California Income Tax Return Form

What is the California Income Tax Return Form

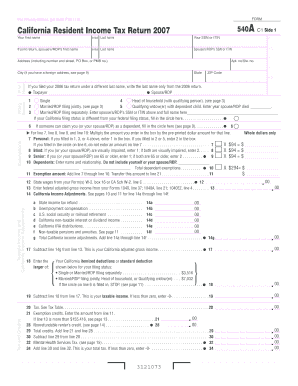

The California income tax return form is a document that residents use to report their income and calculate their tax liability to the state of California. This form is essential for individuals and businesses to comply with state tax laws. It collects information on various income sources, deductions, and credits that can reduce the overall tax burden. Understanding this form is crucial for ensuring accurate reporting and compliance with California tax regulations.

Steps to complete the California Income Tax Return Form

Completing the California income tax return form involves several important steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out the form by entering your personal information, income details, and applicable deductions.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form, as an unsigned form may be considered invalid.

- Submit the form by the designated deadline, either electronically or via mail.

How to obtain the California Income Tax Return Form

Residents can obtain the California income tax return form through several methods. The form is available online on the California Franchise Tax Board's website, where users can download and print it. Additionally, physical copies can be requested at local tax offices or public libraries. It's important to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal use of the California Income Tax Return Form

The California income tax return form is legally binding when completed accurately and submitted in accordance with state laws. To ensure legal validity, it must be signed by the taxpayer, and all information provided should be truthful and complete. Misrepresentation or failure to file can result in penalties or legal consequences. Utilizing secure digital platforms for submission can enhance the form's legal standing, as they often provide necessary compliance with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the California income tax return form typically align with federal tax deadlines. Generally, the deadline for individual taxpayers is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific changes or extensions that may apply each tax year to ensure timely filing.

Required Documents

To complete the California income tax return form, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical bills or mortgage interest

- Proof of any tax credits you may claim

- Identification information, including your Social Security number

Form Submission Methods (Online / Mail / In-Person)

The California income tax return form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to file electronically using approved e-filing software.

- By Mail: Completed forms can be printed and mailed to the appropriate state tax office.

- In-Person: Some individuals may prefer to submit their forms in person at designated tax offices.

Quick guide on how to complete california income tax return form 6164537

Complete California Income Tax Return Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the proper form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage California Income Tax Return Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to adjust and eSign California Income Tax Return Form without hassle

- Obtain California Income Tax Return Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign California Income Tax Return Form and ensure stellar communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california income tax return form 6164537

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is the California income tax return form and why do I need it?

The California income tax return form is a required document that residents must file with the state to report their earnings and calculate tax liabilities. Completing this form ensures compliance with state tax laws and identifies potential tax refunds. Using airSlate SignNow can simplify the process of signing and submitting your California income tax return form electronically, saving you time and effort.

-

How can airSlate SignNow help with filling out the California income tax return form?

airSlate SignNow provides an intuitive platform for filling out and eSigning your California income tax return form. You can easily upload necessary documents, share them with tax professionals, and ensure all signatures are captured quickly. This streamlines the entire process, making it less daunting for users unfamiliar with the tax forms.

-

Is there a cost associated with using airSlate SignNow for my California income tax return form?

Yes, airSlate SignNow offers various pricing plans to accommodate different user needs. While some features may be available for free, advanced functionalities related to your California income tax return form may require a subscription. Reviewing the pricing options will help you choose the best plan that suits your budget.

-

What features does airSlate SignNow offer for handling my California income tax return form?

airSlate SignNow includes features such as document templates, secure storage, and real-time collaboration, ideal for managing your California income tax return form. You can also track the status of your documents and receive notifications once they have been signed. These features enhance your workflow and ensure you're always informed.

-

Can I integrate airSlate SignNow with other tax software for my California income tax return form?

Yes, airSlate SignNow offers integrations with various tax software solutions, making it easier to manage your California income tax return form. These integrations allow you to import and export data seamlessly, reducing the need for duplicate entries. This functionality helps ensure accuracy and efficiency in your tax preparation.

-

What benefits does eSigning my California income tax return form provide?

eSigning your California income tax return form with airSlate SignNow provides benefits such as quicker turnaround times and enhanced security. It eliminates the need for printing, scanning, or mailing documents, which can delay your filing process. Additionally, electronic signatures are legally binding, ensuring your documents are valid and compliant.

-

Is airSlate SignNow suitable for businesses that need to file multiple California income tax return forms?

Absolutely! airSlate SignNow is designed for businesses of all sizes to efficiently manage multiple California income tax return forms. You can create bulk templates, store multiple forms, and send them for signature simultaneously, streamlining the process for your team. This is particularly beneficial during tax season when time is of the essence.

Get more for California Income Tax Return Form

- Sample letter to governor asking for help form

- Louisiana marriage license application form

- Caregiver job application form pdf

- Lego dimensions checklist pdf form

- Pa application form pdf

- American national make a payment form

- Motor vehicle dealer board dealerwholesale colorado gov colorado form

- 05 idaho marriage first sex pub health and welfare healthandwelfare idaho form

Find out other California Income Tax Return Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation