income tax return form is legally binding, meaning that the information provided must be accurate and truthful. Filing this form is a legal requirement for most individuals and entities that earn income in the United States. Failure to file or providing false information can result in penalties, including fines and interest on unpaid taxes. It is essential to understand that the IRS has the authority to audit tax returns and may request additional documentation to verify the accuracy of the information reported. Therefore, utilizing reliable tools and resources, such as e-signature solutions, can help ensure compliance and facilitate the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the IRS income tax return form are critical to avoid penalties and interest. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need more time can file for an extension, which allows an additional six months to submit their return. However, it is important to note that an extension to file does not extend the deadline for payment of any taxes owed. Therefore, taxpayers should estimate their tax liability and pay any amount due by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS income tax return form can be submitted through various methods, providing flexibility for taxpayers. The most efficient way to file is electronically, using IRS-approved e-filing software, which allows for quicker processing and potential faster refunds. Alternatively, taxpayers can print and mail their completed forms to the appropriate IRS address based on their location and the type of return being filed. In-person submission is also an option at designated IRS offices, although appointments may be required. Regardless of the method chosen, ensuring that the form is submitted by the deadline is essential for compliance.

Required Documents

To accurately complete the IRS income tax return form, certain documents are necessary. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of other income sources. Additionally, taxpayers should gather documentation for deductions and credits, such as mortgage interest statements, student loan interest payments, and receipts for charitable contributions. Keeping organized records throughout the year can simplify the process of gathering these documents when it is time to file. Having all required information at hand ensures a smoother and more accurate filing experience.

Quick guide on how to complete irs income tax return form

Complete Irs Income Tax Return Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Irs Income Tax Return Form on any device with the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

How to alter and eSign Irs Income Tax Return Form with ease

- Locate Irs Income Tax Return Form and click Get Form to begin.

- Leverage the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Income Tax Return Form to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs income tax return form

Create this form in 5 minutes!

How to create an eSignature for the irs income tax return form

How to make an e-signature for a PDF in the online mode

How to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The best way to create an e-signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow, and how does it relate to the treasury internal revenue service?

airSlate SignNow is an eSignature platform that allows businesses to send and sign documents electronically. It supports compliance with regulations set forth by the treasury internal revenue service, ensuring that your digital signatures are legally binding and secure.

-

How can airSlate SignNow help me with treasury internal revenue service documentation?

With airSlate SignNow, you can easily prepare, send, and manage documents required by the treasury internal revenue service. This includes forms like W-2s and 1099s, which can be signed electronically, saving time and reducing paperwork errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need a basic plan for small tasks or a comprehensive plan for large teams handling treasury internal revenue service forms, there is an option that fits your needs.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital signing?

Yes, airSlate SignNow is designed with an intuitive interface that allows users of all experience levels to navigate easily. Even if you're not familiar with electronic signatures, you'll find it simple to send and manage documents for the treasury internal revenue service.

-

Does airSlate SignNow integrate with other software I use for treasury internal revenue service tasks?

Absolutely! airSlate SignNow offers integrations with various tools like CRM systems and document management software, making it easier to incorporate into your existing workflow. This is particularly useful for organizations dealing with treasury internal revenue service requirements.

-

What security features does airSlate SignNow provide to comply with treasury internal revenue service standards?

airSlate SignNow employs robust security measures including data encryption and secure cloud storage to protect your documents. These features ensure that your dealings, especially those involving the treasury internal revenue service, meet industry security standards.

-

Can airSlate SignNow help track the status of documents submitted to the treasury internal revenue service?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your sent documents. This capability is essential for keeping tabs on submissions related to the treasury internal revenue service, ensuring they are signed and processed promptly.

Get more for Irs Income Tax Return Form

- Wwwuslegalformscomform library535801 20212021 live freshwater bait fish license application cagov

- Www1mainegov revenue sitesform maine w 4me employees withholding allowance certi cate

- Michigan treasury onlinetax form search treas securestatemiustreasury treasury state of michigantax form search treas

- Fmcsa form op 1 federal motor carrier safety administration

- Fillable michigan department of treasury 518 rev 02 18 kallasleo michigan business tax registration online ampamp form

- Massachusetts department of revenue form m 1310 statementmassachusetts department of revenue form m 1310 statementwhat is irs

- Wwwbattlecreekpublicschoolsorgdownloadspo box 30171 lansing mi 48909 7671 tax deferred payment form

- Motor carrier services manual alabama department of revenue 617787424 form

Find out other Irs Income Tax Return Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors